Read Judgment: State of Karnataka V. Somanna & Ors.

Pankaj Bajpai

Banagalore, March 29, 2022: While dealing with a case where Sessions Judge has declined to permit the State to cross-examine the victim on her turning hostile in a case arising out of the provisions of the POCSO Act, 2012 and Sections 9, 10 and 11 of the Prohibition of Child Marriage Act, 2006, the Single Judge M. Nagaprasanna of the Karnataka High Court has permitted cross-examination of the rape victim strictly in accordance with Section 33 of the POSCO Act, even though she turned hostile.

Going by the background of the case, a complaint is registered for offences punishable u/s 376(n) r/w/s 34 of the IPC, Sections 4, 6, 8, 12 and 17 of the POSCO Act and Sections 9, 10 and 11 of the Prohibition of Child Marriage Act. The complaint was registered on an allegation that second to tenth accused having knowledge that the victim girl was minor got her marriage with first accused who knowing full well that the victim was a minor girl had committed sexual assault on her many a times.

In the course of trial, recording of evidence of prosecution witnesses, the victim turns hostile. On her turning hostile, the State seeks permission of the Sessions Judge to cross-examine the witness. The Sessions Judge having declined such cross-examination drives the State to this Court in the subject petition.

After considering the submissions, Justice Nagaprasanna observed that in terms of Section 33(2) of the POCSO Act, the Special Public Prosecutor or as the case would be, the counsel appearing for the accused shall, while recording examination-in-chief, cross-examination or re-examination of the child communicates the questions to be put to the child to the Special Court which shall in turn put those questions to the child.

Therefore, the victim is permitted to be cross-examined under the POSCO Act itself on her turning hostile which would also cover the situation under sub-section (2) of Section 33 of the POCSO Act, added the Single Judge.

Justice Nagaprasanna found that the Apex Court in the case of Nipun Saxena v. Union Of India, (2019) 2 SCC 703, while interpreting Section 33 of the POSCO Act has held that: “Position of law regarding appreciation of the evidence of the child witness is well settled. A child witness, if found competent to depose to the facts and if her version is reliable, such evidence could be the basis of conviction. The only precaution which is to be taken by the court while appreciating such evidence is to rule out any possibility of tutoring. If the Court is satisfied that the evidence of the child is not the tutored version and if it is found reliable, the same can be the sole basis for conviction”.

The Apex Court in case of Nipun Saxena’s Case (Supra) further held that the State is to be permitted to cross-examine the victim, however, such cross-examination can be only in terms of Section 33 of the POSCO Act which mandates that while cross-examination questions shall be put to the Court and the Court in turn to put the same questions to the victim, added the Single Judge.

Accordingly, the High Court allowed the criminal petition and quashed the order passed by the Principal District and Sessions Judge, Chamarajnagar.

Read Order: Nirmala v. State Of Punjab

Monika Rahar

Chandigarh, March 29, 2022: Applying the ratio of the Supreme Court in Amarsing Ramjibhai Barot Vs. State of Gujarat‘ 2005(3) Apex Criminal 326, the Punjab and Haryana High Court has granted bail to the petitioner (one of the three accused) on the ground that the quantity of the contraband recovered from the three accused, when taken individually, would make the petitioner’s case fall under the category of non-commercial quantity.

The bench of Justice Sant Parkash held, “In the present case, the recovery effected from all the three accused if taken/carried out individually then the recovery can be concluded to be non-commercial.”

In Amarsingh Ramjibhai Barot (Supra), the Apex Court held that the quantity of contraband carried by both the accused could not be added to bring it within the meaning of commercial quantity and Section 29 will not be attracted.

The Court was approached with a petition under Section 439 of Cr.P.C. for the grant of regular bail to the petitioner, in an FIR registered against him under Sections 22(b), 27(b) of the Narcotic Drugs and Psychotropic Substances Act, 1985 (NDPS Act).

On July 31, 2021, the petitioner and his co-accused were apprehended by a Police party patrolling the area. On their search, recovery of commercial quantities of contraband [12 vials of Omerex, 400 tablets of Tramadol and 150 tablets of Carisoprodol] was made from all the three accused persons. Drug money in the amount of Rs. 1,26,000/- was also recovered from the present petitioner.

The petitioner’s counsel argued that nothing else apart from 2 bottles of Omerex and 50 tablets of Carisoma and Rs. 1,26,000/- were allegedly recovered from the petitioner. The counsel further argued that no independent witness was joined by the police party during the alleged recovery and that the mandatory provisions of the NDPS Act were not complied with. Also, the counsel submitted that the Challan in the present case was already filed and the petitioner was in custody since July of 2021. Therefore, the counsel sought the release of the petitioner on regular bail.

Importantly, the petitioner’s counsel argued that the alleged recovery of contraband is to be taken individually and not jointly and, in the present case, when the contraband is taken individually, the case would fall under non-commercial quantity. In support of his arguments, the Counsel relied upon the Supreme Court in Amarsingh Ramjibhai Barot (Supra). On the other hand, the State Counsel submitted that the petitioner was accused of having committed serious offences, thus, in view of the nature of the accusation and gravity of the offences, the Counsel advanced a case against the grant of regular bail to the petitioner.

The Court at the outset had a detailed look at the contraband recovered from the three accused persons individually, to expound that in the present case, the recovery effected from all the three accused, if taken/carried out individually, would be non-commercial.

The Court allowed the petition keeping in consideration the ratio of the Top Court in Amarsingh Ramjibhai Barot (Supra), various factors such as as the recovery of the contraband from all the three accused taken individually was non-commercial, the charge sheet was already presented, custodial interrogation of the petitioner was not required for effecting any recovery and the trial was going to take a long time.

Thus, the petitioner was ordered to be released on regular bail on furnishing of personal and surety bonds to the satisfaction of the Trial Court/Chief Judicial Magistrate/Duty Magistrate concerned.

Read Order: Surat Singh & others v. State of Haryana & another

Monika Rahar

Chandigarh, March 29, 2022: The liability of an accused would arise for assaulting a person, who was suffering from a disorder disease or bodily infirmity thereby accelerating the death of the other only if it could be said that the accused had the knowledge thereof, held the Punjab and Haryana High Court.

In this, an FIR was registered on the statement of the complainant who stated that owing to a land dispute between him and his brother, he and his son were assaulted by his brother and others. He also alleged that his wife was also assaulted with a brick and kick blow on her chest and stomach and was also pulled down on a melted road, leading to her death.

Initially, the said FIR was registered under Sections 148, 149 and 302 IPC. However, pursuant to the post-mortem and Histopath Report, the cause of her death was stated to be cardiogenic/neurogenic shock and therefore, the report under Section 173 Cr.P.C. was submitted under Sections 148, 149 and 323 Cr.P.C. During the course of the trial, an application under Section 323 Cr.P.C. was moved by the complainant for committing the case to the Court of Sessions on the ground that an offence of either Section 302 or 304 IPC was made out.

The trial Court held that the statement of Dr. Poonam Dahiya (who conducted the post-mortem and prepared Histopath Report) did not in any way suggest that an offence under Section 302/304 IPC was made out. Thus, the application of the complainant was dismissed.

The complainant challenged the same before the Additional Sessions Judge, Sonepat which remanded the case back to the trial Court for reconsideration but made observations to the effect that a prima facie case under Section 302 IPC was made out and that the case should have been committed to the Court of Sessions. It is this order which is in challenge in the present petition.

The case of the petitioner’s counsel was that the deceased-Satwanti did not receive any visible injury on her person as per Dr. Poonam Dahiya. The Histopathological Report was also inconclusive about the cause of death and therefore, Dr. Poonam Dahiya opined that cardiogenic/neurogenic shock could not be ruled out as the possible cause of death, the counsel added. Thus, the counsel contended that no offence under Sections 304/302 IPC was made as observed by the Sessions Court while remanding the case back to the trial Court.

On the other hand, the counsel for the complainant contended that there was sufficient evidence to establish that an offence under Sections 302/304 IPC was made out. A reading of the FIR would reveal that the deceased was assaulted and that resulted in her death. Therefore, the counsel submitted that it would be a matter of trial as to whether the assault on the deceased was one for which they could be liable under Sections 302/304 IPC or in the alternative under Section 323 IPC.

The court observed at the very outset that a perusal of the post-portem of the deceased Satwanti would reveal that no external injury marks on her body were seen, and therefore, the cause of death was to be given after the Histopath Report. Further, the court noted (as mentioned in the chagrsheet) that the deceased-Satwanti was suffering from severe anemia and she died due to deficiency of blood due to her old ailment.

Thus, it became apparent to the court that not only did the deceased not receive any external injury or internal injury and that being an old case of anemia, her death was caused on account cardiogenic/neurogenic shock. Also, the Court added that the absence of any injury on the deceased shows that she was not subjected to any severe beating.

“When this was so, had she not had a preexisting medical condition she in all probability would not have died”, asserted Justice Jasjit Singh Bedi.

Also, the court noted that the charge sheet did not make a mention of the fact that any of the accused/petitioners, were aware of the pre-existing medical condition of the deceased at the time when the occurrence took place.

In this backdrop the Court made the above-stated observations to the effect,“The liability of an accused would arise for assaulting a person, who was suffering from a disorder disease or bodily infirmity thereby accelerating the death of the other only if it could be said that the accused had the knowledge thereof as has already been submitted hereinabove.”

Thus, the Court opined that an offence under Section 302/304 IPC could not be made out.

While observing that the Additional Sessions Court remanded the matter back without actually providing any reasoning for the same, the Court held that the Judge ought not to have remanded the matter back for reconsideration with the observations to the effect that a prima facie case under Section 302 IPC was made out because it left the Magistrate with virtually no discretion in the matter to objectively assess the evidence on record and then pass an order.

Thus, the impugned order was set aside.

Read Order: Hardeep Singh @ Hardeep Sharma v. State of Punjab

Monika Rahar

Chandigarh, March 29, 2022: While dealing with a pre-arrest bail plea of an accused against whom an FIR under Section 377 IPC was registered by his wife for committing an act of unnatural sexual intercourse upon her on their wedding night, the Punjab and Haryana High Court has held that the Court is to strike the balance between the personal liberty and the overall interest of the society, while considering the plea for anticipatory bail.

While denying bail to the accused-petitioner, the Bench of Justice Rajesh Bhardwaj added,“However, the interest of the society always prevail upon the right of personal liberty.”

The Instant petition was filed under Section 438 of Cr.P.C. praying for the grant of anticipatory bail to the petitioner in an FIR registered under Section 377 IPC by the wife of the petitioner (husband).

As per the allegations levelled in the FIR, the marriage between the petitioner and the complainant took place on February 5, 2022. It was the allegation of the complainant/prosecutrix that her husband (the petitioner), during their wedding night, i.e. on February 7, 2022, forced her, when she was on her menstrual period to do oral sex with him and thereafter he committed unnatural sex with her. She further alleged that having no other alternative, the Wife deserted the matrimonial home and was later admitted to AP Jain Civil Hospital, Rajpura.

Apprehending his arrest, the petitioner approached the Additional Sessions Judge, Sangrur for the grant of anticipatory bail which was declined. Aggrieved by the same, the petitioner approached the High Court by way of the present petition.

The petitioner’s counsel contended that the petitioner was falsely implicated in this case and that within a short span of marriage, false and frivolous allegations were levelled against him after the wife deserted the matrimonial home. He contended that in view of the provisions of Section 375 Exception 2 IPC, the alleged act did not amount to rape.

Section 375 Exception 2 IPC provides that sexual intercourse or sexual acts by a man with his own wife not being under fifteen years of age is not rape.

At the outset, the Court opined that the allegations levelled by the complainant/wife were not on account of the harassment and cruelty caused to her on account of demand of dowry, rather, the same were on account of unnatural sex with the complainant when she was passing through the period of menstruation.

Also, the Court noted that the investigation in the present case was at the threshold and at that stage, the Court stated that it could not go into the defence taken by the accused. The Court was of the opinion that the allegations prima facie did not warrant the Court to invoke the extraordinary jurisdiction under Section 438 Cr.P.C., as for the exercise of such power, the factors to be taken into consideration are the gravity of offence; the probability of the petitioner fleeing from justice; the probability of tampering with the ongoing investigation etc.

Hence, the petition was dismissed.

Read Judgment: DEPUTY COMMISSIONER OF INCOME TAX vs. M/s M R SHAH LOGISTICS PVT LTD

Pankaj Bajpai

New Delhi, March 29, 2022: Finding that the AO, after recounting the background history of M R Shah Logistics (Assessee) and background of M.R. Logistics (chairman of assessee company), shifted the burden on assessee to say that the share application money received by it was not its unaccounted income, the Supreme Court has held that sequitur to a declaration under the IDS cannot lead to immunity (from taxation) in the hands of a non-declarant.

Simply because re-opening of assessment was not based on company chairman’s declaration under IDS, the fact that such an entity owned up and paid tax and penalty on amounts which it claimed, were invested by it as share applicant, cannot by any rule or principle inure to assessee’s advantage, observed a Division Bench of Justice Uday Umesh Lalit and Justice S. Ravindra Bhat.

Going by the background of the case, pursuant to a search proceeding conducted at the office premises of one Shirish Chandrakant Shah, wherein several materials were seized. On analysis of such documents, the revenue was of opinion that Shirish Chandrakant Shah was providing accommodation entries, through various companies controlled and managed by him, and that the assessee was one of the beneficiaries of the business (of accommodation entries provided by Shirish Shah) through bogus companies. This was based on the fact that many companies which invested amounts towards share capital on high premiums in the assessee’s company were also controlled and managed by Shirish Shah. The AO was of opinion that the assessee was also a beneficiary of the accommodation entries provided by Shirish Shah. During the course of previous searches in the case of Shirish Chandrakant Shah, an accommodation entry provider in Mumbai, it was observed that huge amounts of unaccounted moneys of promoters/directors were introduced in closely held companies of the assessee’s group.

The reasons to believe also stated that the chairman of M.R. Shah Group was asked about the application money received by the assessee. In the course of the statement, he disclosed that M/s. Garg Logistics Pvt. Ltd. had declared Rs. 6.36 crores as undisclosed cash utilized for investment in the share capital of the assessee, M.R. Shah Logistics Pvt. Ltd. through various companies. The assessee company’s chairman voluntarily disclosed the statements made by Garg Logistics about the declaration by Garg Logistics P Ltd, under the Income Declaration Scheme (IDS).

The reasons supplied by the AO further noted that he had completed the assessment in the case of Pradeep Birewar group and that a search took place in respect of that group along with various individuals who had obtained accommodation entries of long-term capital gains (LTCG) in the shares of Ganesh Spinners Ltd. from Shirish Chandrakant Shah. It was found that Pradeep Birewar was an Ahmedabad based accommodation entry provider engaged in facilitating one-time accommodation entries to various clients. The “reasons to believe” further noted that the materials seized, including the books of Shirish Chandrakant Shah contained date wise details of cash receipts and accommodation entries paid. On a consideration of all those materials, it was found that cash credit of Rs. 70.01 crores were received by Shirish Chandrakant Shah.

The matter reached High Court, which was of the opinion that the AO had no information to conclude that the disclosure by Garg Logistics was not from funds of that declarant but was in fact the unaccounted income of the assessee. Hence, present appeal.

After considering the submissions, the Supreme Court noted that the basis for a valid re-opening of assessment should be availability of tangible material, which can lead the AO to scrutinize the returns for the previous assessment year in question, to determine, whether a notice u/s 147 is called for.

“As a matter of fact, M/s Garg Logistics filed its IDS application with a different Commissionerate which did not share information with the AO in the present case; he did not also call for any such information. Pravin Chandra Agrawal, the chairman of the assessee (M.R. Shah group) was queried with regard to the capital raised with high premium during a search, and post search inquiry. He submitted details of the IDS declaration by Garg Logistics Pvt Ltd to say that the amounts received toward share applications were genuine transactions. Clearly, in the present case, the High Court went wrong in holding that the department had shared confidential IDS information of Garg Logistics Pvt Ltd”, added the Court.

Speaking for the Bench, Justice Bhat found that the record reveals that Garg Logistics Pvt. Ltd had not invested Rs. 6,36,00,000/- in the assessee company during the relevant period and the details of income declaration by Garg Logistics under the IDS scheme was submitted by Pravin. P. Agrawal (the assessee’s chairman) in support of its claim of genuineness of receipt of share capital.

However, as noticed earlier, the basis for reopening the assessment in this case was the information from the material seized during search in cases of Shrish Chandrakant Shah and correlation with return of income of the assessee, and there was no scrutiny assessment done at the original assessment stage, added the Bench.

Justice Bhat found that another aspect which should not be lost sight of is that the information or “tangible material” which the assessing officer comes by enabling re-opening of an assessment, means that the entire assessment (for the concerned year) is at large; the revenue would then get to examine the returns for the previous year, on a clean slate – as it were.

Therefore, to hold as the High Court did, in this case, that since the assessee may have a reasonable explanation, is not a ground for quashing a notice under Section 147, and as long as there is objective tangible material (in the form of documents, relevant to the issue) the sufficiency of that material cannot dictate the validity of the notice, added the Bench.

The Bench talked about the scope and effect of the Income Declaration Scheme (IDS), introduced by Chapter IX of the Finance Act, 2016. The objective of its provisions was to enable an assessee to declare her (or his) suppressed undisclosed income or properties acquired through such income. It is based on voluntary disclosure of untaxed income and the assessees acknowledging income tax liability. This disclosure is through a declaration (Section 183) to the Principal Commissioner of Income Tax within a time period, and deposit the prescribed amount towards income tax and other stipulated amounts, including penalty. Section 192 grants limited immunity to declarants, noted the Court.

The Apex Court noted that disclosure under IDS is through a declaration (Section 183) to the Principal Commissioner of Income Tax within a time period, and deposit the prescribed amount towards income tax and other stipulated amounts, including penalty, and as noticed previously the declarant was Garg Logistic Pvt Ltd and not the assessee.

“Facially, Section 192 affords immunity to the declarant: “…nothing contained in any declaration made under section 183 shall be admissible in evidence against the declarant for the purpose of any proceeding relating to imposition of penalty…” Therefore, the protection given, is to the declarant, and for a limited purpose”, added the Court.

However, the Top Court observed that the High Court proceeded on the footing that such protection would bar the revenue from scrutinizing the assessee’s return, absolutely, and quite apart from the fact that the re-opening of assessment was not based on Garg Logistic’s declaration, the fact that such an entity owned up and paid tax and penalty on amounts which it claimed, were invested by it as share applicant, (though the share applicants were other companies and entities) to the assessee in the present case, cannot by any rule or principle inure to the assessee’s advantage.

The Apex Court therefore concluded that the High Court fell into error, in holding that the sequitur to a declaration under the IDS can lead to immunity (from taxation) in the hands of a non-declarant.

Read Judgment: Pawandeep Singh vs. Registrar of Trademarks & Another

Pankaj Bajpai

New Delhi, March 29, 2022: Observing that the refusal of a trade mark without even affording a hearing would be contrary to the fundamental tenets of natural justice, the Delhi High Court has asked the Controller General of Patents, Designs & Trade Marks to device a proper mechanism for holding show cause hearings by including certain features.

Finding that the hearing was not held and the application was refused by wrongly recording that a hearing had been granted, the Single Judge Pratibha Singh observed that there is a need to alter the current mode and manner of holding hearings from publishing monthly cause lists to publishing daily cause lists with proper serial numbers, giving open links to Counsels/Applicants individually or publishing the same on the Trade Mark Registry website and by moving to a platform which would permit more individuals to join the hearings simultaneously at a time.

The observation came pursuant to a petition filed with a grievance that the trademark application of Pawandeep Singh (Petitioner) in Class – 17 for the registration of the mark ‘SWISS’ had been refused without even affording a hearing to him. The case of the Petitioner was that two notices for hearing were given to him, and even though the agent for the Petitioner logged in for the hearing, the official concerned did not log in, on both the occasions.

After considering the submissions, Justice Singh found that the orders which were passed by the Registrar of Trademarks dealt with precious rights relating to the trademarks of individuals and businesses.

The Trade Mark Registry deals with lakhs of applications every year and therefore, the utilisation of a platform for virtual conference hearing wherein only three individuals are permitted to join at a time, would be grossly insufficient and an outdated mode of holding hearings, added the Single Judge.

Justice Singh further noted that the office of the Registrar of Trademarks should encourage and move towards having a much more transparent system of hearings in the presence of Agents/ Lawyers/ Applicants who may be permitted to join through an open link.

The hearings can also be held by publishing daily cause lists with a serial number for the applications being taken up and allotting at least two-hour slots where the open link is made available on the website of the Trade Mark Registry, added the Single Judge.

Therefore, Lawyers/Applicants/Agents ought to be permitted to appear through the open link and make submissions before the Examiner so long as they do it in an orderly manner without disturbing the hearings being held, added the Court.

The High Court therefore held that the office of the Registrar of Trade Marks, shall afford a proper hearing to the Applicant and pass orders in accordance with law. The date of hearing shall be communicated to the Applicant through email by the Examiner.

Read Order: Bindu vs. High Court of Judicature at Allahabad Through Its R.G And Another

Pankaj Bajpai

New Delhi, March 29, 2022: Affirming that for the purpose of Article 233(2) of the Constitution, an Advocate has to be continuing in practice for not less than 7 years as on the cut-off date and at the time of appointment as District Judge, the Allahabad High Court has refused to grant the mandamus to permit the candidate (petitioner – advocate) to appear in the exam of Judicial Officer in the U.P. State Higher Judicial Services, even though she cleared the preliminary exam.

A Division Bench of Justice Dr. Kaushal Jayendra Thaker and Justice Ajai Tyagi observed that the petitioner had not qualified the practicing period just when she applied in pursuance to the advertisement issued by the Allahabad HC through its R.G (respondents).

Going by the background of the case, Bindu (petitioner) applied for being appointed as a Judicial Officer in the U.P. State Higher Judicial Services. Although the petitioner had cleared the preliminary exam, she was not permitted to appear for final exams, on the ground that on interpretation of the rules and placing reliance on the judgment of the Apex Court in Deepak Aggrawal v. Keshav Kaushik and others, (2013) 5 SCC 277, the committee found that the petitioner does not have continuous practice for seven years on date of exam/filling form. The High Court on its administrative side conveyed to the petitioner that she was not qualified as per rules.

After considering the submissions, the High Court found that the petitioner cannot seek appointment as Judicial Officer/District Judge in this calendar year as the petitioner does not fulfil the criteria fixed as per provisions of Articles 233, 234 and 236 of the Constitution of India and the rules for.

In the present case, the petitioner herein from a period of 2017 to 2019 was employed and so there is brake in a legal practice, and the Rules framed have to be construed so as to see that the purpose of the legislation is not withered down, added the Court.

The High Court found that the petitioner ceased to be an Advocate under the Advocates Act, 1961 in August 2017 when she got selected as EXAMINER OF TRADE MARK & G.I.

“It is submitted by learned counsel at that time she surrendered her practicing licence. Thereafter in the year 2019, she was selected as Public Prosecutor in CBI where she is still working. The petitioner is a Public Prosecutor at present but as Public Prosecutor, she has not put in continuous service of 7 years”, added the Court.

Hence, the High Court dismissed the petition.

Read Order: UNION OF INDIA THRO AMITKUMAR, INTELLIGENCE OFFICER OR HIS SUCCESSOR IN OFFICE Versus STATE OF GUJARAT

Pankaj Bajpai

New Delhi, March 29, 2022: The Gujarat High Court has refused to interfere with the order passed by the Trial Court acquitting the wife of the accused person charged for offences under NDPS Act on finding that she had no prior knowledge about her husband carrying any contraband substance.

A Division Bench of Justice S.H Vora and Justice Sandeep N. Bhatt observed that in an acquittal appeal if other view is possible, then also, the appellate Court cannot substitute its own view by reversing the acquittal into conviction, unless the findings of the trial Court are perverse, contrary to the material on record, palpably wrong, manifestly erroneous or demonstrably unsustainable.

The observation came pursuant to an application by the original complainant (Union of India through Narcotics Control Bureau) challenging an order whereby the trial Court acquitted the original accused (second respondent – Ruksanabanu wife of Shaikh Mohammad Rafik) for the offences punishable u/s 8(c), 20(b) and 29 of the Narcotic Drugs and Psychotropic Substances Act, 1985 (NDPS Act).

Going by the background of the case, all the original three accused committed the offence punishable u/s 8(c), 20(b) and 29 of the NDPS Act. When the third accused was searched, he was found with contraband Charas weighing 7.79 Kg from the bag held by him. Accordingly, all the three accused were intercepted by the complainant.

It was the case of complainant that the third accused, Imtekhab Rafikbhai Rangrej, was in possession of the bag and refused to provide its key and therefore the lock of the bag was forced open and the quantum of Charas was found therein. During trial, the first & third accused were found guilty for the offence punishable u/s NDPS Act; whereas the second respondent was given benefit of doubt.

After considering the submissions, the High Court found that testimony of the Intelligence Officer, serving with NCB Office, Ahmedabad, established that the third accused was found with contraband Charas contained in a bag he held.

It was noticed that first & second accused did not hold the bag and neither anything incriminating was found from their person, and on scrutiny of evidence, the trial Judge found that second respondent was merely a companion of her husband i.e., first accused and she was not an accomplice in the crime, added the Court.

Speaking for the Bench, Justice Vora observed that the moment the person has intention or knowledge of the fact, he or she would be said to have culpable intention, and thus, the trial Judge on appraisal of entire evidence observed that no doubt of a reasonable degree could be entertained that second respondent had real knowledge of the nature of the substance locked in the bag and key in possession of the third accused.

“The submissions based on confessional statement of respondent No.2 so as to implicate her in offence which needs not to be taken any further in light of a decision rendered in case of Tofan Singh VS State of Tamil Nadu [(2014 1 Crimes(SC) 42], because the confessional statement is recorded when respondent No.2 was in custody and therefore, it being the weak piece of evidence and in absence of any corroborative evidence, no reliance can be placed upon such statement and thus the trial Judge has rightly done so”, added the Bench.

Accordingly, the High Court concluded that the trial Judge had rightly acquitted the second respondent and endorsed such finding of the trial Judge leading to the acquittal of the second respondent.

Read Order: Maghar Singh Since Deceased Through Lrs. v. Gurdev Singh And Ors.

Monika Rahar

Chandigarh, March 29, 2022: While observing that the various clauses of a Will have to be harmoniously construed and the Will has to be carefully perused in its entirety while analyzing the intent of the testator before arriving at a conclusion, the Punjab and Haryana High Court has held that merely because it is provided in the testamentary disposition (Will) that after the death of the legatee, the property will stand bequeathed in a particular manner, does not imply that the testator conferred a limited estate/ life interest in favour of the legatee.

The Bench of Justice Anil Kshetarpal also added,“… it would not be appropriate to read something in the Will unless it has been specifically provided and that the normal rule of construction is to read the complete Will in order to understand the intent of the testator.”

In this case, the father of the plaintiff-appellant (Sh. Kishna @ Kishan/ testator) executed a Will, which is undisputed. The dispute was with respect to the manner of bequeathing the property in dispute. The plaintiff’s case was that Smt. Nihal Kaur (wife of Sh. Kishna @ Kishan) inherited only a limited estate/life interest, while the defendants contended that Smt. Nihal Kaur became the absolute owner of the property which was bequeathed in her favour after the death of late Sh. Kishna @ Kishan.

Initially, the plaintiff-appellant filed a suit for grant of decree of declaration to the effect that he is the owner in possession of 4 Bighas, 8 Biswas and 17 Biswasis, being half share of the land measuring 17 Bighas and 15 Biswas as Smt. Nihal Kaur (his mother) had only a limited estate as per the Will of his father. Therefore, the plaintiff argued that the Will that was executed by Smt. Nihal Kaur in 1975, in favour of Smt. Gurdev Kaur (wife of plaintiff’s brother) and sale deed of 1991 in favour of the third and fourth defendants was illegal.

Before the High Court, the question in the two Regular Second Appeals when in the testamentary disposition neither there was a specific recital regarding conferring a limited estate/life interest in favour of the testator’s wife nor any restriction was imposed on her from alienating the property, then, if it could be held that the testator bequeathed only a limited estate because the Will provided for a specific manner of regulating the succession of the property after her death.

Before the Court, the petitioner’s counsel argued that once it was provided in the Will that after the death of Smt. Nihal Kaur, her share of land would be given to his three sons or their male progeny in equal share, then, Smt. Nihal Kaur received only a limited estate/life interest in the said property.

On the contrary, respondents submitted that the testamentary disposition of the plaintiff’s father bequeathed the complete ownership in favour of late Smt. Nihal Kaur.

After perusing the Will, the Court opined,that Smt. Nihal Kaur was never prohibited from alienating the property during her lifetime and the testator did not restrict his wife from dealing with the property in any manner during her lifetime. The Court further expounded that the testator tried to regulate the bequest after the death of Smt. Nihal Kaur provided she died intestate.

“Therefore, it was only a contingent provision which became redundant on the execution of Will with regard to the said property by Smt. Nihal Kaur”, asserted Justice Kshetarpal.

On the interpretation of the terms of a Will, the Court opined that it would not be appropriate to read something in the Will unless it has been specifically provided and added that the normal rule of construction is to read the complete Will in order to understand the intent of the testator.

The Bench noted that on a complete reading of the present Will, it became evident to the Court that neither the testator specifically provided that Smt. Nihal Kaur will only have a life or limited estate nor it was provided that she will not have the right to alienate/transfer the property bequeathed in her favour.

In such circumstances, the Court was of the opinion that it was not reasonable to hold that the wife was conferred only a limited estate or life interest merely because it was provided in the testamentary disposition that after the death of the legatee, the property will stand bequeathed in a particular manner.

Further, the Court remarked that it is well settled that various clauses of the Will have to be harmoniously construed and the Will has to be carefully perused while analyzing the intent of the testator before arriving at a conclusion.

Referring to the factual aspects,the Bench said “It is evident from the testamentary disposition that late Sh. Kishna @ Kishan has bequeathed 30 Bighas Kham land in favour of his wife, whereas, the remaining entire land was bequeathed in favour of Sh. Ajaib Singh, Sh. Maghar Singh and Sh. Joginder Singh in equal shares while excluding the daughter or any other heir or relative from the bequest. Furthermore, while referring to the residential house, the testator specifically provided that Smt. Nihal Kaur would have only a right of residence in the aforesaid house.”

Thus, Regular Second Appeals were dismissed.

Read Order: Sanjay Gupta vs. State & Another

Pankaj Bajpai

New Delhi, March 29, 2022: Dismissing a Revision Petition filed by the revisionist-accused based on the conclusion that the accused had failed to attribute the reason for dishonour of cheque issued by him when presented for encashment by the complainant, the Delhi High Court has opined that once issuance of a cheque and signature thereon are admitted, presumption of a legally enforceable debt in favour of the holder of the cheque arises.

The Bench of Justice Rajnish Bhatnagar observed that it is for the accused to rebut the presumption, though accused need not adduce his own evidence and can rely upon the material submitted by the complainant, however, mere statement of the accused may not be sufficient to rebut the said presumption.

Going by the background of the case, the second respondent had filed a complaint u/s 138 of NI Act against the revisionist stating that the revisionist had taken a friendly loan of Rs. 4,80,000 from the respondent for a period of one month. The revisionist issued the cheque drawn on Kotak Mahindra Bank for the said sum in favour of the respondent.

When the said cheque was presented for encashment by the respondent, it was returned by the banker with remark “fund insufficient.” Thereafter, the respondent issued legal notice calling upon the revisionist to make payment of the cheque amount within 15 days of the receipt of the legal notice. However, no payment was made within the stipulated period which resulted in the filing of complaint u/s 138 of NI Act.

Thereafter, the Metropolitan Magistrate (MM) convicted the revisionist u/s 138 NI Act and sentenced the revisionist to simple imprisonment for three months and fine of Rs. 7 Lakh to be paid completely as compensation to the respondent. On appeal, the ASJ modified the sentence to the extent that a fine of Rs 7 lakh shall be paid as compensation to the second respondent and if the said fine was not paid within 4 weeks, the revisionist shall undergo simple imprisonment for three months. Hence, the present revision petition was filed

After considering the submissions, Justice Bhatnagar observed that the Negotiable Instruments Act provides sufficient opportunity to a person who issues the cheque.

Once a cheque is issued by a person, it must be honoured and if it is not honoured, the person is given an opportunity to pay the cheque amount by issuance of a notice and if he still does not pay, he is bound to face the criminal trial and consequences, added the Single Judge.

Justice Bhatnagar further noted that while imposing sentence on the accused after his conviction, it is to be kept in mind that the sentence for offence u/s 138 of NI Act should be of such nature as to give proper effect to the object of legislation and no drawer of the cheque can be allowed to take dishonour of cheque issued by him light heartedly.

Referring to judgments of the Apex Court in Suganthi Suresh Kumar vs. Jagdeeshan, Appeal (crl.) 65-66 of 2002 and K.Bhaskaran vs. Sankaran Vaidhyan Balan, (1999)7 SCC 510, the Bench reaffirmed that the Magistrate can alleviate the grievance of the complainant by resorting to Section 357(3) Cr.P.C. wherein no limit of compensation to be awarded by the Magistrate has been mentioned and, thus, the Magistrate is empowered to impose a reasonable amount of compensation payable to complainant.

Accordingly, the High Court upheld the order passed by the Trial Court.

Read Order: Harkesh Kaur v. Sr. Superintendent of Post Offices and Others

Monika Rahar

Chandigarh, March 29, 2022: While allowing a petition filed by a widow holding a succession certificate to claim the amount lying in her deceased-husband’s account , the Punjab and Haryana High Court has held that the duty of a nominee is only to collect the amount on behalf of the person for whom the nominee is appointed.

The Court added that with the death of the nominee, the rightful owner cannot be deprived of his/her dues, which admittedly according to the parties, in this case, belonged to the deceased husband of the petitioner.

The Bench of Justice Raj Mohan Singh held, “… the petitioner being succession certificate holder can replace the status of the deceased nominee being a rightful owner so as to claim the amount which is lying deposited [in her deceased husband’s account] with the first and second respondents.”

In this case, the second respondent was the nominee of the deceased husband of the petitioner. The petitioner obtained a succession certificate from the Court of Additional Civil Judge (Senior Judge), Garhshankar by an order whereby the succession certificate was ordered to be issued to the petitioner subject to the petitioner furnishing indemnity bond in the sum of Rs 50 lakh with one surety in the like amount within a prescribed period.

The petitioner approached the High Court with a petition seeking the issuance of an appropriate writ in the nature of mandamus, directing the first respondent to release the amount lying in the account of the deceased husband of the petitioner.

It was the case of the petitioner’s counsel that necessary compliance with the Order of Additional Civil Judge (Senior Judge), Garhshankar was already done by the petitioner. It was further submitted that as per the order of the Additional Civil Judge, the succession certificate was to bear a clause directing the manager of the concerned bank to disburse the amount lying in the account of the deceased with interest to the registered nominee if any.

The Court was informed by the counsel for the nominee-respondent that the nominee had expired.

On the legality governing the role of a nominee, the Court opined that the duty of a nominee is only to collect the amount on behalf of the person for whom the nominee is appointed. The Court further added that a nominee is just like an agent to collect the money on behalf of the principal, and thus with the death of the nominee, the rightful owner cannot be deprived of his/her dues, which, in the present case, admittedly belonged to the deceased husband of the petitioner.

Thus, in this backdrop, the Court adjudged that the petitioner being succession certificate holder can replace the status of the deceased nominee being a rightful owner so as to claim the amount, which was lying deposited before the first and the second respondents.

Consequently, this petition was allowed and the respondents were directed to do the needful in releasing the amount lying in the account of the deceased husband of the petitioner along with permissible interest in accordance with the law.

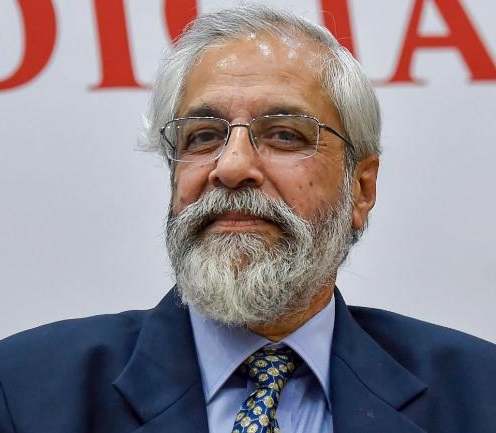

Time for judiciary to introspect and see what can be done to restore people’s faith – Justice Lokur

Justice Madan B Lokur, was a Supreme Court judge from June 2012 to December 2018. He is now a judge of the non-resident panel of the Supreme Court of Fiji. He spoke to LegitQuest on January 25, 2020.

Q: You were a Supreme Court judge for more than 6 years. Do SC judges have their own ups and downs, in the sense that do you have any frustrations about cases, things not working out, the kind of issues that come to you?

A: There are no ups and downs in that sense but sometimes you do get a little upset at the pace of justice delivery. I felt that there were occasions when justice could have been delivered much faster, a case could have been decided much faster than it actually was. (When there is) resistance in that regard normally from the state, from the establishment, then you kind of feel what’s happening, what can I do about it.

Q: So you have had the feeling that the establishment is trying to interfere in the matters?

A: No, not interfering in matters but not giving the necessary importance to some cases. So if something has to be done in four weeks, for example if reply has to be filed within four weeks and they don’t file it in four weeks just because they feel that it doesn’t matter, and it’s ok if we file it within six weeks how does it make a difference. But it does make a difference.

Q: Do you think this attitude is merely a lax attitude or is it an infrastructure related problem?

A: I don’t know. Sometimes on some issues the government or the establishment takes it easy. They don’t realise the urgency. So that’s one. Sometimes there are systemic issues, for example, you may have a case that takes much longer than anticipated and therefore you can’t take up some other case. Then that necessarily has to be adjourned. So these things have to be planned very carefully.

Q: Are there any cases that you have special memories of in terms of your personal experiences while dealing with the case? It might have moved you or it may have made you feel that this case is really important though it may not be considered important by the government or may have escaped the media glare?

A: All the cases that I did with regard to social justice, cases which concern social justice and which concern the environment, I think all of them were important. They gave me some satisfaction, some frustration also, in the sense of time, but I would certainly remember all these cases.

Q: Even though you were at the Supreme Court as a jurist, were there any learning experiences for you that may have surprised you?

A: There were learning experiences, yes. And plenty of them. Every case is a learning experience because you tend to look at the same case with two different perspectives. So every case is a great learning experience. You know how society functions, how the state functions, what is going on in the minds of the people, what is it that has prompted them to come the court. There is a great learning, not only in terms of people and institutions but also in terms of law.

Q: You are a Judge of the Supreme Court of Fiji, though a Non-Resident Judge. How different is it in comparison to being a Judge in India?

A: There are some procedural distinctions. For example, there is a great reliance in Fiji on written submissions and for the oral submissions they give 45 minutes to a side. So the case is over within 1 1/2 hours maximum. That’s not the situation here in India. The number of cases in Fiji are very few. Yes, it’s a small country, with a small number of cases. Cases are very few so it’s only when they have an adequate number of cases that they will have a session and as far as I am aware they do not have more than two or three sessions in a year and the session lasts for maybe about three weeks. So it’s not that the court sits every day or that I have to shift to Fiji. When it is necessary and there are a good number of cases then they will have a session, unlike here. It is then that I am required to go to Fiji for three weeks. The other difference is that in every case that comes to the (Fiji) Supreme Court, even if special leave is not granted, you have to give a detailed judgement which is not the practice here.

Q: There is a lot of backlog in the lower courts in India which creates a problem for the justice delivery system. One reason is definitely shortage of judges. What are the other reasons as to why there is so much backlog of cases in the trial courts?

A: I think case management is absolutely necessary and unless we introduce case management and alternative methods of dispute resolution, we will not be able to solve the problem. I will give you a very recent example about the Muzaffarpur children’s home case (in Bihar) where about 34 girls were systematically raped. There were about 17 or 18 accused persons but the entire trial finished within six months. Now that was only because of the management and the efforts of the trial judge and I think that needs to be studied how he could do it. If he could do such a complex case with so many eyewitnesses and so many accused persons in a short frame of time, I don’t see why other cases cannot be decided within a specified time frame. That’s case management. The second thing is so far as other methods of disposal of cases are concerned, we have had a very good experience in trial courts in Delhi where more than one lakh cases have been disposed of through mediation. So, mediation must be encouraged at the trial level because if you can dispose so many cases you can reduce the workload. For criminal cases, you have Plea Bargaining that has been introduced in 2009 but not put into practice. We did make an attempt in the Tis Hazari Courts. It worked to some extent but after that it fell into disuse. So, plea bargaining can take care of a lot of cases. And there will be certain categories of cases which we need to look at carefully. For example, you have cases of compoundable offences, you have cases where fine is the punishment and not necessarily imprisonment, or maybe it’s imprisonment say one month or two month’s imprisonment. Do we need to actually go through a regular trial for these kind of cases? Can they not be resolved or adjudicated through Plea Bargaining? This will help the system, it will help in Prison Reforms, (prevent) overcrowding in prisons. So there are a lot of avenues available for reducing the backlog. But I think an effort has to be made to resolve all that.

Q: Do you think there are any systemic flaws in the country’s justice system, or the way trial courts work?

A: I don’t think there are any major systemic flaws. It’s just that case management has not been given importance. If case management is given importance, then whatever systematic flaws are existing, they will certainly come down.

Q; And what about technology. Do you think technology can play a role in improving the functioning of the justice delivery system?

I think technology is very important. You are aware of the e-courts project. Now I have been told by many judges and many judicial academies that the e-courts project has brought about sort of a revolution in the trial courts. There is a lot of information that is available for the litigants, judges, lawyers and researchers and if it is put to optimum use or even semi optimum use, it can make a huge difference. Today there are many judges who are using technology and particularly the benefits of the e-courts project is an adjunct to their work. Some studies on how technology can be used or the e-courts project can be used to improve the system will make a huge difference.

Q: What kind of technology would you recommend that courts should have?

A: The work that was assigned to the e-committee I think has been taken care of, if not fully, then largely to the maximum possible extent. Now having done the work you have to try and take advantage of the work that’s been done, find out all the flaws and see how you can rectify it or remove those flaws. For example, we came across a case where 94 adjournments were given in a criminal case. Now why were 94 adjournments given? Somebody needs to study that, so that information is available. And unless you process that information, things will just continue, you will just be collecting information. So as far as I am concerned, the task of collecting information is over. We now need to improve information collection and process available information and that is something I think should be done.

Q: There is a debate going on about the rights of death row convicts. CJI Justice Bobde recently objected to death row convicts filing lot of petitions, making use of every legal remedy available to them. He said the rights of the victim should be given more importance over the rights of the accused. But a lot of legal experts have said that these remedies are available to correct the anomalies, if any, in the justice delivery. Even the Centre has urged the court to adopt a more victim-centric approach. What is your opinion on that?

You see so far as procedures are concerned, when a person knows that s/he is going to die in a few days or a few months, s/he will do everything possible to live. Now you can’t tell a person who has got terminal cancer that there is no point in undergoing chemotherapy because you are going to die anyway. A person is going to fight for her/his life to the maximum extent. So if a person is on death row s/he will do everything possible to survive. You have very exceptional people like Bhagat Singh who are ready to face (the gallows) but that’s why they are exceptional. So an ordinary person will do everything possible (to survive). So if the law permits them to do all this, they will do it.

Q: Do you think law should permit this to death row convicts?

A: That is for the Parliament to decide. The law is there, the Constitution is there. Now if the Parliament chooses not to enact a law which takes into consideration the rights of the victims and the people who are on death row, what can anyone do? You can’t tell a person on death row that listen, if you don’t file a review petition within one week, I will hang you. If you do not file a curative petition within three days, then I will hang you. You also have to look at the frame of mind of a person facing death. Victims certainly, but also the convict.

Q: From the point of jurisprudence, do you think death row convicts’ rights are essential? Or can their rights be done away with?

A: I don’t know you can take away the right of a person fighting for his life but you have to strike a balance somewhere. To say that you must file a review or curative or mercy petition in one week, it’s very difficult. You tell somebody else who is not on a death row that you can file a review petition within 30 days but a person who is on death row you tell him that I will give you only one week, it doesn’t make any sense to me. In fact it should probably be the other way round.

Q: What about capital punishment as a means of punishment itself?

A: There has been a lot of debate and discussion about capital punishment but I think that world over it has now been accepted, more or less, that death penalty has not served the purpose for which it was intended. So, there are very few countries that are executing people. The United States, Saudi Arabia, China, Pakistan also, but it hasn’t brought down the crime rate. And India has been very conservative in imposing the death penalty. I think the last 3-4 executions have happened for the persons who were terrorists. And apart from that there was one from Calcutta who was hanged for rape and murder. But the fact that he was hanged for rape and murder has not deterred people (from committing rape and murder). So the accepted view is that death penalty has not served the purpose. We certainly need to rethink the continuance of capital punishment. On the other hand, if capital punishment is abolished, there might be fake encounter killings or extra judicial killings.

Q: These days there is the psyche among people of ‘instant justice’, like we saw in the case of the Hyderabad vet who was raped and murdered. The four accused in the case were killed in an encounter and the public at large and even politicians hailed it as justice being delivery. Do you think this ‘lynch mob mentality’ reflects people’s lack of faith in the justice system?

A: I think in this particular case about what happened in Telangana, investigation was still going on. About what actually happened there, an enquiry is going on. So no definite conclusions have come out. According to the police these people tried to snatch weapons so they had to be shot. Now it is very difficult to believe, as far as I am concerned, that 10 armed policeman could not overpower four unarmed accused persons. This is very difficult to believe. And assuming one of them happened to have snatched a (cop’s) weapon, maybe he could have been incapacitated but why the other three? So there are a lot of questions that are unanswered. So far as the celebrations are concerned, the people who are celebrating, do they know for certain that they (those killed in the encounter) were the ones who did the crime? How can they be so sure about it? They were not eye witnesses. Even witnesses sometimes make mistakes. This is really not a cause for celebration. Certainly not.

Q: It seems some people are losing their faith in the country’s justice delivery system. How to repose people’s faith in the legal process?

A: You see we again come back to case management and speedy justice. Suppose the Nirbhaya case would have been decided within two or three years, would this (Telangana) incident have happened? One can’t say. The attack on Parliament case was decided in two or three years but that has not wiped out terrorism. There are a lot of factors that go into all this, so there is a need to find ways of improving justice delivery so that you don’t have any extremes – where a case takes 10 years or another extreme where there is instant justice. There has to be something in between, some balance has to be drawn. Now you have that case where Phoolan Devi was gangraped followed by the Behmai massacre. Now this is a case of 1981, it has been 40 years and the trial court has still not delivered a judgement. It’s due any day now, (but) whose fault is that. You have another case in Maharashtra that has been transferred to National Investigating Agency two years after the incident, the Bhima-Koregaon case. Investigation is supposedly not complete after two years also. Whose fault is that? So you have to look at the entire system in a holistic manner. There are many players – the investigation agency is one player, the prosecution is one player, the defence is one player, the justice delivery system is one player. So unless all of them are in a position to coordinate… you cannot blame only the justice delivery system. If the Telangana police was so sure that the persons they have caught are guilty, why did they not file the charge sheet immediately? If they were so sure the charge sheet should have been filed within one day. Why didn’t they do it?

Q: At the trial level, there are many instances of flaws in evidence collection. Do you think the police or whoever the investigators are, do they lack training?

A: Yes they do! The police lacks training. I think there is a recent report that has come out last week which says very few people (in the police) have been trained (to collect evidence).

Q: You think giving proper training to police to prepare a case will make a difference?

A: Yes, it will make a difference.

Q: You have a keen interest in juvenile justice. Unfortunately, a lot of heinous crimes are committed by juveniles. How can we correct that?

A: You see it depends upon what perspective we are looking at. Now these heinous crimes are committed by juveniles. Heinous crimes are committed by adults also, so why pick upon juveniles alone and say something should be done because juveniles are committing heinous crimes. Why is it that people are not saying that something should be done when adults are committing heinous crimes? That’s one perspective. There are a lot of heinous crimes that are committed against juveniles. The number of crimes committed against juveniles or children are much more than the crimes committed by juveniles. How come nobody is talking about that? And the people committing heinous crimes against children are adults. So is it okay to say that the State has imposed death penalty for an offence against the child? So that’s good enough, nothing more needs to be done? I don’t think that’s a valid answer. The establishment must keep in mind the fact that the number of heinous crimes against children are much more than those committed by juveniles. We must shift focus.

Q: Coming to NRC and CAA. Protests have been happening since December last year, the SC is waiting for the Centre’s reply, the Delhi HC has refused to directly intervene. Neither the protesters nor the government is budging. How do we achieve a breakthrough?

A: It is for the government to decide what they want to do. If the government says it is not going to budge, and the people say they are not going to budge, the stalemate could continue forever.

Q: Do you think the CAA and the NRC will have an impact on civil liberties, personal liberties and people’s rights?

A: Yes, and that is one of the reasons why there is protest all over the country. And people have realised that it is going to happen, it is going to have an impact on their lives, on their rights and that’s why they are protesting. So the answer to your question is yes.

Q: Across the world and in India, we are seeing an erosion of the value system upholding rights and liberties. How important is it for the healthy functioning of a country that social justice, people’s liberties, people’s rights are maintained?

A: I think social justice issues, fundamental rights are of prime importance in our country, in any democracy, and the preamble to our Constitution makes it absolutely clear and the judgement of the Supreme Court in Kesavananda Bharati and many other subsequent judgments also make it clear that you cannot change the basic structure of the Constitution. If you cannot do that then obviously you cannot take away some basic democratic rights like freedom of assembly, freedom of movement, you cannot take them away. So if you have to live in a democracy, we have to accept the fact that these rights cannot be taken away. Otherwise there are many countries where there is no democracy. I don’t know whether those people are happy or not happy.

Q: What will happen if in a democracy these rights are controlled by hook or by crook?

A: It depends upon how much they are controlled. If the control is excessive then that is wrong. The Constitution says there must be a reasonable restriction. So reasonable restriction by law is very important.

Q: The way in which the sexual harassment case against Justice Gogoi was handled was pretty controversial. The woman has now been reinstated in the Supreme Court as a staffer. Does this action of the Supreme Court sort of vindicate her?

A: I find this very confusing you know. There is an old joke among lawyers: Lawyer for the petitioner argued before the judge and the judge said you are right; then the lawyer for the respondent argued before the judge and the judge said you’re right; then a third person sitting over there says how can both of them be right and the judge says you’re also right. So this is what has happened in this case. It was found (by the SC committee) that what she said had no substance. And therefore, she was wrong and the accused was right. Now she has been reinstated with back wages and all. I don’t know, I find it very confusing.

Q: Do you think the retirement age of Supreme Court Judges should be raised to 70 years and there should be a fixed tenure?

A: I haven’t thought about it as yet. There are some advantages, there are some disadvantages. (When) You have extended age or life tenure as in the United States, and the Supreme Court has a particular point of view, it will continue for a long time. So in the United States you have liberal judges and conservative judges, so if the number of conservative judges is high then the court will always be conservative. If the number of liberal judges is high, the court will always be liberal. There is this disadvantage but there is also an advantage that if it’s a liberal court and if it is a liberal democracy then it will work for the benefit of the people. But I have not given any serious thought onthis.

Q: Is there any other thing you would like to say?

A: I think the time has come for the judiciary to sit down, introspect and see what can be done, because people have faith in the judiciary. A lot of that faith has been eroded in the last couple of years. So one has to restore that faith and then increase that faith. I think the judiciary definitely needs to introspect.

‘A major issue for startups, especially during fund raising, is their compliance with extant RBI foreign exchange regulations, pricing guidelines, and the Companies Act 2013.’- Aakash Parihar

Aakash Parihar is Partner at Triumvir Law, a firm specializing in M&A, PE/VC, startup advisory, international commercial arbitration, and corporate disputes. He is an alumnus of the National Law School of India University, Bangalore.

How did you come across law as a career? Tell us about what made you decide law as an option.

Growing up in a small town in Madhya Pradesh, wedid not have many options.There you either study to become a doctor or an engineer. As the sheep follows the herd, I too jumped into 11th grade with PCM (Physics, Chemistry and Mathematics).However, shortly after, I came across the Common Law Admission Test (CLAT) and the prospect of law as a career. Being a law aspirant without any background of legal field, I hardly knew anything about the legal profession leave alone the niche areas of corporate lawor dispute resolution. Thereafter, I interacted with students from various law schools in India to understand law as a career and I opted to sit for CLAT. Fortunately, my hard work paid off and I made it to the hallowed National Law School of India University, Bangalore (NSLIU). Joining NLSIU and moving to Bangalorewas an overwhelming experience. However, after a few months, I settled in and became accustomed to the rigorous academic curriculum. Needless to mention that it was an absolute pleasure to study with and from someof the brightest minds in legal academia. NLSIU, Bangalore broadened my perspective about law and provided me with a new set of lenses to comprehend the world around me. Through this newly acquired perspective and a great amount of hard work (which is of course irreplaceable), I was able to procure a job in my fourth year at law school and thus began my journey.

As a lawyer carving a niche for himself, tell us about your professional journey so far. What are the challenges that new lawyers face while starting out in the legal field?

I started my professional journey as an Associate at Samvad Partners, Bangalore, where I primarily worked in the corporate team. Prior to Samvad Partners, through my internship, I had developed an interest towards corporate law,especially the PE/VC and M&A practice area. In the initial years as an associate at Samvad Partners and later at AZB & Partners, Mumbai, I had the opportunity to work on various aspects of corporate law, i.e., from PE/VC and M&A with respect to listed as well as unlisted companies. My work experience at these firms equipped and provided me the know-how to deal with cutting edge transactional lawyering. At this point, it is important to mention that I always had aspirations to join and develop a boutique firm. While I was working at AZB, sometime around March 2019, I got a call from Anubhab, Founder of Triumvir Law, who told me about the great work Triumvir Law was doing in the start-up and emerging companies’ ecosystem in Bangalore. The ambition of the firm aligned with mine,so I took a leap of faith to move to Bangalore to join Triumvir Law.

Anyone who is a first-generation lawyer in the legal industry will agree with my statement that it is never easy to build a firm, that too so early in your career. However, that is precisely the notion that Triumvir Law wanted to disrupt. To provide quality corporate and dispute resolution advisory to clients across India and abroad at an affordable price point.

Once you start your professional journey, you need to apply everything that you learnt in law schoolwith a practical perspective. Therefore, in my opinion, in addition to learning the practical aspects of law, a young lawyer needs to be accustomed with various practices of law before choosing one specific field to practice.

India has been doing reallywell in the field of M&A and PE/VC. Since you specialize in M&A and PE/VC dealmaking, what according to you has been working well for the country in this sphere? What does the future look like?

India is a developing economy, andM&A and PE/VC transactions form the backbone of the same. Since liberalization, there has been an influx of foreign investment in India, and we have seen an exponential rise in PC/VA and M&A deals. Indian investment market growth especially M&A and PE/VC aspects can be attributed to the advent of startup culture in India. The increase in M&A and PE/VC deals require corporate lawyersto handle the legal aspects of these deals.

As a corporate lawyer working in M&A and PE/VC space, my work ranges from drafting term-sheets to the transaction documents (SPA, SSA, SHA, BTA, etc.). TheM&A and PE/VC deal space experienced a slump during the first few months of the pandemic, but since June 2021, there has been a significant growth in M&A and PE/VC deal space in India. The growth and consistence of the M&A and PE/VC deal space in India can be attributed to several factors such as foreign investment, uncapped demands in the Indian market and exceptional performance of Indian startups.

During the pandemic many businesses were shut down but surprisingly many new businesses started, which adapted to the challenges imposed by the pandemic. Since we are in the recovery mode, I think the M&A and PE/VC deal space will reach bigger heights in the comingyears. We as a firm look forward to being part of this recovery mode by being part of the more M&A and PE/VC deals in future.

You also advice start-ups. What are the legal issues or challenges that the start-ups usually face specifically in India? Do these issues/challenges have long-term consequences?

We do a considerable amount of work with startupswhich range from day-to-day legal advisory to transaction documentation during a funding round. In India, we have noticed that a sizeable amount of clientele approach counsels only when there is a default or breach, more often than not in a state of panic. The same principle applies to startups in India, they normally approach us at a stage when they are about to receive investment or are undergoing due diligence. At that point of time, we need to understand their legal issues as well as manage the demands of the investor’s legal team. The majornon-compliances by startups usually involve not maintaining proper agreements, delaying regulatory filings and secretarial compliances, and not focusing on proper corporate governance.

Another major issue for startups, especially during fund raising, is their compliance with extant RBI foreign exchange regulations, pricing guidelines, and the Companies Act 2013. Keeping up with these requirements can be time-consuming for even seasoned lawyers, and we can only imagine how difficult it would be for startups. Startups spend their initial years focusing on fund-raising, marketing, minimum viable products, and scaling their businesses. Legal advice does not usually factor in as a necessity. Our firm aims to help startups even before they get off the ground, and through their initial years of growth. We wanted to be the ones bringing in that change in the legal sector, and we hope to help many more such startups in the future.

In your opinion, are there any specific India-related problems that corporate/ commercial firms face as far as the company laws are concerned? Is there scope for improvement on this front?

The Indian legal system which corporate/commercial firms deal with is a living breathing organism, evolving each year. Due to this evolving nature, we lawyers are always on our toes.From a minor amendment to the Companies Act to the overhaul of the foreign exchange regime by the Reserve Bank of India, each of these changes affect the compliance and regulatory regime of corporates. For instance, when India changed the investment route for countries sharing land border with India,whereby any country sharing land border with India including Hong Kong cannot invest in India without approval of the RBI in consultation with the central government,it impacted a lot of ongoing transactions and we as lawyers had to be the first ones to inform our clients about such a change in the country’s foreign investment policy. In my opinion, there is huge scope of improvement in legal regime in India, I think a stable regulatory and tax regime is the need for the hour so far as the Indian system is concerned. The biggest example of such a market with stable regulatory and tax regime is Singapore, and we must work towards emulating the same.

Your boutique law firm has offices in three different cities — Delhi NCR, Mumbai and Bangalore. Have the Covid-induced restrictions such as WFH affected your firm’s operations? How has your firm adapted to the professional challenges imposed by the pandemic-related lifestyle changes?

We have offices in New Delhi NCR and Mumbai, and our main office is in Bangalore. Before the pandemic, our work schedule involved a fair bit of travelling across these cities. But post the lockdowns we shifted to a hybrid model, and unless absolutely necessary, we usually work from home.

In relation to the professional challenges during the pandemic, I think it was a difficult time for most young professionals. We do acknowledge the fact that our firm survived the pandemic. Our work as lawyers/ law firms also involves client outreach and getting new clients, which was difficult during the lockdowns. We expanded our client outreach through digital means and by conducting webinars, including one with King’s College London on International Treaty Arbitration. Further, we also focused on client outreach and knowledge management during the pandemic to educate and create legal awareness among our clients.

‘It’s a myth that good legal advice comes at prohibitive costs. A lot of heartburn can be avoided if documents are entered into with proper legal advice and with due negotiations.’ – Archana Balasubramanian

Archana Balasubramanian is the founding partner of Agama Law Associates, a Mumbai-based corporate law firm which she started in 2014. She specialises in general corporate commercial transaction and advisory as well as deep sectoral expertise across manufacturing, logistics, media, pharmaceuticals, financial services, shipping, real estate, technology, engineering, infrastructure and health.

August 13, 2021:

Lawyers see companies ill-prepared for conflict, often, in India. When large corporates take a remedial instead of mitigative approach to legal issues – an approach utterly incoherent to both their size and the compliance ecosystem in their sector – it is there where the concept of costs on legal becomes problematic. Pre-dispute management strategy is much more rationalized on the business’ pocket than the costs of going in the red on conflict and compliances.

Corporates often focus on business and let go of backend maintenance of paperwork, raising issues as and when they arise and resolving conflicts / client queries in a manner that will promote dispute avoidance.

Corporate risk and compliance management is yet another elephant in India, which in addition to commercial disputes can be a drain on a company’s resources. It can be clubbed under four major heads – labour, industrial, financial and corporate laws. There are around 20 Central Acts and then specific state-laws by which corporates are governed under these four categories.

Risk and compliance management is also significantly dependent on the sector, size, scale and nature of the business and the activities being carried out.

The woes of a large number of promoters from the ecommerce ecosystem are to do with streamlining systems to navigate legal. India has certain heavily regulated sectors and, like I mentioned earlier, an intricate web of corporate risk and compliance legislation that can result in prohibitive costs in the remedial phase. To tackle the web in the preventive or mitigative phase, start-ups end up lacking the arsenal due to sheer intimidation from legal. Promoters face sectoral risks in sectors which are heavily regulated, risks of heavy penalties and fines under company law or foreign exchange laws, if fund raise is not done in a compliant manner.

It is a myth that good legal advice comes at prohibitive costs. Promoters are quick to sign on the dotted line and approach lawyers with a tick the box approach. A lot of heartburn can be avoided if documents are entered into with proper legal advice and with due negotiations.

Investment contracts, large celebrity endorsement contracts and CXO contracts are some key areas where legal advice should be obtained. Online contracts is also emerging as an important area of concern.

When we talk of scope, arbitration is pretty much a default mechanism at this stage for adjudicating commercial disputes in India, especially given the fixation of timelines for closure of arbitration proceedings in India. The autonomy it allows the parties in dispute to pick a neutral and flexible forum for resolution is substantial. Lower courts being what they are in India, arbitration emerges as the only viable mode of dispute resolution in the Indian commercial context.