I. Background

While announcing extension of the lockdown, Prime Minister Narendra Modi had urged everyone to download the ‘Aarogya Setu’ (“the app”), an application developed by the Government of India as a measure to combat the severe respiratory syndrome COVID-19.

The app essentially requires access to the location and bluetooth of the device to find out proximity with anyone who might have tested positive for COVID-19. As per clause 1(a) of the privacy policy of the app, it collects the following information:

It further states that instead of storing the information itself, it creates a Digital ID (“DiD”) unique to each person. Hence when two people with the app on their phone come in contact with each other, the information will get stored on the other person’s device for a period of 30 (thirty) days and will be stored on the government’s servers as well. If a person has not tested positive for COVID-19, the information from the government’s server will get deleted in 45 (forty-five) days.

II. Privacy and other concerns

a. Aarogya Setu is not an open source app

An open source programme is where the developer shares the source code for people to evaluate the application. Therefore, it is difficult for people to rely on whether the data is anonymised or that the application actually functions as has been advertised to the users.

If the app was made open source, any code developers could point out a bug or fix it. This would have also ensured transparency.

b. Collection of Data

The data collected at the time of registration has been listed above. The primary principle of any data collection is that it should be limited to what is essential for the purpose of providing services (as is also provided by the upcoming Personal Data Protection Bill, 2019). The government has stated it will create a DiD from the data provided and use location and bluetooth to identify COVID-19 cases. There is a lack of clarity on the kind of data collected by the government, e.g. sex and profession of a person. This is in complete contrast with a similar app created by the Government of Singapore called ‘trace together’ where the data stored is limited to a mobile number which then creates an ID for every phone number collected. Therefore, the Government of India should clarify the purpose of collecting each detail of the user.

The data retention time, for those users who have not been tested positive for COVID-19, on other user’s devices is 30 (thirty) days and 45 (forty-five) days on government’s servers. This data retention time is far exceeding the incubation period for COVID-19 which is 14 (fourteen) days, as declared by the World Health Organisation (“WHO”). Therefore, it shall be noted that the retention of data is beyond the period of incubation.

c. Retention of Data

Clause 3 (a) of the privacy policy of the app states that the data shall be retained “as long as your account remains in existence or for such period thereafter as required under any law for the time being in force.”

The clause states that the data which has been collected at the time of registration shall be retained till the account of a user is active “or” as required by any law in force. The issue is with the vaguely structured language of the clause. The laws of India are not yet adequate to safeguard its citizens’ personal data. Therefore, to collect such information, and not deleting it after the said purpose of providing services has been fulfilled, raises a concern over how long shall the data actually be retained by the government. This allows the government to turn the data collected into a permanent architecture instead of deleting it after the purpose has been served. Moreover, this is also in contradiction to

the upcoming Personal Data Protection Bill, 2019 which clearly states that the data shall be removed once the purpose of processing the data has been fulfilled.

Clause 3(c) of the privacy policy of the app states “nothing herein shall apply to the anonymised, aggregated datasets generated by personal data”. This gives the government the right to store the anonymised data even after the user has deleted its account for as long as it wishes. The concern is that firstly, ‘anonymised’ has not been defined either in the privacy policy or the Information Technology (Reasonable security practices and procedures and sensitive personal data or information) Rules, 2011. Therefore, if the data is anonymised in such a way that it is possible to reverse engineer it, the privacy is not actually secured and the data protection concerns emerge. Further, the measures taken for the security of the aggregate datasets has not been laid down. Aggregate data sets denote the aggregate groups of places in the form of a summary. Therefore, one cannot be certain of the security of any community, which may be at risk.

d. Storage of data on other devices and on the government server

It has been highlighted in the privacy policy of the app that the data is stored on the devices of those people with whom you have come in contact. The government has further clarified in the policy that the data will not be accessible by the people on whose device the data has been stored. However, the government has not stated if only they DiD is stored on other devices, or the anonymised data, or data in any other encrypted format. For example, Singapore’s app ‘trace together’ clarifies that the devices only exchange a temporary ID which is encrypted by a private key which is only held with the Ministry of Health.

Further, by virtue of the government having access to the devices itself, it is unclear as to whether the government also has access to other information like contacts or any other details that might be stored on the device.

Further, clarity is required by the government as to which ministry shall have access to the data uploaded on the government’s server. For example, the privacy policy of ‘trace together’ clearly states that the data shall be held by the ministry of health. Further, it needs to be identified whether inter-ministerial data sharing shall be permitted.

e. Third party transfers

Clause 6 of the privacy policy of the app states that the data may be provided to “the persons carrying out medical and administrative intervention necessary in relation to COVID-19”. Therefore, the government can also broaden the scope of those people whose “medical and administrative” intervention is necessary. It is suggested that the

government should have been more specific about the third-party transfers and transfer such data to ANY third party only after obtaining specific consent before such transfer, in order to uphold the spirit of privacy. Moreover, any medical and administrative intervention may also be carried out by private entities which may be involved in research sciences pertaining to COVID-19 or any medical agency which is helping the government with infrastructure required for COVID-19. Therefore, the government holds the power to broaden the scope of third-party transfers at any point in time.

f. Limitation of liability

The Government of India absolves itself from any liability including inability to access the app or failure to accurately identify a person who has contracted COVID-19 or any unauthorised access to the information collected. Firstly, this portrays a clear lack of accountability on the part of the government. The government needs to consider a scenario where the false alarm may go to users, and their information is transferred to the third party without their specific consent. Further, as per the privacy policy, the data retention period is 60 (sixty) days after the cure of COVID-19. Therefore, in case of a false alarm, the event after which the data shall be deleted needs to be clarified. In such cases, the lack of accountability portrays miniscule concern to user’s data protection. Secondly, once the data is collected by any entity or organisation, it is their responsibility to ensure that there is no “unauthorised access” and shall take full responsibility in case of any misuse. Further, it is essential to define what an unauthorised access is, in order to ensure that reasonable security measures are in place.

Lack of such assurance calls for a severe reconsideration on the introduction of the app to the general public and for it to be recalled until all such questions with regards to the citizens’ privacy have been answered.

On a positive note, the government has designated the grievance officer who is the Deputy Director General of National Informatics Centre.

****

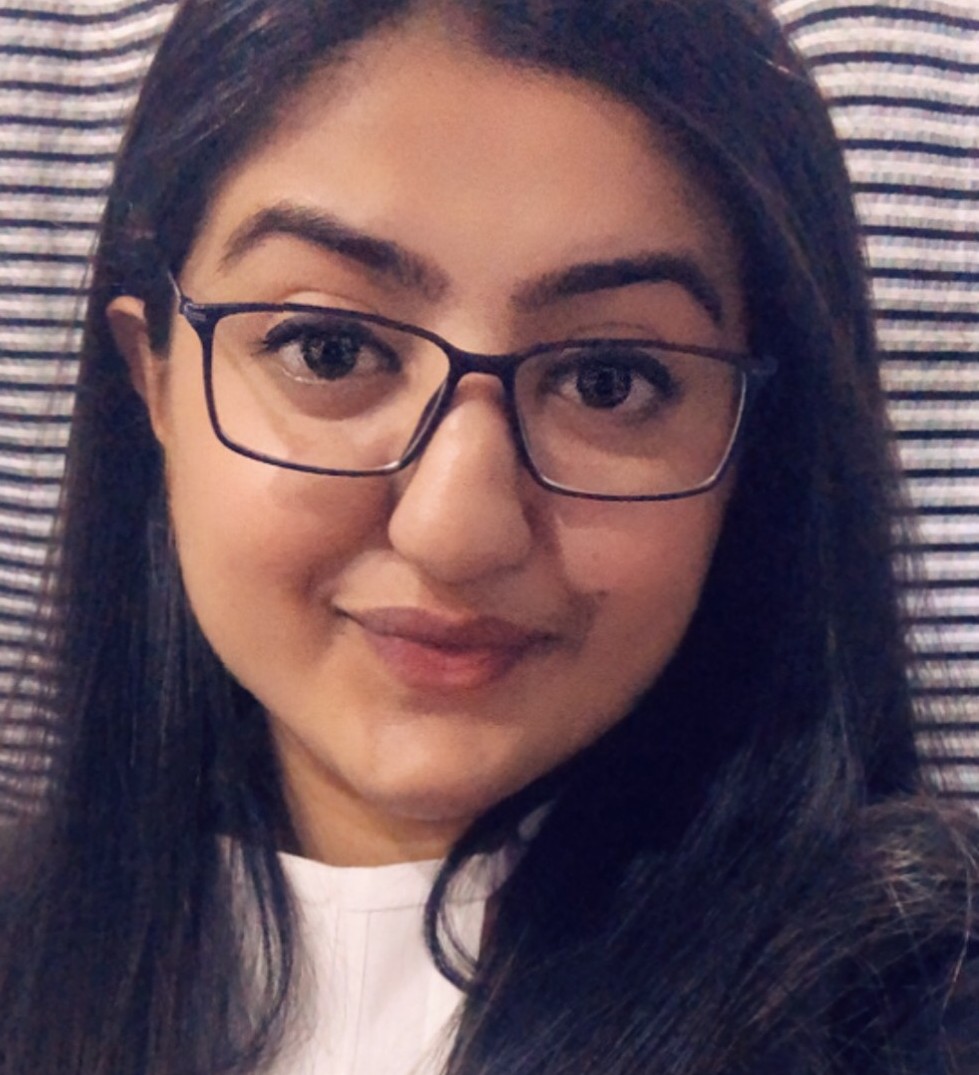

Shivani Agarwal practices corporate and commercial law and is the founder of W-Investment (winvestment.wordpress.com). She closely follows developments in cryptocurrencies and blockchain laws. Her areas of work include banking laws, restructuring and project and finance.

Samaksh Khanna is the Co-founder of W-Investment (winvestment.wordpress.com), a blogging platform for mainly exploring the usage of blockchain in law and research on cryptocurrencies. He closely follows privacy laws and digital assets laws.

The Government of India, through the Procurement Policy Division, Department of Expenditure at the Ministry of Finance (MoF), has recently issued an office memorandum on May 13, 2020 (O.M. No. F. 18/4/2020-PDD) pertaining to force majeure (MoF Memorandum). The MoF Memorandum seeks to provide relief to parties who have contracted with the Government under and in accordance with Manual for Procurement of Goods, 2017 (Goods Procurement Manual); Manual for Procurement of Works, 2019 (Works Procurement Manual); Manual for Procurement of Consultancy and other services, 2017 (Consultancy Procurement Manual) (collectively Procurement Manuals); and public private partnership (PPP) contracts.

Notably, the MoF had earlier issued another office memorandum on February 19, 2020 (February Memorandum), stating that disruption of supply chain due to corona virus in China or any other country would be regarded as a natural calamity and the force majeure clause, as provided under the Goods Procurement Manual, may be invoked ‘wherever considered appropriate’. The February Memorandum was issued prior to Covid-19 affecting operations in India and recognized hardship faced by contractors with regard to import of equipment and goods from other countries which were impacted by the pandemic.

The MoF Memorandum goes a step further from the February Memorandum and provides clarity on the applicability of force majeure on account of disruption in transportation, manufacturing and distribution of goods and services in India and the restrictions placed by directives of the Ministry of Home Affairs under the Disaster Management Act, 2005, as well as those placed by the respective State Governments and Union Territories. Consequently, the MoF Memorandum seeks to remedy the effects of ‘extraordinary events or circumstances beyond human control leading to delays in or non-fulfilment of contractual obligations’ for parties contracting under the aegis of Procurement Manuals.

Restrictions imposed by the Government on economic activity during the lockdown have impacted the transportation, manufacturing and distribution of goods and services throughout the country, which have caused unforeseen delays to ongoing projects. The MoF Memorandum is a welcome step by the Government and provides relief to contractors and concessionaires who have been impacted by Covid-19 but did not have adequate relief factored into their contracts with government agencies.

There being no unified legislation for PPP projects, these are governed by plethora of guidelines, policies, manuals, and sectoral legislations and, most importantly, the terms of the contract executed between parties. It is noteworthy that the MoF Memorandum finds mention of PPP projects and states that ‘period of the contract may have become unremunerative’ with respect to PPP contracts.

While the settled law is that a contract becoming onerous does not lead to frustration, however, the MoF Memorandum seeks to address the extraordinary exigencies owing to the pandemic. Per the MoF Memorandum, under contracts for construction/works, goods and services and PPP with Government Agencies, parties can invoke the force majeure clause ‘after fulfilling due procedure’ and ‘wherever applicable’. This position of giving primacy to the contractual terms appears to be in sync with the position taken by the MoF under the February Memorandum.

The MoF Memorandum supplements the contractual agreement between the parties and not supersede it. However, this would apply only to agreements which do not have adequate provision for force majeure events. Having said that, it will not aid parties who have signed contracts with restrictive covenants. The settled legal position is that relief or excuse from performance on account of force majeure would be governed as per the wording of the contract. Notably, concession agreements based on the model concession agreements (MCA) provide for a robust mechanism for force majeure, which are unforeseen circumstances beyond reasonable control of the parties. The MCA’s further classify them into non-political, indirect-political and political force majeure events, with separate treatment and consequences for each. Therefore, a critical analysis of the underlying contract is imperative and sole reliance upon the MoF Memorandum in seeking relief may not be prudent.

The MoF Memorandum also provides that for such contracts, obligations which were required to be fulfilled on or after February 20, 2020 under PPP contracts would be extended for a minimum period of three months and not exceeding six months, without any cost or penalty on the contractors or concessionaires. Interestingly, the cut-off date is one day after the February Memorandum. The term of concession agreements for PPP projects is also stated to be extended by a similar period (three to six months), depending on specific circumstances of the case and for the period affected by the force majeure event.

The MoF Memorandum goes on to provide that a party would only be entitled to seek relief for force majeure if they were not in default as on February 19, 2020 (date of the February Memorandum). However, it does not specify if a single breach, which may not be material or cause impediment to completion of the project, would recuse the concessionaire or the contractor for claiming relief under force majeure. A non-material breach which is incidental to the performance of the concessionaire or contractor should not preclude them from claiming relief due to force majeure event. There needs to be greater clarity by the Government to avoid any ambiguity in interpretation.

Lastly, the MoF Memorandum also states that invoking force majeure would only apply in respect of non-performance attributable to the lockdown situation or restrictions imposed by legislation or executive orders of the Government on account of COVID-19 and that obligations of parties would resume upon expiry of the period specified in the MoF Memorandum.

****

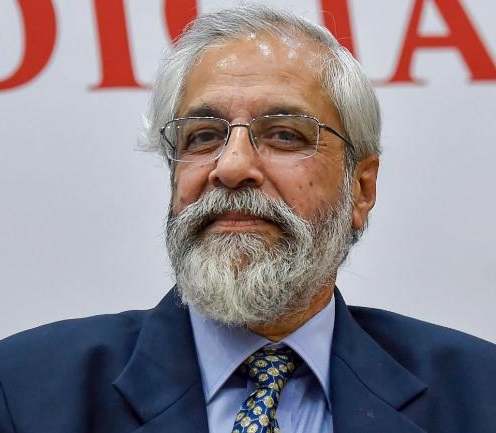

Hemant Sahai is the Founding Partner of HSA Advocates, a leading law firm in India and is recognized by peers, clients and diverse international legal publications as an “astute lawyer”, and one of the “leading lawyers” in India. For the last three decades, Mr. Sahai has been a trusted legal counsel to some of the largest corporates in India and overseas and is widely recognized for his role in shaping the Indian legal industry. In addition to the traditional legal transactional and advisory assignments for corporate groups, Mr. Sahai has also been an adviser to central government ministries, PSUs, regulatory authorities, multilateral institutions (World Bank, IFC, ADB, etc.), banks and financial institutions, etc. on a range of policy and regulatory issues. Mr. Sahai has served as an adviser to several working groups and committees formed by top government bodies/institutions including certain extra ministerial policy advisory bodies set up by the Prime Minister’s Office, Ministry of Power, Ministry of New and Renewable Energy and other government bodies, from time to time. He has advised the Planning Commission, Niti Aayog and other Governmental bodies on policy issues, drafting model transaction and policy documents, etc.

Introduction

The 18th of May marked 65 years since the enactment of the Hindu Marriage Act,1955 (“The Act”). The Act was part of the gamut of the Hindu Code Bill (“The Bill”) which attempted to codify, unify and liberalise Hindu Personal Laws. The Act granted individuals, especially women, greater autonomy in terms of marriage, dissolution of marriage, absolute ownership of property, equal parity in terms of inheritance, adoption, maintenance and guardianship. The Bill applies to Hindu, Sikh, Jain and Buddhist faiths.[1]

It was initially drafted by a committee chaired by BN Rau and this draft was significantly reviewed by Dr. B.R. Ambedkar who introduced it on 11.04.1948 in the Constituent Assembly. The Bill faced severe opposition and an All India Anti-Hindu Code Bill Committee was formed on the grounds that the Constituent Assembly had no right to interfere with the personal laws of Hindus which are based on the dharma shastras. Several other organisations carried out various protests against the enactment of the Bill. The Bill was eventually passed in the Parliament owing to the relentless efforts of Dr. BR Ambedkar and Pandit Jawaharlal Nehru. The Hindu Marriage Act, 1955 is one of the four acts that are a product of the Bill.[2]

The Act, being a social welfare legislation, is constantly evolving, through amendments and judicial precedents, in order to incorporate the interests of the prevalent social and economic milieu and to account for the enlarging and dynamic interests of the people. Further, these judicial pronouncements assist in filling any lacunae in the Act and in expanding the ambit and purpose of the Act. Through the course of this essay, certain important amendments and judicial pronouncements that have helped widen the ambit and applicability of the Act are analysed and explained.

Certain Salient Provisions:

One of the most significant features of the Act is that it granted considerable autonomy to individuals, especially women in terms of marriage, divorce, maintenance, custody rights. The Act is an all-encompassing legislation in terms of granting several legal remedies to those who seek a decree of dissolution of marriage or a decree of restitution of conjugal rights. Among the most important features of the Act is that it specifically lays down conditions of a valid Hindu marriage. A marriage is considered to be valid only if at the time of marriage neither party has a living spouse, neither party is incapable of giving valid consequent due to unsoundness of mind, neither party though capable of giving a valid consent has been suffering from mental disorder making him or her unfit for marriage and procreation of child, person is not subject to recurrent attacks of insanity, the bride has attained the age of 18 years and the groom has attained the age of 21 years[3]. However, some conditions of a void marriage, like if the parties are within the degrees of prohibited relationship and/ or sapindas of each other, are permissible if the custom permits such type of marriages. Therefore, in some instances, there has been some room for customs and traditions, wherein these permissible customs take precedence over the codified law and thus, the custom permits such relations. Further, in the event that a marriage has been entered into wherein the bridegroom is under the age of 21 years and the bride is below the age of 18 years, then a punishment of rigorous imprisonment for a period that may extend up to two years or with a sum that may extend to Rs.1,00,000/- or both is attracted.[4] In the event that a marriage takes place wherein the parties are within the degrees of prohibited relationship or are sapindas to each other and their custom does not provide for it, then a punitive action of simple imprisonment which may extend to one month or with a fine which may extent to Rs.1,000/- or both is attracted.[5] The Act has outlawed bigamy, even if it is customary in certain communities and the punishment for bigamy is imprisonment for a period of seven years, and a fine[6].

Another important aspect of the Act was the differentiation between void and voidable marriages. A void marriage is one wherein the parties are within the degrees of prohibited relationship or are sapindas to each other or the marriage is bigamous in nature[7]. In the event that a marriage is void, then a decree of nullity can be sought. The conditions that make a marriage voidable is enumerated in Section 12 of the Act. In the event that a marriage is voidable, then it may be annulled by a decree of nullity.

The Act provides interim and permanent maintenance to the husband or wife in the proceedings, depending on who files the claim for maintenance, thereby removing any gender barriers in terms of accessing financial support and maintenance. Further, it has been recognised that a woman who actually earns is not entitled to any maintenance.[8] The Act also grants permanent and interim custody of children to either the husband or the wife, depending upon whom the welfare of the child lies with.

Dissolution of marriage through a decree of divorce and important amendments

One of the most important features of the Act is that it introduced the concept of divorce or dissolution of marriage. Prior to the enactment of the Act, the concept of divorce did not exist in India and an aggrieved person could not ask for a grant of dissolution of marriage. Even after the enactment of the Act, it was not easy to get a of decree of divorce from the Courts due to the limited grounds available for dissolution of marriage. Prior to the Marriage Laws (Amendment) Act 1976, the grounds under which a person could seek a grant of divorce was if a person was “living in adultery”, “ceased to be a Hindu”, etc. These grounds were limited, for example a person had to be continuously committing acts of adultery and a single digression would not have sufficed to constitute as grounds for a divorce. Further, mutual consent was not recognised as a ground for divorce and two individuals could not amicably separate from one another.

The Marriage Laws (Amendment) Act 1976 brought with it crucial changes. One crucial change brought about by it was the insertion of the provision of seeking a divorce on the grounds of mutual consent[9]. A petition or first motion petition can be presented by both the parties after the parties have been living separately for a period of one year or more. Thereafter, the second motion petition has to be presented after a period of six months has lapsed and then a decree of divorce is granted to the parties. The statutorily mandated “cooling off period” of six months can be “waived” in certain occasions.

The Hon’ble Supreme Court, in the case of Amardeep Singh v Harveen Kaur[10] held that since the period of six months mentioned in Section 13B(2) of the Act is not mandatory but directory in nature, it will be the discretion of the concerned Court to exercise its powers, depending on the facts and circumstances of each case, to waive the cooling off period of six months, where there is no possibility of parties to resume cohabitation and there are chances of alternative rehabilitation. In the event that the concerned Court is satisfied that all efforts for mediation/conciliation including efforts in terms of Order XXXIIA Rule 3 CPC and Section 23(2) of the Act and Section 9 of the Family Courts Act, 1984 to reunite the parties have failed and there is no likelihood of success in that direction by any further efforts and that the parties have genuinely settled their differences including alimony, custody of child or any other pending issues between the parties and the waiting period will only prolong their agony, the concerned Court can waive the period of six months mentioned in Section 13B(2) of the Act. The aforementioned judgment of the Supreme Court is helpful as it provides a remedy to parties who wish to reducing the waiting period of 6 months in order to get a grant of decree of divorce. However, the statutorily prescribed waiting period of 6 months has not been invalidated and is still in place which ensures that parties always have the discretion to exercise the waiting period in order to re-think or re-evaluate their decision for dissolution of their marriage. Therefore, the two legal aspects co-exist and are available to parties who either want a decree of divorce be granted immediately or want to exercise the “cooling off period” of six months.

In India, the fault theory of divorce exists which means that the petitioner or the person seeking a divorce has to show that he or she is not at fault and is innocent and the fault lies with the respondent or the spouse. Further, the petitioner has to sufficiently and specifically lay down the fact that he or she has not taken any advantage of his or her wrong or been an accessor to or connived at or condoned the acts of the other party on which the dissolution of marriage has been sought. The Respondent in turn has to prove that he is not at fault. The fault theory of divorce embodies the concept that a marriage is a sacrament that has to be saved and protected. Further, due to the fault theory of divorce occupying centre stage in divorce proceedings in India, grounds such as irretrievable breakdown of marriage does not find a place in the grounds for divorce, despite the Parliament and various Law Commission Reports highlighting the importance of it being a ground for divorce.

Irretrievable breakdown of marriage essentially means that a divorce can be sought by one party on the basis that the marriage is irredeemable, dead letter and beyond repair and the husband and wife are living separately for several years and despite mediation and conciliatory efforts, it is still impossible for the parties to reside together as husband and wife. Even though irretrievable breakdown of marriage is not a statutory provision, the Hon’ble Supreme Court of India has recognised the concept of irretrievable breakdown of marriage, the lacunae in the statute with regard to this as a ground and has granted a divorce in several cases where the marriage has irretrievably broken down by exercising its inherent jurisdiction under Article 142 of the Constitution of India (“the Constitution”) in a plethora of judgments. In the case of Munish Kakkar vs Nidhi Kakkar, the Hon’ble Supreme Court of India held that since the continuity of the marriage between the parties was fruitless and was causing further emotional trauma and disturbance to both the parties, the sooner it comes to an end, the better it would be, for both the parties. Therefore, the Court exercised its inherent jurisdiction under Article 142 of the Constitution and granted a decree of divorce and dissolved the marriage between the parties since an end to this marriage would permit the parties to go their own way in life after having spent two decades battling each other and have a better life separately.

In another case of R.Srinivas Kumar v R. Sametha, the Supreme Court exercised its inherent power under Article 142 of the Constitution by granting a decree of divorce since the parties have been living separately for more than 22 years and it will not be possible for them to live together and that the marriage is totally unworkable, emotionally dead, beyond salvage and has broken down irretrievably. The Supreme Court also clarifies that if both the parties amicably agree for separation permanently and for a divorce through mutual consent, then they can approach the appropriate forum to seek a divorce. However, if only one party does not agree, then the powers of the Supreme Court under Article 142 of the Constitution can be invoked. There are several other cases in which the Supreme Court has invoked Article 142 of the Constitution such as Naveen Kohli v Neelu Kohli[11] which also recommended the Government to consider amending the Act to incorporate irretrievable breakdown of marriage as a ground for divorce., Samar Ghosh v Jaya Ghosh[12], Sukendhu Das v Reeta Mukherjee[13] amongst others.

The Law Commission of India in its 71st Report, in as early as April 1978 recommended the Act to be amended in order to insert irretrievable breakdown of marriage as a ground for divorce. Thereafter, in its 217th Report dated 30.03.2009 once again recommended that irretrievable breakdown of marriage should be incorporated as a ground for granting a decree of divorce in light of several Supreme Court precedents that did not exist during the recommendation made in its 7st Report. Further, the Marriage Laws (Amendment) Bill, 2010 was introduced and passed in the Rajya Sabha which sought an amendment to the Act to incorporate irretrievable breakdown of marriage as a ground for divorce. However, the Bill lapsed as the Parliament’s session also lapsed and was thereafter never introduced. Therefore, the prevailing sentiment is that the Act be amended in order to insert irretrievable breakdown of marriage as a ground for divorce and the same has been recognised as being imperative by various Law Commissions.

Another curial feature of the Act is that it conferred legitimacy upon children born from void and voidable marriages and did not automatically render them illegitimate due to no fault of theirs. Before the Marriage Laws (Amendment) Act 1976 was enacted, under Section 16, a child begotten from a void or voidable marriage was considered legitimate only if a degree of nullity was awarded for the marriage between the parents of the child. Further, such a child would be considered to be legitimate as if the marriage between the parents of the child had been dissolved instead of being annulled [14]. Ergo, in the event that the parents of the child did not obtain a declare of nullity for their marriage, the child would be considered an illegitimate child and therefore would be precluded from various inheritance rights. However, after The Marriage Laws (Amendment) Act, 1976 was passed, a child born from a void or voidable marriage will be considered to be a legitimate child in the same manner as though he was begotten from a valid marriage even if a degree of nullity or annulment has not been obtained by the parents of the child. This was a crucial and important amendment as now illegitimate children’s familial rights would not suffer any infirmity[15].

Another provision of the Act which has been under challenge numerous times and is also presently under challenge is the provision regarding restitution of conjugal rights. Section 9 of the Act provides that in the event that a husband or wife without reasonable cause withdraws from the society of the other, then a petition for the restitution of conjugal rights may be presented by the aggrieved party. The constitutional validity of this provision is presently under challenge in the Supreme Court on the grounds that it is violative of the right to privacy, individual autonomy and dignity of individuals guaranteed under Article 21 of the Constitution. Several countries such as United Kingdom, South Africa and Ireland have abolished provisions and legal actions of restitution of conjugal rights.

Therefore, to conclude, the Hindu Marriage Act, 1955 is an important piece of social welfare legislation that has provided a codified framework along with legal remedies with regard to issues of marriage and divorce. Further, the Act is constantly evolving and changing to incorporate the prevailing sentiments and interests of people and the milieu. While there does exist certain lacunae in the Act, the lacunae are filled through various judicial pronouncements. Further, certain provisions are becoming a little gender neutral and are accounting for other circumstances, thereby giving all parties an equal and fair opportunity.

****

Prachi Dutta is a practising Advocate in New Delhi. She studied History at Hindu College, Delhi University and thereafter pursued LLB Hons. from Jindal Global Law School, Sonepat.

[1] India After Gandhi by Ramchandra Guha

[2] Ibid

[3] Section 5 of the Act

[4] Section 18 of the Act

[5] Ibid

[6] Section 494 Indian Penal Code, 1860

[7] Section 11 of the Act

[8] K.N. vs R.G. [MAT. App. (F.C.) 93/2018] , Rupali Gupta vs Rajat Gupta (2016) 234 DLT 693 (DB)

[9] Section 13B of The Act

[10] (2017) 8 SCC 746

[11] (2006) 4 SCC 558

[12] (2007) 4 SCC 511

[13] (2017) 9 SCC 632

[14] Section 16 (pre-amendement)- Legitimacy of children of void and voidable marriages.—Where a decree of nullity is granted in respect of any marriage under section 11 or section 12, any child begotten or conceived before the decree is made who would have been the legitimate child of the parties to the marriage if it had been dissolved instead of having been declared null and void or annulled by a decree of nullity shall be deemed to be their legitimate child notwithstanding the decree of nullity:

Provided that nothing contained in this section shall be construed as conferring upon any child of a marriage which is declared null and void or annulled by a decree of nullity any rights in or to the property of any person other than the parents in any case where, but for the passing of this Act, such child would have been incapable of possessing or acquiring any such rights by reason of his not being the legitimate child of his parents.

[15] Parayankandiyal Eravath Kanapravan Kalliani Amma v. K. Devi [(1996) 4 SCC 76]

Abstract

This article elucidates the general meaning, idea, and extent of the legal doctrine of ‘frustration’ and clause of ‘force majeure’ in regard to section 56 of the Indian Contract Act, 1972. It deals briefly with the concept and submission of force majeure in India along with other jurisdictions’ and addresses what can amount to force majeure excuse. There is always a sense of confusion when it pertains to ‘Doctrine of Frustration’ and clause of ‘Force Majeure’ in an operating contract. This uncertainty sometimes brings either of the parties of the agreement, to the court of law and brings an end to the contract. Therefore both Doctrine of Frustration and clause of Force Majeure is comprehensively analyzed and interpreted herein.

Keywords

Force Majeure; Frustration of contract; concept; Section 56; Indian Contract Act; Application; reasons; case laws[1]

1. INTRODUCTION

The principle of freedom to contract is a founding principle upon which the world of commercial contracts operates. This strictly means that the parties to a contract are free to agree on their own rights and obligations to be included in their agreement. Problems can occur however, where one party is prevented from, or unable to, carry out his/her obligations under the contract due to a supervening events beyond their control. As a result, a doctrine has accordingly emerged in the law of contract to provide for situations where such an eventuality occurs.

Under the doctrine of frustration, a promisor is relieved of any liability under a contractual agreement in the event of a breach of contract where a party to the agreement is prevented from performing their obligations, due to some event, which become impossible to perform and outside their control. In such circumstances, the law deems it unfair to compel the injured party to comply with the terms of the agreement. Hence, the law relieves this person from their obligations by regarding the contract as frustrated for all purposes.

Therefore, structurally this article will proceed in three parts. Part I will discuss about the notion behind doctrine of frustration with the help of judgments’. The second part deals with the explanation behind Force Majeure in India along with other jurisdictions’ followed by a conclusion.

I. Section 56 of Indian Contract Act, 1872

Agreement to do impossible act – An agreement to do an act impossible in itself is void. —An agreement to do an act impossible in itself is void.

Section 56 lays down a rule of positive law and does not leave the matter to be determined according to the intention of the parties. (Naithati Jute Mills Ltd. V. Khyaliram Jagannath, AIR 1968 SC 522) (Para 7)

To attract and apply Section 56, the following conditions must be filled:

(a) There should be a valid and subsisting contract between the parties,

(b) There must be some part of the contract yet to be performed,

(c) The contract after it is entered, becomes impossible to be performed,

(d) The impossibility is by reason of some events which the promisor could not prevent, and

(e) The impossibility is not induced by the promisor or due to his negligence

Paragraph 2 of section 56 makes the contract to do an act void on account of following events:

Paragraph 3 of section 56 postulates that where a person has promised to do something, which –

Which promisee did not know to be impossible or unlawful, such promisor will be held liable to make compensation to the other party for any loss sustained through non-performance of the promise.

Frustration of Contract:

(U.P. State Electricity Board v. Kanoria Chemical, AIR 1986 SC 156) (Para 41)

Specific grounds of frustration

The principle of impossibility/frustration of contract of performance is applicable to a great variety of contracts. The following grounds of frustration have become well established:

(1) Destruction of Subject-Matter

The doctrine of impossibility applies where the actual and specific subject matter of the contract has ceased to exist.

(2) Change in Circumstances

Similarly, the contract may be declared as frustrated by the courts if the parties to an executory contract, which is not fully performed or fully executed face in the course of carrying it out with a turn of events, which they did not anticipate prior to the execution of the contract like the following:

Escalation

(3) Death or incapacity to perform

A party to a contract is excused from performance if it depends upon the existence of a given person or becomes too ill to perform.

For example:

(a) A contract to act at a theatre for six months in consideration of a sum, paid in advance by B. On several occasions A is too ill to act. The contract to act on those occasions becomes void. (Section 56 Illustration (e) from the Contract Act)

(4) Government or Legislative Intervention –

(i) A contract will be dissolved when legislative or administrative intervention has taken place.

(ii) Where the intervention makes the performance unlawful, the courts will have no choice but to put an end to the contract.

(5) Intervention of War

(6) Application to Leases

(7) Frustration of contract of sale

(8) Frustration of contract? Award on Interest

(9) No party can say they will be bound by only one part of the agreement and not the other part, unless such other part is impossible of performance

(10) If the performance of the contract comes to an end on account of repudiation, frustration or breach of contract, arbitration agreement would survive for the purpose of resolution of disputes

(11) Delay in performance of contract

(12) Forfeiture of earnest money

(13) Specific Performance of contract

(14) Doctrine of frustration – Induced frustration – whether contract stood frustrated due to non- performance of obligation by the other party

(15) Doctrine of frustration can apply only to executory contracts and not the transaction which have created a demise in presenti

(16) Contract of Guarantee – Doctrine of Frustration, inapplicability

II. FORCE MAJEURE: A DETAILED ANALYSIS

Some events are unavoidable, nobody can dodge them and no specific class of people can avert its effects by using any power be it of money, strength etc. Everybody gets affected, some more than the others.

The following report will make your understanding better about this concept.

COVID- 19 has been declared as a pandemic by the World Heath Organisation, and the Ministry of Health and Family Welfare has issued an advisory on social distancing, w.r.t. mass gathering and has put travel restrictions to prevent spreading of COVID-19.

On 19th February, 2020, vide an office memorandum O.M. No. 18/4/2020-PPD, the Government of India has clarified that the disruption of the supply chains due to spread of coronavirus in China or any other country should be considered as a case of natural calamity and “force majeure clause” may be invoked, wherever considered appropriate, following the due procedure.

In view of the current situation where COVID- 19 has a global impact, and is resulting in a continuous sharp decline in the market, it is important to understand the relevance of force majeure clauses, and the effect thereof.

INDIA

1. What’s Force Majeure in Indian law?

2. What is the legal provision of claims for Force Majeure in Indian law?

“Section 56. Agreement to do impossible act—An agreement to do an act impossible in itself is void.

Contract to do act afterwards becoming impossible or unlawful.—A contract to do an act which, after the contract is made, becomes impossible, or, by reason of some event which the promisor could not prevent, unlawful, becomes void when the act becomes impossible or unlawful.”

Invocation of force majeure

The sine qua non for invocation of Section 56 is as below:

It is imperative to note that force majeure is present in common law as the doctrine of contract. In other words, Doctrine of Frustration is an inbuilt factor in Section 56 of the Act. However, it can neither be invoked in case of commercial hardship nor can be used as a device to avoid a bad bargain.

In Ganga Saran v. Ram Charan AIR 1952 SC 9, where Fazl Ali J speaking for the three member bench of Supreme Court held that;

“It seems necessary for us to emphasize that so far as the courts in this country are concerned, they must look primarily to the law as embodied in sections 32 and 56 of the Indian Contract Act, 1872.”

The heart to the Doctrine of frustration travels through Section 32 and hence it should be read together for the purpose of Section 56.

3. How do the Indian precedents define Force Majeure?

Over the years, Courts in India have dealt with various situations where they have defined force majeure in different manners. Some of those are enlisted below.

Force majeure clauses vary. They can be specific (a list of specific events that are treated as being force majeure, such as fire, flood, war or similar) or general (referring simply to events outside the reasonable control of a party to the contract), or a combination of both.

“19. McCardie J. in Lebeaupin v. Crispin ([1920] 2 K.B. 714), has given an account of what is meant by “force majeure” with reference to its history.

The expression “force majeure” is not a mere French version of the Latin expression “vis major”. It is undoubtedly a term of wider import. Difficulties have arisen in the past as to what could legitimately be included in “force majeure”.

Judges have agreed that strikes, breakdown of machinery, which, though normally not included in “vis major” are included in “force majeure”.

An analysis of rulings on the subject into which it is not necessary in this case to go, shows that where reference is made to “force majeure”, the intention is to save the performing party from the consequences of anything over which he has no control.

This is the widest meaning that can be given to “force majeure”, and even if this be the meaning, it is obvious that the condition about “force majeure” in the agreement was not vague. The use of the word “usual” makes all the difference, and the meaning of the condition may be made certain by evidence about a force majeure clause, which was in contemplation of parties.

In this case, the court held that force majeure will not include economic problems like insufficient funds, it will only include unforeseeablt and unpredicted circumstances.

“Force majeure” is governed by the Indian Contract Act, 1872. The Supreme Court held: “In so far as a force majeure event occurs de hors the contract, it is dealt with by a rule of positive law under Section 56 of the Contract. The performance of an act may not be literally impossible but it may be impracticable and useless from the point of view”.

“the Act does not enable a party to a contract to ignore the express covenants thereof and to claim payment of consideration, for performance of the contract at rates different from the stipulated rates, on a vague plea of equity. Parties to an executable contract are often faced, in the course of carrying it out, with a turn of events which they did not at all anticipate, for example, a wholly abnormal rise or fall in prices which is an unexpected obstacle to execution. This does not in itself get rid of the bargain they have made.”

At various points of time, different Courts of India and England have dealt with the subject matter but the concept and substance of the entire concept more or less remains the same subject to facts and contracts, which vary from case to case.

a. The event shall render the contract impossible to perform –

b. The event shall be unavoidable and economic hardship alone cannot result in Force Majeure – a rise in cost or expense has been stated not to frustrate a contract.

c. The event must be unforeseeable – the event must be incapable of being anticipated or predicted by common due diligence. An advance warning for an expected Force Majeure event, shall not trigger the Force Majeure clause.16

d. Causal test or ‘but for’ test – The event shall have occurred not by default of the party but only as a result of the supervening event. This is referred to as the “causal test” where the Court examines whether the non-performance is a direct result of a supervening event; and “but for” such supervening event, the contract would have otherwise been performed. This causal test is the most crucial test, which shall be satisfied by adducing evidence. In a situation where Force Majeure event has indeed occurred, and if such event did not preclude the party from performing the contract, such party cannot take benefit of Force Majeure clause.

e. Conditions precedent must be fulfilled – Most Force Majeure clauses provide that a non-performing party seeking benefit of Force Majeure clause in the contract, shall put the other party to such notice. These terms are conditions precedent for invocation, failing compliance of such clauses, a party may not be able to take shelter under Force Majeure.

f. Duty to mitigate – A party relying on Force Majeure clause is supposed to take all the necessary measures to mitigate the loss caused due to its non-performance.

g. The party seeking to rely on the clause may also need to show it was not aware, at the time of entering the contract, that the circumstances giving rise to the event of force majeure was likely to occur.

In Taylor vs. Caldwell, (1861-73) All ER Rep 24, the law in England was extremely rigid. A contract had to be performed after its execution, notwithstanding the fact that owing to an unforeseen event, the contract becomes impossible of performance, which was not at the fault of either of the parties to the contract. This rigidity of the common law was loosened somewhat by the decision in Taylor (supra), wherein it was held that if some unforeseen event occurs during the performance of a contract which makes it impossible of performance, in the sense that the fundamental basis of the contract goes, it need not be further performed, as insisting upon such performance would be unjust.

In Gulf Oil Corp. v. FERC 706 F.2d 444 (1983), the U.S. Court of Appeals for the Third Circuit considered litigation stemming from the failure of the oil company to deliver contracted daily quantities of natural gas. The court held that Gulf- as the non- performing party- needed to demonstrate not only that the force majeure event was unforeseeable but also that the availability and delivery of the gas were affected by the occurrence of a force majeure event.

Inability to sell at a profit is not the contemplation of the law of a force majeure event excusing performance and a party is not entitled to declare a force majeure because the costs of contract compliance are higher than it would have liked or anticipated. In this regard, the following cases are relevant:

“Performance may be impracticable because extreme and unreasonable difficulty, expense, injury, or loss to one of the parties will be involved. A severe shortage of raw materials or of supplies due to war, embargo, local crop failure, unforeseen shutdown of major sources of supply, or the like, which either causes a marked increase in cost or prevents performance altogether may bring the case within the rule stated in this Section. Performance may also be impracticable because it will involve a risk of injury to person or to property, of one of the parties or of others, that is disproportionate to the ends to be attained by performance. However, “impracticability” means more than “impracticality.” A mere change in the degree of difficulty or expense due to such causes as increased wages, prices of raw materials, or costs of construction, unless well beyond the normal range, does not amount to impracticability since it is this sort of risk that a fixed-price contract is intended to cover.”

JUDGMENTS

UNITED KINGDOM

Given the relatively narrow scope of the doctrine of frustration, parties who find they are unable to perform their contractual obligations due to the COVID-19 outbreak, quarantine measures or other government actions should consider whether their contracts contain express force majeure or similar clauses and whether they fall within the protection offered by the relevant clause. Typically, a force majeure clause in a contract will:

UNITED STATES OF AMERICA

CANADA

The key criteria for establishing frustration: the occurrence of an unforeseen event that causes a radical change in performance of contract for the relying party.

This radical change is generally one that makes performance under existing circumstances impossible, impractical or frustrates the original purpose of the agreement. The onus would be on the party alleging frustration of the contract to prove these elements.

Despite the occurrence of an extreme and impairing event, Canadian courts (excluding Quebec) have not implied a force majeure provision in common law. This infers the standard rules of force majeure interpretation would not apply if there is no force majeure clause expressly written in the contract. However, there have been some cases where courts have pondered the applicability of force majeure in contracts missing such express provisions.

In Royal Bank v. Netupsky, the court acknowledged the novel question of whether a force majeure term could be implied or operate as a matter of law. In this case, the Royal Bank of Canada had negotiated a line of credit agreement without a force majeure clause with a company that had substantial ties to Iraq.

At the time of contract, the bank was aware that Canada had set trade prohibitions with Iraq; i.e. the alleged force majeure event that led to the borrowing company’s credit default. Although the court did not decide on the issue of whether a force majeure provision could be implied, analysis was conducted on the foreseeability of the alleged force majeure event.

It was held that there was no basis for a force majeure argument because both parties had agreed to a contract that did not contemplate the effects of the trade prohibitions despite having full knowledge of the inhibition.

In Naylor Group Inc. v Ellis-Don Construction Ltd., the doctrine is applied where, “a situation has arisen for which the parties made no provision in the contract and the performance of the contract becomes ‘a thing radically different from that which was undertaken by the contract.’ ” This statement can be broken down into three considerations:

The Situation: Similar to how force majeure clauses trigger upon force majeure events, the doctrine of frustration is activated by a supervening event that occurs through no fault of either party. Furthermore, according to Capital Quality Homes Ltd. v Colwyn Construction Ltd. and Gerstel v Kelman the event must not have been contemplated by the parties or foreseeable at the time of contracting.

The Absence of Contractual Provision: The lack of a contractual provision, generally referring to an express force majeure clause, is a prerequisite for the general doctrine of frustration to apply. This means that courts will choose to apply either frustration or force majeure—parties are not meant to rely on both.

The Radically Different Performance of Contract: According to a case of Bang v Sebastian, this consideration can be interpreted as a situation, which “renders the performance of the contract substantively different than the parties had bargained for”. As McLean v Miramichi (City) further elaborates with reference to legal scholarship, the basis of changing circumstances can be categorized into three types of circumstances: (1) where the frustrating event has rendered performance impossible; (2) cases in which performance remains possible, but the purpose for which one or both parties entered the agreement has been undermined; and (3) cases where temporary impossibility has grounded discharge for frustration.

CHINA

The China Council for the Promotion of International Trade (CCPIT) is offering force majeure certificates enabling Chinese companies, seeking to rely on such provisions, to suspend their contractual obligations after the submission of relevant documents.

According to the Contract Law of The People’s Republic of China, Article 117, and Article 118 state the situations under which a party can invoke force majeure. It is only in case of any unforeseeable, unavoidable, as well as impossible to overcome events, that a firm can do so.

But, any company invoking FM must establish a link between the non-performance of their contractual duties and the FM event. The FM event must result in non-performance directly and must be occurring during the performance period of the contract, i.e., after signing and before termination. Just because the process might have gotten a bit more time-consuming or costlier, the contractor may not be excused from their obligations. The affected party must produce sufficient evidence to prove that their working is impacted.

Under PRC General Provisions of the Civil Law, FM is an excuse for non-performance of the civil obligations. If a contract does not have the provision for FM, it is automatically implied. But, in case the clause is enlisted, the affected party can depend on it. However, any dispute that arises out of contractual non-performances, the final decision will be made by the court or an arbitrary body.

****

Preeti Ahluwalia is an Advocate, who is currently practicing under a Senior Advocate at the Delhi High Court. She graduated from the University of Leeds, the United Kingdom with a specialisation in International Business Law (LL.M) in 2018 and from Amity University, Noida with a specialisation in Commercial Law (BA LL.B) (Hons.) in 2017. She is a highly qualified Legal Researcher with impeccable editing and legal citation abilities to support comprehensive and readable research outcomes. She is also well-versed in Civil, Arbitration, and Company’s law and skilled in case analysis.

[1] Fareya Azfar, ‘The Force Majeure ‘Excuse” [2012] 26(2) Arab Law Quarterly 249-253

It is time for India to shift from a flourishing service economy to a manufacturing economy which is one of the most viable solutions to deal with the menace of fiscal deficit, rising unemployment and to climb up the ladder in the global economy.

This article is not an insight into complex economic nuances and analysis, since I am no economist, rather it is only a broad checklist which is ensuing out of the day to day difficulties experienced by investors in setting up industries across the length and breadth of the country.

This blog is also in the wake of the discussion the Government of India recently had to lay down a road map to woo foreign investors in India.

In the above checklist, each and every bullet point is amenable to detailed discussions and brain storming to execute them into action. Losing this opportunity would be a failure of the economic mandate and the inability of India to introduce to the world a second large-scale manufacuring hub in Asia, which happens to be the need of the hour as well as the calling by the West and the Far East.

****

Advocate Matrugupta Mishra is Partner at New Delhi-based Praxis Counsel that specialises in infrastructure-related litigation and arbitration matters.

“The caged bird sings with a fearful trill, of things unknown, but longed for still, and his tune is heard on the distant hill, for the caged bird sings of freedom.”[1] – Maya Angelou

Maya Angelou has eloquently and beautifully described the agony of being borne and bred in captivity. She speaks about longing for freedom, even if you have never actually known it. While the caged bird might be also understood as a metaphor for a person who has been enslaved or captivated, it cannot be denied that it is an apt and plausible description of animals who have been captivated and kept in a zoo.

Zoo, as we understand it today is a public place where wild animals are kept in captivation for the purpose of exhibition, scientific study, etc. This article aims to examine the origin of zoo, the applicable legal framework present in India, moral responsibility towards welfare of animals, etc., in order to determine the relevance and need of urban zoos present in the country today.

How did the practice start?

While, it is impossible to ascertain the exact time period when the practice of captivating animals began, there is considerable evidence to prove that it has been a part of human culture since ancient times. One of the earliest appearances of a concept akin to the modern zoo is dated back to 2500 BC Egypt. Paintings on ancient Egyptian tombs where wild animals such as antelope, gazelle, etc., are depicted wearing collars have been discovered. Historians have also found evidence that this practice was also found in other civilizations such as Chinese, Roman, Aztec, Greek, etc. However, zoos or zoological parks as we know them today only came into existence in 1800 century. The first zoo in the world is supposed to be in Paris.[2] While the Thiruvananthapuram Zoo is popularly considered to be the first zoo in India.[3] The usage of the term zoo only became prevalent in 19th century in London as an abbreviation of zoological gardens.[4]

It is pertinent and fair to mention that with the passage of time, there has been a significant transformation in the way zoo is build. From museum like structures with compact cages for keeping the animals, the structure of zoo has gradually evolved to more habitable enclosure for ensuring the conservation of wild-life. The biggest reason behind this transformation is the change in objective, i.e., from show of power and entertainment to scientific study and conservation of endangered species.

What are the applicable laws?

The Indian Constitution: The Constitution of India recognizes the importance of protecting the wildlife and accordingly has not only entrusted the responsibility to the State but also to the citizens of India. Article 48A of Part IV of the Constitution, charges the State with the responsibility of protection and improvement of environment and safeguarding of forest and wild-life. While Article 51A(g) of Part IVA states that it is the fundamental duty of every citizen of India to protect and improve the environment including wild-life and to show compassion towards living creatures. However, being part of ‘the Directive Principles of State Policy’ and ‘Fundamental Duties’ respectively, the same are not enforceable by any court of law and merely acts as a guideline.

The constitution empowers both the parliament as well as the state legislature to pass statutes for preventing cruelty to animals and protecting wild-life and birds under the concurrent list of Schedule-VII of the Constitution.

Interestingly, it was the infamous 42nd Amendment[5] to the Constitution that inserted Article 48A, 51A(g) and the abovementioned entries. Overshadowed by the other more notorious changes it brought about, the pivotal role played by the amendment in giving animal rights a greater representation under the Constitution, is often forgotten.

The Wildlife (Protection) Act, 1972: The Wildlife (Protection) Act, 1972 (“Act”) was enacted in September, 1972 with the objective “to provide for the protection of wild animals, birds and plants and for matters connected therewith or ancillary or incidental thereto with a view to ensuring the ecological and environmental security of the country”. Repealing all the other repugnant acts dealing with protection of wildlife[6], the Act became the primary statute for protection of wild animals and birds. However, it was only 19 years after the enactment of the Act, that the parliament first chose to incorporate provisions in respect to regulation of zoos vide the Wildlife (Protection) Amendment Act, 1991.

The term “zoo” is defined very broadly under the Act to mean “an establishment, whether stationary or mobile, where captive animals are kept for exhibition to the public and includes a circus and rescue centers but does not include an establishment[7] of a licensed dealer in captive animals.”[8] Inclusion of circus[9] and rescue shelters ensured that these establishment had to abide by the Act and hence gave greater protection to animals. Nonetheless, it is still debatable if the abovementioned establishment which are so distinctive in nature can be efficiently clubbed together for the purpose of regulation.

Chapter IVA of the Act deals with central zoo authority and recognition of zoo. As per the provisions of the Act, not only a zoo requires to be recognized by the central zoo authority in order to operate, but post April 2003 a zoo may be only established after procuring prior approval from the Authority. In the year 2018-2019, there are 142 zoos which are recognized by the authority and are in operation.[10]

The Central Zoo Authority is a statutory body established by the Central Government as the apex governing body. Apart from its role of granting recognition and approval to zoos, the Central Zoo Authority is also entrusted with functions such as specifying minimum standards for housing, vet care and upkeep of animals in the zoo, coordination of acquisition, exchange and loaning of animals for breeding in captivity, coordinating research, training, etc. Furthermore, the Authority also has the power to deny granting recognition, suspending recognition or canceling it if it has reasons to believe that zoo is functioning in a manner which is prejudicial to the protection and conservation of wild life and/or is not abiding by the standards, norms and other matters as may be prescribed from time to time. Some of the general requirements prescribed[11] are to establish and sustain population of physically, genetically and behaviorally healthy animals, proper landscaping to provide a naturalistic environment, to refrain from display of sick and injured animals to the visitors, etc.

Apart from the above regulatory provisions, it is worthy to mention that the Act also penalizes any person who teases, molest, injures, feeds, or disturbs animals in the zoo with fine of rupees 2000/- or 6 months imprisonment or both. The penalty slightly increases for repeated or subsequent offenses.

Other relevant policies and guidelines: One of the earliest attempts to giving proper direction to the management of zoo by the government was in 1983 when the Indian Board of Wildlife decided to prepare and adopt national Wild-Life Action Plan. The first wildlife action plan was adopted in the year 1983 and was in effect till 2001. Presently, the third national wildlife action plan is in operation and shall be in operation till the year 2031.[12]

The government took the next major step towards regulating the zoos in India through the National Zoo Policy, 1998[13] issued on October, 1998. The policy recognized and emphasized on the role played by zoo in ex-situ conservation[14]. The policy laid down guidelines and strategies on acquisition, housing, health care of animals as well as the general planning and management of the zoo. Apart from the above the government has also come up with guidelines from time to time for the purpose of management of the zoos operating in the country.

Does zoo ensure the well-being of animals?

The applicable laws depict zoo to be a sanctum aiming to protect its inhabitants, however the accuracy of this utopian image is quite questionable. The inhuman beating of elephants in Mysore in 2005 [15], the rampant increase in death tolls of animals of National Zoological Park, Delhi[16] in the past few years are all reminders that this sanctuary is not that sacrosanct after all. What is even more perturbing is that many zoos present in the country today are negligent and deficient in providing the basic amenities such as proper drinking water, food, housing, veterinary care, environmental enrichment, safety and security to the animals.[17]

Only a very limited amount of credible information about such instances trickles down to the common man and even those often gets lost in the hustle of the usual news. The main source of information in respect to the animals in the zoo are the annual reports published by the zoo authorities. However, allegations that the figures of such reports are manipulated for the purpose of manifesting a more favorable condition of the animals in captivity has been a major concern for the environmentalist and animal activists for a long time.[18] Such circumstances highlight the lack of transparency. Therefore there is a need for re-evaluation of the present system and introduction of a better check and balance machinery in order to ensure the safety of these animals.

The big question: is it moral?

While the provisions of the Act and the National Zoo Policy make tall claims that the central purpose of a zoo is conservation of wildlife and education, the reality is that it majorly functions as a place for amusement. Hence, the question that stares us in the face is: ‘is it humane to strip wild animals from their natural habitat for the purpose of human entertainment?’.

It is necessary to address right in the start that the concept of zoo is not totally deprived of merit. Many species which were dangerously close to extinction have indeed been saved by breeding in captivity. Hence it is safe to conclude that zoo does act as an effective tool of ex-situ conservation. But the question remains that ‘is keeping animals in captivity the only way of saving them from extinction?’. The answer is in negative, as other methods of In-situ conservation do exist. It may also be argued that Ex-situ conservation is actually less desirable, as once animals become adapted to captivity it is difficult for them to survive in their natural habitat and are made dependent on human care forever.

Furthermore, many animals which are kept in zoo are not endangered species and therefore their captivity does not serve the purpose of conservation at all. Interestingly, a very similar question was raised before the Hon’ble Bombay High Court in People for Ethical Treatment of Animals vs. Commissioner, Brihan Mumbai Mahanagarpalika & Others[19]. In the said case it was argued that keeping animals which are not declared to be endangered in the zoo can’t be said to be done in furtherance of animal conservation and hence is not in line with the objective of the Act. However, the Hon’ble High Court restrained itself from making any observation or ruling on this contention and only noted the reply of the central government on this issue, which weakly claimed that the practice was necessary to inspire empathy among zoo visitors. The stand of the government here was quite oxymoronic as it claimed that for ensuring public empathy towards wild-animals, it is necessary to deprive them from their natural habitat and way of life. An act which may be reasonably argued to be sign of indifference itself.

Even though a case can be made both for and against the relevance and desirability of zoos in the country today, it is necessary to remember that Article 51A(g) of the Constitution charges each citizen with the moral responsibility to show compassion towards all living creatures and it is this test of morality that the urban zoo of present times miserably fails to qualify.

****

Bhavya is a graduate of KIIT School of Law, Bhubaneswar. Since her graduation she has been working as an associate with Alliance Law Group. She is primarily involved in the corporate commercial practice of the firm including but not limited to corporate advisory, company law litigation and consumer disputes.

[1] ‘I know why the caged bird sings’ by Maya Angelou, first published in the year 1969.

[2] Zoo, National Geographic, resource library, https://www.nationalgeographic.org/encyclopedia/zoo/(Last accessed on 17.05.2020)

[3] Zoological Garden, Thiruvananthapuram, Department of Cultural Affairs, Government of Kerala, http://www.keralaculture.org/thiruvananthapuram-zoo/542 (Last accessed on 17.05.2020)

[4]Encyclopaedia Britannica, https://www.britannica.com/science/zoo(Last accessed on 17.05.2020)

[5]The Constitution (Forty-Second Amendment) Act, 1976, Legislative Department, government of India, http://legislative.gov.in/constitution-forty-second-amendment-act-1976, (Last accessed on 17.05.2020)

[6] Section 66 of the Wildlife (Protection) Act,1972.

[7] It was the Wildlife (Protection) Amendment Act, 2002 (Act 16 of 2003) which substituted “but does not include a circus and an establishment” with “and includes a circus and rescue centres but does not include an establishment” and hence broadened the definition of the term. The Amendment came into effect from 1-4-2003.

[8] Section 2(39) of the Wildlife (Protection) Act,1972.

[9] Section 2(7A) of the Wildlife (Protection) Act,1972 defines it as “an establishment, whether stationary or mobile, where animals are kept or used wholly or mainly for the purpose of performing tricks or manoeuvres”

[10] The annual report by Central Zoo Authority for the FY 2018-19.

[11] Schedule of the Recognition of Zoo Rules, 2009

[12] Central Zoo Authority website, http://cza.nic.in/page/en/national-wild-life-action-plan (Last accessed on 17.05.2020)

[13]National Zoo Policy, 1998, available at http://cza.nic.in/page/en/national-zoo-policy-1998 (Last accessed on 17.05.2020)

[14] Off-site conservation.

[15] Elephants illtreated at Mysore Zoo by Hindu, published on September, 2014 https://www.thehindu.com/news/national/karnataka/elephants-illtreated-in-mysore-zoo-says-animal-welfare-group/article6462583.ece (Last accessed on 17.05.2020)

[16] The annual report by Central Zoo Authority for the FY 2017-18 and FY 2018-19 available at http://cza.nic.in/uploads/documents/reports/english/ar2018-19.pdf .

[17] India’s: Zoos a grim report by PETA India, https://www.petaindia.com/issues/animals-in-entertainment/indias-zoos/ (Last accessed on 17.05.2020)

[18] Delhi Zoo records 245 animal deaths in 14 months: Report published by Indian Express on 21st July, 2019, https://indianexpress.com/article/cities/delhi/delhi-zoo-records-245-animal-deaths-in-14-months-report-5839808/ (Last accessed on 17.05.2020)

[19] Writ Petition No. 2825 Of 2004, judgment dated 18.07.2005.

After Article 370 of the Constitution of India was abrogated, the External Affairs Minister of India, Dr. S. Jaishankar stated to a foreign correspondent “you know what..? this Government actually does what it says in its election manifesto!”. While in this particular case the government actually did what it promised to, that has not always been the case with any dispensation whatsoever. Should we not ensure that each promise made in the election manifestos by every State and Central Government is actually enforced, to the hilt? Unfortunately, most Election Manifestos and the promises made in it by each political party are conveniently forgotten.

An election manifesto is generally defined as a published declaration of the intentions, motives or views of an individual, group, political party or the government, in certain cases. It therefore serves as a reference document or benchmark for the public at large on what a political party stands for. By comparing the ideologies, policies and programmes of political parties, electors can decide which party they should vote for, based on which election manifesto best aligns with their expectations and aspirations.[1] Political parties have published such election manifestos since the year 1952.

However, there are basic issues that every political manifesto has and this problem has persisted for 73 years. The first and fundamental problem with an election manifesto, across the political spectrum, is that it does not contain adequate details of the manner in which the policy would be implemented, the source of funds for such implementation, etc. Illustratively, political parties promised, in their election manifestos, to float schemes for the downtrodden with certain benefits on a daily, monthly or yearly basis with the intent to sway the electorate. However, the schemes in the election manifestos conveniently did not apprise the electorates as to how the ex-chequer would fund the scheme nor how an individual would qualify for receiving money under a particular scheme. In short, the scheme was absolutely bereft of any particulars.

In some manifestos, certain regional political parties offered freebies such as pressure cookers, stoves etc., with the sole intention to induce the electorate into voting for a particular party.

Finally, in the present political scenario, most manifestos tend to have offensive campaign material, which is inserted to stir a particular feeling or inclination.

The bottom line still is that despite each of these problems, election manifestos issued by the different parties have always played a crucial part in the formation of governments at the state as well as at the central level. Each government has in fact been brought to power purely on the strength of its election manifesto.

Unfortunately, the political parties who have been elected either on the strength of their manifestos or otherwise, tend to ignore, indefinitely delay, or even outright reject manifesto policies, which were popular with the public at the time of elections. These political parties can do this simply because there is no enforcement mechanism, parameter or guideline in respect of election manifestos, whether in the Representation of Peoples Act, 1951 or set by the Election Commission, despite repeated directions by the Supreme Court of India.

One aspect as described above and its growing trend, i.e. regional parties offering freebies in their election manifestos such as pressure cookers, gas stoves, washing machines, laptops, gold thalis, electric fans etc. came to the attention of the Supreme Court. It was argued that offering these freebies was contrary to the principles set out in Article 282[2] of the Constitution of India. To curb this growing problem of providing freebies and to provide a proper code of conduct, the Supreme Court[3]directed the Election Commission of India to frame guidelines on election manifestos to be included as part of the Model Code of Conduct for elections. The direction of the Supreme Court is set out hereunder:

“79. Therefore, considering that there is no enactment that directly governs the contents of the election manifesto, we hereby direct the Election Commission to frame guidelines for the same in consultation with all the recognized political parties as when it had acted while framing guidelines for general conduct of the candidates, meetings, processions, polling day, party in power etc. In the similar way, a separate head for guidelines for election manifesto released by a political party can also be included in the Model Code of Conduct for the Guidance of Political Parties & Candidates. We are mindful of the fact that generally political parties release their election manifesto before the announcement of election date, in that scenario, strictly speaking, the Election Commission will not have the authority to regulate any act which is done before the announcement of the date. Nevertheless, an exception can be made in this regard as the purpose of election manifesto is directly associated with the election process.”

In terms of the directions of the Supreme Court thus, the Election Commission on August 12, 2013 held consultations with various political parties. However, despite express directions of the Supreme Court of India, the Election Commission did not issue guidelines whether in respect of freebies, timing of release of election manifesto, implementation of promises etc.

Instead, the Election Commission came up with generic guidelines stating that the election manifesto is to be in compliance with the Model Code of Conduct, the promises should not vitiate the purity of elections and that “in the interest of transparency, level playing field and credibility of promises, it is expected that manifestos also reflect the rationale for the promises and broadly indicate the ways and means to meet the financial requirements for it”. The guidelines were so broad and generic that the entire exercise further to the Supreme Court’s directions was rendered futile.

Some political parties, in the Lok Sabha election for the year 2014, exploited these patently weak guidelines when they released their manifestos on the day of voting in the first phase, with a view to sway voters. Unfortunately, the Election Commission at that point in time did not take any steps whatsoever against this behavioural pattern of these political parties.