Read Order: Krishan v. State of Haryana[SC-CRIMINAL APPEAL NO. 2351 of 2011]

Tulip Kanth

New Delhi, January 29, 2024: While observing that the evidence of recovery of the weapon at the instance of the appellant-accused couldn’t be accepted as reliable andthe findings created a serious doubt about the truthfulness of the prosecution case, the Supreme Court has quashed a murder conviction.

The present case was about the murder of Pawan and Ajju Chaudhary. According to the prosecution case, in the year 2004, the deceased Pawan went to Rohini to meet his ailing sister Sushila. Dharmender (PW-2), a complainant&brother of the deceased Pawan, had stated that the deceased had fallen into bad company and cases of dacoity and theft were registered against him. He stated that on January 4, 2004, he enquired with his sister, who told him that the deceased Pawan had returned after meeting her. He was informed on the next day that his brother Pawan had been shot dead. Thereafter, the bodies of both the deceased were found by the police.

The prosecution examined a total of 20 witnesses. According to the case of the prosecution, the report of the ballistic expert showed that the bullets recovered from the body of the deceased Pawan were fired from the country-made pistol, which was recovered at the instance of the appellant.

It was argued from the side of the accused that the case of the prosecution was not based on circumstantial evidence but on the eye-witness account of witnesses PW-1 and PW-3. It was submitted that neither of the eyewitnesses supported the prosecution and both were declared hostile. It was urged by the Counsel that in the absence of any independent witness, the recovery of the alleged weapon at the instance of the appellant couldn’t be relied upon.Moreover, the recovery was from an open place accessible to all, and that also happened more than one month after the date of the incident.

The State Counsel submitted that the recovery of the weapon of assault had been proved to have been made at the instance of the appellant. The report of the expert established that the bullet found on the dead body of deceased Pawan could have been fired from the weapon recovered at the instance of the appellant. The counsel also relied upon various precedents to support her contention that conviction can be based on the disclosure and recovery of a weapon at the instance of the accused.

At the outset, the Division Bench of Justice Abhay S. Oka and Justice Ujjal Bhuyannoticed that neither PW-1 nor PW-3 supported the case of the prosecution. Though Memorandum Panchnama of recovery recorded that the weapon was recovered after digging, both PW-15 and PW-20 had not deposed to that effect. It was also observed that both the police witnesses initially stated that no independent witnesses were available, PW-20 stated in his cross-examination that there were public witnesses available who were not found interested.

The recovery was allegedly made one month and four days after the occurrence and the recovery was made from open space in a garden. Thus, the place was easily accessible to many. Moreover, neither PW-15 nor PW20 had stated that the weapon and cartridges were buried underground and were recovered only after digging. Lastly, though independent witnesses were available, they were not made witnesses to the Panchnama made pursuant to the alleged statement made by the appellant. As the recovery of the weapon at the appellant's instance cannot be believed, the decisions relied upon by the learned counsel for the respondent are not significant at all, the Bench held.

According to the prosecution case, on February 9,2004, the appellant led the police party to a place where he had thrown the dead bodies. However, dead bodies were already recovered on January 5, 2004. Therefore, the place from which dead bodies were recovered was known to the police long before the appellant led them there.

“Consequently, it cannot be said that there was a discovery by the appellant of the place where dead bodies were kept. Therefore, that part of the statement of the accused, which records that he would show the place where he had thrown the dead bodies, is not admissible in evidence under Section 27 of the Indian Evidence Act, 1872”, the Bench said.

It was further noticed that the police had not investigated the role played by the said Naresh Yadav, who, according to PW-2, the brother of the deceased, was on inimical terms with the deceased. “When, according to the family of the deceased, Naresh Yadav was the suspect, police ought to have investigated the role played by Naresh Yadav. There is yet another critical aspect of the case. PW-15 and PW-20 have not stated in their examination-in-chief how they became aware that PW-1 and PW-3 were the eyewitnesses”, the Bench remarked.

Observing that the evidence of recovery of the weapon at the instance of the appellant couldn’t be accepted as reliable and the findings recorded above created a serious doubt about the truthfulness of the prosecution case, the Bench opined that the benefit of the doubt must be extended to the appellant. “It can also be said that once the evidence of recovery is disbelieved, it was a case of no evidence as the eyewitnesses did not support the prosecution”, the Bench said.

Thus, allowing the appeal, the Bench acquitted the appellant of the offences alleged against him and directed that he be immediately set at liberty.

Read Order:Manjinder Singh Sirsa v. State Nct Of Delhi And Anr [DEL HC- CRL.M.C. 316/2024]

Tulip Kanth

New Delhi, January 29, 2024: While observing that the offence of defamation was not a one-time offence committed in the year 2020, the Delhi High Court has dismissed the plea of BJP leader Manjinder Singh Sirsa seeking stay on proceedings initiated by a criminal complaint filed against him by former President of Delhi Sikh Gurdwara Management Committee (DSGMC)Manjit Singh GK.

The petitioner had approached the Delhi High Court by filing an application under Section 482 of the Code of Criminal Procedure, 1973 seeking ad-interim stay of the proceedings in a Complaint Casepending before the ACMMRouse Avenue Court, New Delhi.The summons in the aforesaid complaint case were issued against accused persons namely Manjinder Singh Sirsa, Harmeet Singh Kalka and Jagdeep Singh Kahlon. The accused persons had preferred a Criminal Revision against the said order, and the same stood dismissed which had been assailed in the petition.

The Senior Counsel, appearing on behalf of petitioner, argued that impugned order passed by the ASJ in revisional jurisdiction had led to serious miscarriage of justice. It was argued by the Senior Counsel that the impugned order had been passed on the amended complaint of the complainant alleging defamation against the petitioner, which on the face of it, was time barred and was based on inadmissible material and allegations.

It was stated that for the incidents of alleged defamation were alleged to have taken place on 16.02.2020 and 21.02.2020, but the complainant had neither preferred application for condonation nor explained the delay. Thus, it was vehemently argued that the complaint, being filed after expiry of period of three years, was barred by time. It was further contended that the ASJ failed to take note of Section 210 of Cr.P.C. which provides that when in a criminal case instituted on private criminal, it is made to appear to Magistrate, during the course of inquiry or trial held by him, that an investigation by police is in progress in relation to the offence which is subject matter of inquiry or trial held by him, the Magistrate shall stay the proceedings of such inquiry or trial and call for a report in the matter from the police officer conducting the investigations. In this regard, it was submitted that allegations of defamation were regarding the letter in regard to usurping the land, which was under investigation in an FIR.

While opposing the grant of stay of trial proceedings, the Counsel for respondent no. 2/complainant argued that petitioner had been adopting delaying tactics, since after the impugned order was passed on 29.11.2023, the petitioner chose not to challenge the same, rather preferred a petition before this Court challenging the jurisdiction of Special Court constituted for cases pertaining to MP/MLAs. It was stated that only after this Court had dismissed his previous petition, the petitioner had now assailed the order dated 29.11.2023.

It was argued that the ASJ had dealt with the issue of limitation and had rightly observed that allegations against the accused persons extended beyond the incidents of February, 2020 since the incidents enumerated in the complaint were also of the year 2022 and 2023, and the videos and social media posts etc. of the defamatory content was still available on the internet. It was submitted that the ASJ had also rightly held that the contents of FIR and the offences for which it had been registered are different from the contents of complaint filed in present case for offence of defamation, and thus, Section 210 of Cr.P.C. would have no applicability.

The Single-Judge Bench of Justice Swarana Kanta Sharma noted that a perusal of the complaint filed for the offence of defamation by the respondent no. 2 revealed that there were allegations against the accused persons, of defaming the complainant between the period 2020 to 2023.

“Prima facie from the perusal of records, it appears that the offence of defamation in this case was not a one-time offence committed in the year 2020. At this stage, this Court does not prima facie find any infirmity with the observations, so as to stay the proceedings before the learned Trial Court”, the Bench added.

The Bench noted that the ASJ, after examining the provision of Section 210 of Cr.P.C. and the judicial precedents on it, had rightly observed that the FIR registered at P.S. Economic Offences Wing, Delhi, in relation to preparation of forged letter was registered on the basis of complaint filed by the respondent no. 2/complainant herein, pursuant to an order passed under Section 156(3) of Cr.P.C. The said FIR stood registered under Sections 420/468/471/120B of IPC.

The FIR has not been registered under Sections 499/500 of IPC i.e. for the offence of defamation, in relation to which the complainant had preferred to file the present complaint. It was also noticed that the ASJ, after considering the law on point, had observed that the purpose of Section 210 of Cr.P.C. was to avoid taking cognizance of the same offence again, to avoid separate trial for the same offence. However, in the present case, the complaint case had been filed for offence of defamation and the FIR had been registered for offences of cheating and forgery, and the question of taking cognizance of the same offence would not arise.

“…besides the fact that Court is also barred from taking cognizance of the offence of defamation on a police report, which can only be taken on a complaint filed by the aggrieved party. It was also observed by learned ASJ that this is not a situation where if cognizance is taken on the basis of police report, it would be for the same offence for which the cognizance is taken in the complaint case, considering the fact that cognizance in a defamation case can be taken only on the basis of a complaint and not on the basis of police report”, the Bench added.

The Bench found that the ASJ had examined in detail, the issue of registration of FIR and simultaneous proceedings in the present complaint case for commission of offence of defamation. Thus, without finding any reason to stay the proceedings in the present complaint case, the Bench dismissed the applications.

Read Order: T.N. GODAVARMAN THIRUMULPAD AND OTHERS v. UNION OF INDIA AND OTHERS [SC- WRIT PETITION (CIVIL) NO. 202 OF 1995]

Tulip Kanth

New Delhi, January 25, 2024: In a case where the appellant was seeking a change in the criteria being followed by State of Goa for identification and demarcation of forest under private ownership or private forest, the Supreme Court has held that the existing criteria are valid & adequate.

“The Ministry of Environment, Forest & Climate Change guidelines, as well as the Scheduled Tribes & other Traditional Forest Dwellers (Recognition of Forest Rights) Act, 2006, are clear and unambiguous, as they have exempted the application of the Forest Conservation Act, 1980, on areas that are less than 1 hectare and where not more than 75 trees have to be cut”, the 3-Judge Bench of Justice Prashant Kumar Mishra, Justice Aravind Kumar and Justice B.R. Gavai held.

The challenge in the present appeals revolved around the criteria issued by the Respondent(s) i.e., the State of Goa and Others for the identification of forests in the State.

The Government of Goa constituted the Sawant Committee in 1997 which identified a total of 46.89 sq. kms as private forest. Thereafter the Karapurkar Committee was constituted in 2000. Since the Karapurkar Committee suggested a revisit to exclude some of the forest areas already identified by the Sawant Committee, the present appellant, Goa Foundation, filed Writ Petition before the Top Court challenging the appointment of the Karapurkar Committee. Meanwhile, the Karapurkar Committee submitted its final report and identified 20.18 sq. kms of private forests. However, the task of both the Committees was incomplete as some areas were left unidentified. The present appellant i.e., Goa Foundation, filed Writ Petition for directions to the State Government of Goa to complete the process of identification of forest and to identify the degraded forest lands.

The State Government appointed two new Committees (The North Goa District Committee and the South Goa District Committee) to identify the remaining areas of private forests in North and South Goa districts that had not been identified by the previous Committee(s). Further, the Appellant filed another Writ Petition seeking the quashing of criteria pertaining to the canopy density which should not be less than 0.4. The Bombay High Court transferred both the Writ to the NGT. The NGT by the impugned order had set aside both the applications and hence the appellant approached the Top Court.

It was the contention of the appellant that the tribunal erred in not passing an order on merits on the premise that the issue was seisin before the Top Court. It was further contended that petition was filed challenging the criteria of minimum 40 per cent canopy density for identification as forest land. It was argued that identification of private forests on the basis of criteria accepted by FSI and by this Court in the order of 2008 passed for determining NPV also to be adopted and followed for identification of forest, which would be in the interest of protection of environment. The appellant prayed for revisiting the criteria for identification of private forest/deemed forest on private lands in the State of Goa, by using the parameters used by FSI, that is based on 0.1 density forest in an area of 1 (one) ha.

The respondent’s counsel submitted that the criteria for identifying the forests and the process therein by different States is under an Order of this Court dated 12.12.1996 in the T.N. Godavarman Thirumulpad v. Union of India [LQ/SC/1996/2183]. This Court mandated that the State Government to evolve the criteria as per their local situation and considering the fact that Forest, being a concurrent subject, needs to be determined as such by the State Government for applicability of the FCA 1980.

The Bench was of the opinion that the appellants cannot feign ignorance about the reports of the Expert Committees. Also, the appellant, asserting a public cause, cannot be considered unaware of the criteria proposed by the Committee. These criteria as recommended by the Committee were published in the public notice and have been a subject of agitation by the appellant/petitioner across various forums.

“Hence, the appellant/petitioner having not raised its little finger to the criteria as prescribed and published in the public notice dated 08.02.1997 is estopped from raising the said issue at this stage. On this short ground itself the appeal has to fail and appellant has to be non-suited”, it said.

It was further noticed by the Bench that the issue relating to identification and demarcation of private forests in the State of Goa had attained finality on three criteria pertaining to forest tree composition, contiguous forest land and minimum area should be 5 (five) hectares and canopy density should not be less than 0.4. In the teeth of the afore-stated facts and the orders passed by the Tribunals as affirmed by the Top Court, the State of Goa had also issued a gazette notification notifying 46.11 sq. km. as private forest.

The Bench also observed that on one hand, the appellant was challenging the criteria adopted by the Sawant and Karapurkar Committees for the identification of private forests and on the other hand it relied on the same criteria adopted by these two committees for the identification of forests, including private forests, before the Tribunal. Thus, the Top Court opined that the appellant cannot be permitted to approbate and reprobate. The appellant had also failed in its endeavour to have the second interim report of the Sawant Committee and the criteria laid down thereunder to be revisited in Tata Housing Development Corporation v. Goa Foundation [LQ/SC/2003/940].

The Bench accepted the submission of the Senior Counsel appearing for the State of Goa that the change of existing criteria in determining the deemed forest would have a negative impact on the conservation measures being undertaken hitherto.Further, it was noticed if the criteria i.e., the canopy density of 0.4 and minimum area of 5 ha is reduced to 0.1 and 1 ha as contended, respectively, it will result in the plantations of coconut, orchards, bamboo, palm, supari, cashew, etc., grown by farmers on their private lands into the category of private forest. The effect would be that even for a minor development on the concerned land, the permission of the Government under the FCA 1980, for the landholders, would become indispensable. It was also noticed that none of the States have adopted the criteria proposed by the appellant, namely the 0.1 density criteria, as it would result in opening a pandoras box, and would result in all the States undertaking the task of reassessing the forest area all over again.

The Top Court also recognised that there can be no uniform criteria for such identification across the country as it had expressly delegated the task of identifying forest areas to Expert Committees to be constituted by State Governments. Thus, upholding the impugned order, the Bench dismissed the appeals.

Read Order: RAJA NAYKAR VERSUS STATE OF CHHATTISGARH [SC- CRIMINAL APPEAL NO. 902 OF 2023]

Tulip Kanth

New Delhi, January 25, 2024: The Supreme Court has set aside an order of conviction in a murder case where the prosecution had utterly failed to prove beyond all reasonable doubt that it was the accused alone who had committed the crime.

The facts leading to the present appeal were that on October 21, 2009, the half-burnt body of Shiva alias Sanwar (deceased) was found behind a temple near Shastri Nagar ground. The prosecution case was that Mohan – the husband of Accused No. 2 and brother of the Appellant was killed by the deceased and as its offshoot, the Appellant committed the murder of the deceased by causing 24 stab wounds on his body. He then wrapped the body in a blanket with the help of other accused persons, took it behind the temple where the half burnt body of the deceased was found. Postmortem examination of the body of the deceased was conducted by the doctor (P.W.11) who observed as many as 24 injuries on the deceased. According to him, after commission of murder, the body of the deceased was burnt and his death was homicidal in nature.

It was further the case of the prosecution that an electricity bill in the name of one, Alakh Verma was found from the body of the deceased, on the basis of which the police proceeded with further investigation. In pursuance of the disclosure statements of the accused persons, seizure was effected and the police concluded that the deceased was murdered by the Appellant and the body was then taken with the help of the other accused persons and an attempt was made to burn the body. At the conclusion of the investigation, a charge-sheet came to be filed and at the conclusion of trial, the Trial Judge found that the prosecution had succeeded in proving that the Appellant had committed the murder of the deceased.

The appeal before the Top Court was filed against the order of the Division Bench of the High Court of Chhattisgarh, Bilaspur thereby dismissing the appeal filed by the Appellant-Accused No. 1 and confirming the order of conviction.

The appellant submitted that there was no evidence at all which established the guilt of the appellant beyond reasonable doubt. It was submitted that from the evidence of the father and brother of the deceased, it would reveal that the dead body of the deceased had not been identified and the prosecution had failed to prove that the dead body found in the garbage was that of Shiva.

On the contrary, the State Counsel argued that as per the FSL report, human blood was present on the dagger which was recovered at the instance of the present appellant. It was further submitted that the recoveries made on the basis of the Memorandum under Section 27 of the Indian Evidence Act, 1872 would establish the guilt of the accused-appellant beyond reasonable doubt.

The Division Bench of Justice B.R. Gavai & Justice Sandeep Mehta , at the outset, made it clear that the prosecution case rested on circumstantial evidence. Reference was made to the judgment in Sharad Birdhichand Sarda vs. State of Maharashtra. The Bench highlighted that it is necessary for the prosecution that the circumstances from which the conclusion of the guilt is to be drawn should be fully established. The Court in Sharad Birdhichand Sarda case (Supra) had held that there must be a chain of evidence so complete as not to leave any reasonable ground for the conclusion consistent with the innocence of the accused and must show that in all human probabilities the act must have been done by the accused.

“It is settled law that the suspicion, however strong it may be, cannot take the place of proof beyond reasonable doubt. An accused cannot be convicted on the ground of suspicion, no matter how strong it is. An accused is presumed to be innocent unless proved guilty beyond a reasonable doubt”, the Bench further opined.

The Bench took note of the fact that the main circumstance on which the High Court and the Trial Judge found the appellant guilty of the crime was the recovery of various articles at his instance. They had further found that the pieces of blanket recovered from the place of incident and the place where the dead body was subsequently taken for being burnt, were found to be identical/similar. The High Court had observed that specific questions were put to the appellant in his examination under Section 313 of the Code of Criminal Procedure, 1973 recovery of various articles at his instance and also regarding the FSL report, but he had failed to give an explanation with regard thereto.

It was also observed by the Bench that the dead body was found much prior to the recording of the Memorandum of the appellant under Section 27 of the Evidence Act. Therefore, only that part of the statement which led to recovery of the dagger and the rickshaw would be relevant, the Bench held while noting that the Property Seizure Memo would show that the dagger was seized from a place accessible to one and all.

According to the prosecution, the incident took place on October 21, 2009 and the recovery was made on October 25, 2009.Moreover, the FSL report didn’t show that the blood found on the dagger was of the blood group of the deceased. Apart from that, even the serological report was not available. Another circumstance relied on by the Trial Judge was with regard to recovery of blood-stained clothes on a Memorandum of the appellant. The said clothes were recovered from the house of the appellant’s sister-in-law after four days.

The only circumstance that was of some assistance to the prosecution case was the recovery of dagger at the instance of the present appellant. However, the said recovery was also from an open place accessible to one and all. In any case, the blood found on the dagger did not match with the blood group of the deceased. While referring to the judgment in Mustkeem alias Sirajudeen v. State of Rajasthan, wherein it was held that sole circumstance of recovery of blood-stained weapon cannot form the basis of conviction unless the same was connected with the murder of the deceased by the accused, the Bench said, “Thus, we find that only on the basis of sole circumstance of recovery of blood-stained weapon, it cannot be said that the prosecution has discharged its burden of proving the case beyond reasonable doubt.”

“Merely on the basis of suspicion, conviction would not be tenable. It is the duty of the prosecution to prove beyond all reasonable doubt that it is only the accused and the accused alone who has committed the crime. We find that the prosecution has utterly failed to do so”, it further added.

On finding of the High Court that the appellant had failed to give any explanation in his statement under Section 313 Cr. P.C., the Bench found that the High Court had failed to appreciate the basic principle that it is only after the prosecution discharges its duty of proving the case beyond all reasonable doubt that the false explanation or non-explanation of the accused could be taken into consideration.

Thus, allowing the appeal, the Bench quashed the order of conviction and directed the appellant to be released forthwith.

Read Order: PRAKASHCHANDRA JOSHI VERSUS KUNTAL PRAKASHCHANDRA JOSHI @ KUNTAL VISANJI SHAH [SC-SLP(C) No. 21139/2021]

Tulip Kanth

New Delhi, January 25, 2023: Considering the fact the husband and wife had been residing separately for almost 13 years and the wife was not even responding to the summons issued by the Courts, the Supreme Courthas granted the decree of divorce and opined that the marriage had irretrievably broken down.

The facts in brief were that the marriage between the appellant and respondent was solemnized in the year 2004 as per the rituals of Hindu religion after having spent eight years in courtship. They are Indian citizens by birth. However, they acquired citizenship of Canada for financial gain and were living a normal matrimonial life in Canada. A male child was born from the wedlock.

In the year 2011, the appellant started experiencing medical problems such as constant back and shoulder pain as well as skin related problems, especially during summer due to rag weed allergy resulting into sleepless nights and miserable days. During the period of recession in Canada, the appellant lost his job and the couple along with the minor child returned to India. The respondent after wilfully staying at her matrimonial home, joined her parental house. After some time, when the appellant asked the respondent to resume cohabitation, the respondent refused to do so. The respondent was interested in returning to Canada for a better future.

The appellant expressed his unwillingness to shift toCanada owing to his health issues. Various attempts were made by the family of the parties to resolve the matrimonial discord between them but to no avail. The respondent left for Canada with her son. Thereafter, the appellant tried to contact the respondent requesting her to come and cohabit with him. It was neither responded to nor complied with.

The appellant preferred a petition under Section 9 of the Hindu Marriage Act for restitution of conjugal rights which remained uncontested on behalf of the respondent. The appellant withdrew the petition for restitution of conjugal rights and filed a divorce petition on the ground of cruelty and desertion. The petition proceeded ex parteand the Family Court dismissed the petition of the appellant. The appellant moved to the High Court but his appeal was dismissed by holding that no case had been made out by the appellant for seeking a decree of divorce on the ground of either cruelty or desertion. Hence, the appellant approached the Top Court.

The issue before the Division Bench of Justice B.R. Gavai and Justice Prashant Kumar Mishra was whether a decree for divorce can be granted for the reason that the marriage has irretrievably broken down.

It was noticed by the Bench that in the proceedings initiated by the appellant for restitution of conjugal rights under Section 9 of the Hindu Marriage Act, the respondent did not appear despite receiving the summons. Similarly, in the divorce proceedings also the respondent failed to enter appearance despite service of notice in the Trial Court, High Court and Supreme Court as well.

“Thus, it is apparent that the respondent does not wish to continue the marital chord and is not responding to court summons much less the request made by the appellant”, it said while further adding, “On the basis of the above factual matrix the present appears to be a case of irretrievable breakdown of marriage.”

Reliance was also placed upon the Apex Court’s judgment in Shilpa Sailesh vs. VarubnSreenivasan, whereby it was held that the Supreme Court, in exercise of power under Article 142(1) of the Constitution of India, has the discretion to dissolve the marriage on the ground of its irretrievable breakdown.

In order to accord satisfaction as to whether the present is a fit case for exercise of power under Article 142 (1) of the Constitution of India to dissolve the marriage on the ground of irretrievable breakdown, the Bench noticed that the parties have been residing separately since February, 2011 and there have been no contact whatsoever between them during this long period of almost 13 years.

“The respondent-wife is not even responding to the summons issued by the courts. It seems she is no longer interested in continuing the marital 10 relations with the appellant. Therefore, we have no hesitation in holding that the present is a case of irretrievable breakdown of marriage as there is no possibility of the couple staying together”, the Bench held while allowing the appeal and dissolving the marriage between the parties on the ground of irretrievable breakdown in exercise of powers under Article 142(1) of the Constitution of India.

Read Order: CENTRAL BUREAU OF INVESTIGATION v. KAPIL WADHAWAN & ANR [SC-CRIMINAL APPEAL NO. 391 OF 2024]

Tulip Kanth

New Delhi, January 25, 2024: While allowing CBI’s appeal challenging the orders of the lower Courts granting bail to Wadhawan brothers in Rs 34,000 DHFL-bank fraud case, the Supreme Court has observed that the respondents could not have claimed the statutory right of default bail under Section 167(2) CrPC on the ground that the investigation qua other accused was pending.

The appellant-CBI had approached the Division Bench of Justice Bela M. Trivedi and Justice Pankaj Mithal to challenge the impugned order passed by the High Court of Delhi upholding the order granting default bail to respondent nos. 1 and 2.

The factual background of this case was an FIR came to be registered on the basis of the complaint lodged by Sh. Vipin Kumar Shukla, DGM, Union Bank of India, for the offences punishable under Section 120-B r/w Section 409, 420 and 477A of IPC and Section 13(2) r/w Section 13(1)(d) of PC Act, 1988 against Dewan Housing Finance Corporation Ltd. (DHFL) and 12 other accused persons/companies. It was alleged in the said FIR that Sh. Kapil Wadhawan, the then Chairman and Managing Director, DHFL, along with 12 other accused persons entered into a criminal conspiracy to cheat the consortium of 17 banks led by Union Bank of India, and in pursuance to the said criminal conspiracy, the said accused persons/entities induced the consortium banks to sanction huge loans aggregating to Rs 42,000 crores approx. and thereafter they siphoned off and misappropriated a significant portion of the said funds by falsifying the books of account of DHFL. It was submitted that they deliberately and dishonestly defaulted on repayment of the legitimate dues of the said consortium banks, and thereby caused a wrongful loss of Rs34,000 crores to the consortium lenders during the period January, 2010 to December, 2019.

The respondent no. 1- Kapil Wadhawan and respondent no. 2- Dheeraj Wadhawan came to be arrested by the appellant-CBI in connection with the said FIR and were remanded to judicial custody on 30.07.2022.After carrying out the investigation, a chargesheet came to be filed by the CBI against 75 persons/entities including the respondent nos. 1 and 2.

Respondent nos. 1 and 2 filed an application under Section 167(2) seeking statutory bail. The Special Court vide the order dated 03.12.2022 holding that the investigation was incomplete and the chargesheet filed was in piecemeal, further held that the respondent nos. 1 and 2 (A-1 and A-2) were entitled to the statutory bail under Section 167(2).

It was the case of the appellant that a report under Section 173 Cr.P.C. filed by the CBI was complete containing all the details as required by law. The statutory bail under Section 167(2) had been granted by the courts below after the Special Court took the cognizance of the alleged offences against the respondents, which was against the statutory scheme of the Code.

The main question that fell for consideration was whether the respondents were entitled to the benefit of the statutory right conferred under the proviso to sub section 2 of Section 167, on the ground that the investigation qua some of the accused named in the FIR was pending, though the report under sub-section (2) of Section 173 (Chargesheet) against respondents along with the other accused was filed within the prescribed time limit, even though the cognizance of the offence was taken by the special court before the consideration of the application of the respondents seeking default bail under Section 167 (2).

The bone of contention raised by the Senior Counsels for the Respondents was that the appellant – CBI having kept the investigation open qua other respondents, the ingredients of Section 173 could not be said to have been complied with and therefore the report/ chargesheet under Section 173 could not be said to be a complete chargesheet.

The Bench referred to K. Veeraswami vs. Union of India and Others [LQ/SC/1991/332]where the Supreme Court has aptly explained the scope of Section 173(2). It was opined that the statutory requirement of the report under Section 173 (2) would be complied with if the various details prescribed therein are included in the report. The report under Section 173 is an intimation to the court that upon investigation into the cognizable offence, the investigating officer has been able to procure sufficient evidence for the court to inquire into the offence and the necessary information is being sent to the court. The report is complete if it is accompanied with all the documents and statements of witnesses as required by Section 175 (5). The Bench further opined that as settled in the afore-stated case, it is not necessary that all the details of the offence must be stated.

Moreover, the Bench observed that the benefit of proviso appended to sub-section (2) of Section 167 of the Code would be available to the offender only when a chargesheet is not filed and the investigation is kept pending against him. Once however, a chargesheet is filed, the said right ceases. It was noted that the right of the investigating officer to pray for further investigation in terms of sub-section (8) of Section 173 is not taken away only because a chargesheet is filed under sub-section (2) thereof against the accused.

“Though ordinarily all documents relied upon by the prosecution should accompany the chargesheet, nonetheless for some reasons, if all the documents are not filed along with the chargesheet, that reason by itself would not invalidate or vitiate the chargesheet”, the Bench said.

Once from the material produced along with the chargesheet, the court is satisfied about the commission of an offence and takes cognizance of the offence allegedly committed by the accused, it is immaterial whether the further investigation in terms of Section 173(8) is pending or not.

“The pendency of the further investigation qua the other accused or for production of some documents not available at the time of filing of chargesheet would neither vitiate the chargesheet, nor would it entitle the accused to claim right to get default bail on the ground that the chargesheet was an incomplete chargesheet or that the chargesheet was not filed in terms of Section 173(2) of Cr.P.C”, the Bench remarked.

Further, placing reliance upon Dinesh Dalmia vs. CBI [LQ/SC/2007/1141],the Bench stated, “…we have no hesitation in holding that the chargesheet having been filed against the respondents-accused within the prescribed time limit and the cognizance having been taken by the Special Court of the offences allegedly committed by them, the respondents could not have claimed the statutory right of default bail under Section 167(2) on the ground that the investigation qua other accused was pending. Both, the Special Court as well as the High Court having committed serious error of law in disregarding the legal position enunciated and settled by this Court, the impugned orders deserve to be set aside and are accordingly set aside.”

Thus, the Bench directed that the respondents-accused shall be taken into custody in this case, if released on default bail pursuant to the impugned orders. However, it was clarified that observations made in this judgment would not influence the Special Court or High Court while deciding the other proceedings, if any pending before them, on merits.

Read Order: MOHIT PILANIA versus THE STATE GOVT. OF NCT OF DELHI AND ANR. [DEL HC-BAIL APPLN. 4252/2023]

Tulip Kanth

New Delhi, January 25, 2024: The Delhi High Court has dismissed a bail petition of a co-accused in a case of criminal conspiracy where the main accused married the complainant for the purpose of cheating money from her. The High Court also emphasized the need for ensuring that the identity of victimof sexual assault is not disclosed in the petitions.

The bail application under Section 439 of the Code of Criminal Procedure, 1973 had been filed by the applicant seeking grant of regular bail in a case registered under Sections 419/420/493/494/495/376/109/201/120B of the Indian Penal Code, 1860.

The brief facts of the case were that the case was registered on the complaint of one Ms. P. In her complaint, she alleged that she had met the main accused Aarav @ Ravi Gautam through online matrimonial site “Jeewansathi.com” and got married to him. On 18.11.2021, she had received a phone call from a woman, who had introduced herself as Nikita, and had told her that accused Aarav was her husband. It was then that she realised that Aarav was already married to another lady when he had got married to her. The accused Aarav had also taken away her gold jewellery and had mortgaged it for bank loan. She had lodged a complaint against him and thereafter, the present FIR was registered and the accused was arrested.

The statement of Ms. P was recorded under Section 164 of Cr.P.C., wherein she had corroborated her statement recorded under Section 161. She had further revealed that the accused Aarav had applied for several loans in her name and PAN Card and had also transferred funds in different bank accounts. She had further alleged that the present accused/applicant Mohit had accompanied main accused Aarav when the date of marriage was fixed in this case.

It was the case of the applicant that he had been falsely implicated in the present case, and the only allegation against him was that he had visited the house of complainant, met her parents and had affirmed the fact that the main accused Aarav @ Ravi Gautam had lost his parents. It was further submitted that the applicant was not aware that main accused Aarav was already married and already had a child. It was his case that the accused had merely attended the Roka ceremony and had received some money in his account on the asking of main accused Aarav.

The State Counsel contended that during investigation, it has transpired that he had shown interest in 1411 women on the website. It was argued that it is the present applicant who had accompanied the main accused to the house of the complainant at the time of roka ceremony and had introduced himself as his friend and had met the parents of the complainant and had affirmed that the main accused had lost his parents.

The Single-Judge Bench of Justice SwaranaKanta Sharma observed that it was the accused herein who had convinced the complainant and her parents for the marriage by misleading them and convincing them that the main accused was unmarried and his parents had passed away. On the said assurance, they had acted and the accused and complainant got married. Moreover, the submissions of the IO revealed that the present accused/applicant was a teacher of the main accused Arav and had, by hatching a criminal conspiracy, cheated the complainant of about Rs. 50,000.

It was also clear from the investigation till date that the main accused Aarav had shown interest in 1411 profiles of women of different age groups on Jeevansathi.com and it was still a matter of investigation as to how many other women he had cheated, married, got engaged to for the purpose of cheating money from them.

The applicant had submitted that the brother of the complainant is a judicial officer and therefore, due to his influence, the FIR was registered and bail was not being granted to the present accused/applicant. The High Court took strong objection to these submissions since it was not the submission alone, but the counsel for the accused had also filed on record an annexure which was a letter with the subject mentioned as Public Interest Litigation (PIL) addressed to the Chief Justice of India. The annexure revealed the name of the judicial officer, his designation and his present posting as well as the details of complainant herself which had been filed on record.

“The counsel for the accused should have been aware that the name of the complainant cannot be revealed in any record and that it is an offence to do so. Even the disclosure of name and designation as well as the present posting of the brother of the complainant is sufficient to disclose her identity which is also in contravention of provisions of Section 228A of IPC”, the Bench held.

The Bench was of the opinion that even if the complainant is the sister of a judicial officer, the same does not mean that just by being the sister of a judicial officer, she has lesser rights compared to other complainants in a criminal case to stand up and fight for herself and seek justice from the Courts of law.

“Moreover, a judicial officer by virtue of being a judicial officer does not waive his fundamental rights which are available to all other citizens of the country as also his social and private rights to look after and stand by his family. He also has a right as the biological sibling of the complainant/victim to stand by her and his family and taking action against any person who brings harm or disrepute to his family”, the Bench noted.

As per the Bench, the contention of the applicant that due to the brother of the complainant being a judicial officer in Delhi, the accused is not getting justice from any Court, in absence of any evidence to support the same, had to be rejected out-rightly. It was further opined by the Bench that the co-accused has targeted innocent women and the present accused in this case has been his close associate to help him succeed in his nefarious design of misguiding the family of the complainant and leading her to get married to him and extracting huge amount of money to his own and the bank account of the present accused for which evidence is on record. Such accused persons need to be dealt with a stern hand so that if granted bail, they will not indulge in similar activities of spoiling lives of other women.

“Arranged marriages are still an entirely family driven decision for their daughters, and the family relies heavily on assurances given by the friends and relatives of the prospective groom”, the Bench held while also observing, “To suggest that since the person cheated is kin of judicial officer and if bail is not granted, it would amount to taking sides in judicial system will amount to judging judicial system with a myopic eye and suggest that a judicial system is so fragile that it would take sides and not do justice.”

Placing reliance upon the judgment in Saleem v. The State of NCT of Delhi and Anr.wherein it was opined that to ensure that the identity of victims of sexual assault is not disclosed in the petitions, the Bench held, “Further, the Registry in these circumstances, is also directed to ensure that henceforth in any petition/applications etc. filed in cases involving sexual offences, a certificate/note be annexed with the first page of the petition by the counsel for the petitioner/applicant certifying that the name of the complainant/victim or any other name etc. has not been mentioned or divulged either in the body of the petition or in any of the annexures filed along with it which will divulge the identity of the victim.”

Thus, dismissing the bail petitions, the Bench ordered, “With regard to the present case, Registry is directed to immediately mask the name of the victim and the judicial officer in annexure -E and particulars about the judicial officer mentioned in para 6 of the grounds of present bail application.”

Read Order: State Bank of India and Ors v. The Consortium of Mr Murari Lal Jalan and Mr Florian Fritsch and Anr [SC-Civil Appeal Nos 3736-3737 of 2023]

Tulip Kanth

New Delhi, January 25, 2024: In a case where a Resolution Plan was submitted under the Insolvency and Bankruptcy Code, 2016 (IBC) by a consortium of Murari Lal Jalan and Florian Fristch in respect of the Corporate Debtor (Jet Airways Limited) with an intent to settle the total outstanding claims, the Supreme Court has asked the consortium to pay Rs 150 crore failing which the consequences under the Resolution Plan would follow.

The batch of appeals, before the 3-Judge Bench of Chief Justice D.Y. Chandrachud, Justice J.B. Pardiwala and Justice Manoj Misra arose from three orders of the National Company Law Appellate Tribunal (NCLAT). A Resolution Plan was submitted under the Insolvency and Bankruptcy Code, 2016 (IBC) by a consortium of Murari Lal Jalan and Florian Fristch in respect of the Corporate Debtor (Jet Airways Limited).

The Plan was voted upon and approved by the Committee of Creditors. The Resolution Professional then filed an application before the Adjudicating Authority to seek approval of the Resolution Plan. The Plan received the imprimatur of the Adjudicating Authority – the National Company Law Tribunal (NCLT) - (Plan Approval Order).Given the uncertainty surrounding the Effective Date, the NCLT, in its Plan Approval Order, mandated the completion of Conditions Precedent and the attainment of the Effective Date within the first 90 days from the Approval Date. The Order also granted the flexibility to request an extension of the 180-day timeline, allowing for an outer limit of 270 days, in accordance with the provisions outlined in the Resolution Plan.

The Successful Resolution Applicant (SRA) and the consortium of lenders represented by the State Bank of India (SBI) were not ad idem on whether the conditions precedent were fulfilled. The SRA took the position that all conditions precedent had been duly fulfilled. Consequently, the DGCA reissued an Air Operation Certificate, confirming the authorization for the Corporate Debtor to engage in commercial air operations. The SRA communicated via email to the Lenders, affirming compliance with all prerequisites and proposing that May 20 2022, should be recognized as the effective date under the Resolution Plan. However, the lenders took a position to the contrary. The SRA filed an Implementation Application and Exclusion Applicationbefore the NCLT seeking a determination in accord with its position.

By an order the NCLT came to the conclusion that the SRA was compliant with the conditions precedent. It allowed the Implementation Application, thereby inter alia permitting the SRA to take control and management of the Corporate Debtor. The order of the NCLT had been challenged by SBI in appeal. The appeal was pending before the NCLAT.TheNCLAT declined to stay the order of the NCLT, which had given rise to the sets of appeals. By a subsequent order, the NCLAT allowed an extension.

The Resolution Plan was envisaged that with an intent to settle the total outstanding claims made by domestic banks, foreign banks and financial institutions, the assenting financial creditors would be entitled to the benefit of payments and securities. This was described as Summary of payments and security package.

In an effort to resolve the imbroglio, an affidavit was filed on behalf of SBI, by its Chief Manager. The affidavit stated that the lenders were agreeable to a certain course of action. However, the inability to meet the conditions necessitates directing the Corporate Debtor into liquidation.Thereafter, an application was moved by the SRA seeking liberty to pay the amount of Rs 350 crore.Permission to do so was granted by the NCLAT extending time until August 31, 2023 for the payment of the amount.

It was the case of the appellant that there had been a default on the part of the SRA in complying with the conditions precedent spelt out in the clauses and on various other aspects, including the payment of workmen’s dues, airport dues and other matters.

The Bench noted that the occasion for an extension of time to the SRA for the deposit of Rs 350 crores arose as a consequence of the affidavit which was filed by SBI before the NCLAT on August 16, 2023. SBIs affidavit envisaged that the lenders would not contest the issues pertaining to the grant or exclusion of time; or extension in terms of the orders which were passed by the NCLT and compliance of the conditions precedent by the SRA. SBIs offer was, however, subject to the fulfillment of three conditions. These conditions were:

- The SRA must infuse an amount of Rs 350 crores by 31 August 2023 (the date by which the payment was to be made in terms of the Resolution Plan read with the order dated 26 May 2023 of NCLT)

- The SRA must undertake to scrupulously follow the other terms and conditions of the Resolution Plan; and

- The SRA must comply with the liabilities in regard to the payment to the employees in terms of the order of the NCLAT dated 21 October 2022 which has been upheld by this Court on 30 January 2023.

The Bench was of the opinion that the NCLAT was not justified in holding, in its order that the last tranche of Rs 150 crorewhich was to be paid would be adjusted against the PBG. The SRA having deposited the first two tranches each of Rs 100 crores must comply with the remaining obligation of depositing Rs 150 crores (to make up a total payment of Rs 350 crores). Having by its conduct accepted the terms set up by SBI it must be obligated to comply with the entirety of its obligations. It must do so in strict compliance with the time schedule set out hereafter, the Bench noted.

SBI had stated that the lenders had been saddled with huge recurring expenditure every month to maintain the remaining airline assets of the Corporate Debtor. The lenders had been embroiled in litigation before the NCLT and NCLAT with little progress on this ground towards implementing the resolution plan.

“Such a state of affairs cannot be permitted to continue interminably as it defeats the very object and purpose of the provisions of and timelines under the IBC. The timely resolution of insolvency cases is vital for sustaining the effectiveness and credibility of the insolvency framework. Therefore, concerted efforts and decisive actions are imperative to break the deadlock and ensure the expeditious implementation of the resolution plan”, the Bench observed.

The lenders had argued in the appeals that there had been a failure on the part of the SRA to comply with the conditions precedent. If the SRA were to comply with the terms as envisaged in SBI’s affidavit evidently issues pertaining to compliance with the conditions precedent were not to be pressed thereafter. In order to furnish this SRA a final opportunity to comply with the earlier position, the Bench issued the following directions:

- The SRA shall peremptorily on or before 31 January 2024, deposit an amount of Rs 150 crores into the designated account of SBI, failing which the consequences under the Resolution Plan shall follow;

- The PBG of Rs 150 crores shall continue to remain in operation and effect, pending the final disposal of the appeal before NCLAT, and shall abide by the final outcome of the appeal and the directions that may be issued by NCLAT; and

- Whether or not the SRA has been compliant with all the conditions of the Resolution Plan as well as of the conditions set out in paragraph 8 of the affidavit dated 16 August 2023 shall be decided by the NCLAT in the pending appeal.

Thus, the Bench held that the order of the NCLAT would be modified in part in terms of the above directions and, hence, the permission which was granted to the SRA to adjust the last tranche of Rs 150 crores against the PBG would stand substituted by these directions. The NCLAT was also requested to endeavour an expeditious disposal of the appeal by the end of March 2024.

Read Order: M/S MANGALAM PUBLICATIONS, KOTTAYAM v. COMMISSIONER OF INCOME TAX, KOTTAYAM [SC- CIVIL APPEAL NOS. 8580-8582 OF 2011]

Tulip Kanth

New Delhi, January 24, 2024: The Supreme Court has clarified that ascertaining the defects and intimating the same to the assessee for rectification, are within the realm of discretion of the assessing officer. If he does not exercise the discretion, the return of income cannot be construed as a defective return.

The Division Bench of Justice B.V. Nagarathna & Justice Ujjal Bhuyan was considering the perennial question in income tax jurisprudence, whether reopening of a concluded assessment i.e. reassessment under Section 147 of the Income Tax Act, 1961 following issuance of notice under Section 148 is legally sustainable or is bad in law.

The assessee was a partnership firm at the relevant point of time though it got itself registered as a company since the assessment year 1994-95. The assessee has been carrying on the business of publishing newspaper, weeklies and other periodicals in several languages under the brand name Mangalam. Prior to the assessment year 1994-95 including the assessment years under consideration, the status of the assessee was that of a firm, being regularly assessed to income tax.

The assessing officer had worked out the escaped income for the three assessment years of 1990- 91, 1991-92 and 1992-93 at Rs.50,96,041.00. This amount was further apportioned between the three assessment years in proportion to the sales declared by the assessee.

Against the aforesaid three reassessment orders for the assessment years 1990-91, 1991-92 and 1992-93, assessee preferred three appeals before the first appellate authority i.e. Commissioner of Income Tax (Appeals), IV Cochin. Assessee raised the ground that it had disclosed all material facts necessary for completing the assessments and the assessments could not have been reopened after expiry of four years from the end of the relevant assessment year as per the proviso to Section 147. It was pointed out that the limitation period for the last of the three assessment years i.e. 1992-93, had expired on 31.03.1997 whereas the notices under Section 148 were issued and served on the assessee only on 29.03.2000. Therefore, all the three reassessment proceedings were barred by limitation. However, as against the total escaped income of Rs.50,96,040.00 for the above three assessment years as quantified by the assessing officer, CIT(A) enhanced and redetermined such income at Rs.68,20,854.00.

The Income Tax Appellate Tribunal, Cochin Bench, Cochin (Tribunal hereinafter) had decided in favour of the assessee by setting aside the orders of reassessment. However, the High Court of Kerala in appeals filed by the revenue under Section 260A had reversed the findings of the Tribunal by deciding the appeals preferred by the revenue in its favour. Thus, the assessee approached the Top Court.

At the outset, the Bench expounded on the meaning of disclosure and said, “…full and true disclosure is the voluntary filing of a return of income that the assessee earnestly believes to be true. Production of books of accounts or other material evidence that could ordinarily be discovered by the assessing officer does not amount to a true and full disclosure.”

From a reading of the reasons recorded by the assessing officer leading to formation of his belief that income of the assessee had escaped assessment for the assessment years under consideration, it was seen that the only material which came into possession of the assessing officer subsequently was the balance sheet of the assessee for the assessment year 1989-90 obtained from the South Indian Bank.

After obtaining this balance sheet, the assessing officer compared the same with the balance sheet and profit loss account of the assessee for the assessment year 1993-94. On such comparison, the AO noticed significant increase in the current and capital accounts of the partners of the assessee. On that basis, he drew the inference that profit of the assessee for the three assessment years under consideration would be significantly higher which had escaped assessment. The figure of under assessment was quantified at Rs.1,69,92,728.00.

It was further opined by the Bench that Section 139 places an obligation upon every person to furnish voluntarily a return of his total income if such income during the previous year exceeded the maximum amount which is not chargeable to income tax. The assessee is under further obligation to disclose all material facts necessary for his assessment for that year fully and truly. However, referring to Calcutta Discount Company Limited Vs. Income Tax Officer, the Bench opined that while the duty of the assessee is to disclose fully and truly all primary and relevant facts necessary for assessment, it does not extend beyond this. Once the primary facts are disclosed by the assessee, the burden shifts onto the assessing officer.

“On the basis of the balance sheet submitted by the assessee before the South Indian Bank for obtaining credit which was discarded by the CIT(A) in an earlier appellate proceeding of the assessee itself, the assessing officer upon a comparison of the same with a subsequent balance sheet of the assessee for the assessment year 1993-94 which was filed by the assessee and was on record, erroneously concluded that there was escapement of income and initiated reassessment proceedings”, it added.

“We have already taken note of the fact that an assessment order under Section 143(3) is preceded by notice, enquiry and hearing under Section 142(1), (2) and (3) as well as under Section 143(2). If that be the position and when the assessee had not made any false declaration, it was nothing but a subsequent subjective analysis of the assessing officer that income of the assessee for the three assessment years was much higher than what was assessed and therefore, had escaped assessment. This is nothing but a mere change of opinion which cannot be a ground for reopening of assessment”, the Bench further held.

Admittedly, the returns for the three assessment years under consideration were not accompanied by the regular books of account. Though under sub-section (9)(f) of Section 139, such returns could have been treated as defective returns by the assessing officer and the assessee intimated to remove the defect failing which the returns would have been invalid, however, the materials on record did not indicate that the assessing officer had issued any notice to the assessee bringing to its notice such defect and calling upon the assessee to rectify the defect within the period as provided under the aforesaid provision.

“Suffice it to say that a return filed without the regular balance sheet and profit and loss account may be a defective one but certainly not invalid. A defective return cannot be regarded as an invalid return. The assessing officer has the discretion to intimate the assessee about the defect(s) and it is only when the defect(s) are not rectified within the specified period that the assessing officer may treat the return as an invalid return”, the Bench held.

It was further noted by the Top Court that ascertaining the defects and intimating the same to the assessee for rectification, are within the realm of discretion of the assessing officer. If he does not exercise the discretion, the return of income cannot be construed as a defective return. As a matter of fact, in none of the three assessment years, the assessing officer had issued any declaration that the returns were defective.

The Assessee has asserted both in the pleadings and in the oral hearing that though it could not file regular books of account along with the returns for the three assessment years under consideration because of seizure by the department, nonetheless the returns of income were accompanied by tentative profit and loss account and other details of income like cash flow statements, statements showing the source and application of funds reflecting the increase in the capital and current accounts of the partners of the assessee etc., which were duly enquired into by the assessing officer in the assessment proceedings.

Taking note of such facts and circumstances, the Top Court held that the Tribunal was justified in coming to the conclusion that the reassessments for the three assessment years under consideration were not justified. Consequently, the Bench set aside the common order of the High Court and restored the order of the Tribunal.

Read Order: ADV BABASAHEB WASADE & ORS v. MANOHAR GANGADHAR MUDDESHWAR & ORS [SC- CIVIL APPEAL NO. 10846 OF 2018]

Tulip Kanth

New Delhi, January 24, 2024: Referring to section 15 of the Societies Registration Act, 1860, the Supreme Court has held that members in default of membership fee would not be entitled to vote and would not be counted as members of the Society. The Top Court opined that if they are not to be counted as members, then there would be no illegality or for that matter any prejudice being caused by not issuing any notice as the same would be an exercise in futility.

The matter revolved around one Shikshan Prasarak Mandal, Mul society registered under the Societies Registration Act, 1860 as a charitable society since 1946. The Society in its turn framed its rules and regulations. Later on, the Society was registered as a Public Trust under the Bombay Public Trusts Act, 1950.

The effective office bearers of the Society namely the President, Vice-President and the Secretary of the Society expired. Even prior to the death of the President due to his poor health, the Executive Body under his presidentship passed a resolution in 1997 empowering Advocate Babasaheb Wasade (appellant No. 1) to be designated as the Working President and he was required to look after day-to-day affairs and management of the Society.

As there was no elected President, Vice-President or the Secretary, 16 members of the Society requested appellant No.1 to summon extraordinary meeting to hold the elections. The elections were held on 08.09.2002 and a new Executive Committee was elected with appellant No.1 as the President and appellant No.2 as the Secretary. Objections were filed by 7 persons alleging to be members of the Society on the ground that notice had not been served on them and that appellant No.1 had no authority to issue notice to summon a meeting for election. It was also alleged in the objections that the signatory nos. 12 to 16 to the request letter were not valid members of the Society and were yet to be approved by the Executive Committee. Further signatory nos. 4 to 7 of the same objection had retired and hence, they ceased to be members.

The Assistant Charity Commissioner allowed the objections. The appellant preferred an appeal before the Joint Charity Commissioner, Nagpur which was allowed. Against this, Miscellaneous Civil Application was filed by the Objectors before the District Judge-4, Chandrapur, which was allowed. Aggrieved by the same, the First Appeal was preferred before the Bombay High Court which had since been dismissed by the impugned order, giving rise to the present appeal.

The Division Bench, comprising Justice Vikram Nath & Justice Ahsanuddin Amanullah, was of the view that in the absence of the office bearers authorised under the bye- laws who could convene the meeting, the only option left for convening the meeting could either be with the Working President on his own or upon the requisition made by the members to convene a meeting.“There is a doctrine of necessity where under given circumstances an action is required to be taken under compelling circumstances”, the Bench stated while referring to Charan Lal Sahu vs. Union of India [LQ/SC/1989/648] & Election Commission of India v. Dr Subramaniam Swamy [LQ/SC/1996/861].

“In the present case, had the Working President not convened the meeting, the elections of the executive body would have been in limbo for an unreasonable amount of time. The convening of the meeting by the Working President upon the requests by the 16 surviving members was a necessity at the time”, the Bench further added.

Noting the fact that the President and Secretary who were authorized under the bye- laws had died and no election had been held for replacing them and even the Vice-President and the Joint-Secretary had also passed away, the Bench held that the only person who could be said to be managing the affairs of the Society was the Working President Mr. Wasade, and in particular, when all the 16 surviving and valid members had made a request for convening a meeting, no fault could be found with the decision of the Working President Mr. Wasade to convene the meeting. In such situation, the Top Court was of the view that the convening of the meeting for holding the elections couldn’t be faulted with.

Referring to section 15 of the Societies Registration Act, the Bench said, “The specific language used is that such members in default of membership fee would not be entitled to vote and would not be counted as members of the Society. If they were not entitled to vote and they were not to be counted as members, there would be no illegality or for that matter any prejudice being caused by not issuing any notice as the same would be an exercise in futility.”

Moreover, the Bench observed that in the bye-laws of the present Society or the Rules of the Society, there is no such provision of automatic cessation of membership where a member goes in default of payment of membership fee for more than three months. However, the effect of the proviso to Section 15 of the Registration Act which admittedly is applicable to the Society, the Objectors have to be treated as suspended members and therefore, would not be entitled to any notice as they had no right to vote or to be counted as members. Once they are not to be counted as members, there was no occasion to give them notice as such Non-issuance of notice to the Objectors would not vitiate the proceeding of the special meeting, the Bench held.

“…we may record that a clear reading and interpretation of the proviso to Section 15 of the Registration Act would disentitle such defaulting members from being given any notice even if their membership was not terminated or ceased”, it added.

The Bench held that the contesting respondent would have no locus to maintain the petition before the District Judge. Although the contesting respondent claimed himself to be the Vice-President of the Society but he had not been able to substantiate his claim. On this ground alone the District Judge ought to have dismissed the petition.

The Bench also observed that upon superannuation or cessation of their employment, four signatories (Members 4 to 7) could not have continued as members of the Society in the category of Employee Members even upon their superannuation by merely paying the yearly subscription fee thereby blocking the entry of the persons, who were still employees.

Therefore, allowing the appeal, the Bench accepted the Change Report. The Top Court concluded the matter by observing, “Moreover, we find that the stalemate in the Society has continued for a pretty long time, which does not bode well for any institution, much less an institution which is running educational institutions and is required to be run in a fair, transparent and legal manner.” The Top Court directed that fresh elections shall be held for the new Executive Committee of the Society by the Charity Commissioner in accordance with law within six months.

Read Order: IN RE : T.N. GODAVARMAN THIRUMULPAD v. UNION OF INDIA AND ORS [SC- Writ Petition(s)(Civil) No(s). 202/1995]

Tulip Kanth

New Delhi, January 24, 2024: The Supreme Court has disposed of a batch of applications pertaining to environmental concerns in its latest order. The Top Court has not only dealt with the issue of continuity of mining activities in the Aravalli Range but has also considered a project proponent’s plea in relation to the Madhya Pradesh Diamond Mining Project as well as the issue of plying of e-rickshaws in the city of Matheran in Maharashtra.

The report of the Central Empowered Committee (CEC) in all the applications showed that mining lease of the applicants did not fall in the Aravali Hills and no illegal mining was found. Though the report of the Forest Survey of India endorsed that no illegal mining had been found in this area, it suggested that the said areas fell within the Aravali Hill Range.

Dr. Manish Singhvi, senior counsel appearing for the State of Rajasthan submitted that the issue as to whether the classification between Aravali Hills and Aravali Ranges, in so far as the mining activities were concerned needed to be finally decided by this Court.

“We, prima facie, feel that if the State is of the view that the mining activities in the Aravali Range is also deterimental to the environmental interest, nothing stops the State Government from preventing mining activities in the Aravalli Range as well”, the Division Bench of Justice B.R. Gavai & Justice Sandeep Mehta held.

The Top Court disposed of the applications with a direction to the State Government to consider the applications filed by the applicants for permitting the renewal and continuance of the mining operations in accordance with law.

The Bench took note of the fact that in so far as mining activities in Aravali Hills and Ranges were concerned, Mr. K. Parameshwaran, Amicus Curiae stated that it will be in the larger public interest, if all these issues were examined by the CEC and a comprehensive direction was issued in that regard.

“We request the CEC to examine the issue as to whether the classification of Aravali Hills and Ranges in so far as permitting mining is concerned, needs to be continued or not. We also request the CEC to take on board the experts in Geology before finalizing its report. The same shall be done within a period of eight weeks from today”, the Bench held.

The Apex Court was also informed that though the issues involved with regard to the mining in Aravali Hills and Rage in Haryana and Rajasthan are common, the matters/applications with regard to the mining in State of Haryana are placed before another Bench of this Court, whereas the matters/applications with regard to the mining in Rajasthan are placed before this Bench.

Since the issues with regard to mining in the Aravali Hills and Ranges are common for both the States, the Bench held that it would be appropriate that the said matters are heard and decided by the Same Bench of the Top Court, so as to avoid any conflicting orders.

“We, therefore, direct the Registrar (Judicial) to place the matter(s) before Hon’ble the Chief Justice of India to obtain appropriate order(s) and place the same before the Bench as directed by the Hon’ble the Chief Justice of India”, the Bench ordered.

The Court also considered an Interlocutory application whereby the applicant prayed for permission to continue its mining operation in the Diamond Mining Project at Village Majhgawan Mine, District Panna, Madhya Pradesh in terms of the Mine Closure Plan dated September 23, 2019. The Expert Appraisal Committee (EAC) had observed that the project proponent needed to seek clarification from the Court regarding the applicability of the earlier orders.

The Top Court had earlier directed that no mining activities should be permitted within an area of one kilometer from the boundary of the National Parks/Wild Life Sanctuaries. However, this Court taking into consideration the peculiar facts and circumstances existing in Panna National Park had granted a specific permission for continuing mining activities, however, subject to stringent conditions mentioned therein.

The Bench considered the fact that the project proponent is one of the Navratna Corporations of the Government of India and if the mining activities were abruptly stopped at this stage, the possibility of illegal mining of diamonds being carried out, couldn’t be ruled out.

“It is rather in the national interest that the Government of India owned company is permitted to continue the activities in a scientific manner till the activities are closed”, the Bench observed.

Lastly, in this batch of applications, the Bench also took notice of its earlier directions with regard to laying of paver blocks on the roads as well as plying of E- rickshaws in the city of Matheran. The Standing Counsel for the State of Maharashtra submitted that the Monitoring Committee in consultation with IIT Bombay, was considering the proposal of using clay paver blocks instead concrete paver blocks. It was submitted that it was necessary to use clay paver blocks in order to prevent the soil erosion.

“We clarify that E-Rickshaws, if permitted, would be only provided to the present hand cart pullers in order to compensate them on account of their loss of employment. We further clarify that there shall also be a restriction on the number of E-rickshaws to be permitted in the city of Matheran”, the Bench held while also directing that alongwith the issue of paver blocks, the Monitoring Committee shall also consider as to which of the roads/streets would be permitted to be used by the E- rickshaws and determine the number of e-rickshaws to be plied in the city of Matheran.

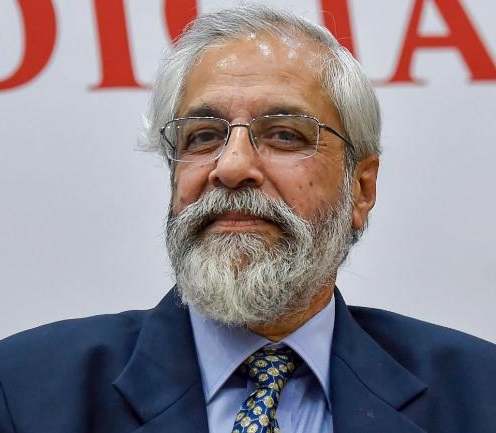

Time for judiciary to introspect and see what can be done to restore people’s faith – Justice Lokur

Justice Madan B Lokur, was a Supreme Court judge from June 2012 to December 2018. He is now a judge of the non-resident panel of the Supreme Court of Fiji. He spoke to LegitQuest on January 25, 2020.

Q: You were a Supreme Court judge for more than 6 years. Do SC judges have their own ups and downs, in the sense that do you have any frustrations about cases, things not working out, the kind of issues that come to you?

A: There are no ups and downs in that sense but sometimes you do get a little upset at the pace of justice delivery. I felt that there were occasions when justice could have been delivered much faster, a case could have been decided much faster than it actually was. (When there is) resistance in that regard normally from the state, from the establishment, then you kind of feel what’s happening, what can I do about it.

Q: So you have had the feeling that the establishment is trying to interfere in the matters?

A: No, not interfering in matters but not giving the necessary importance to some cases. So if something has to be done in four weeks, for example if reply has to be filed within four weeks and they don’t file it in four weeks just because they feel that it doesn’t matter, and it’s ok if we file it within six weeks how does it make a difference. But it does make a difference.

Q: Do you think this attitude is merely a lax attitude or is it an infrastructure related problem?

A: I don’t know. Sometimes on some issues the government or the establishment takes it easy. They don’t realise the urgency. So that’s one. Sometimes there are systemic issues, for example, you may have a case that takes much longer than anticipated and therefore you can’t take up some other case. Then that necessarily has to be adjourned. So these things have to be planned very carefully.

Q: Are there any cases that you have special memories of in terms of your personal experiences while dealing with the case? It might have moved you or it may have made you feel that this case is really important though it may not be considered important by the government or may have escaped the media glare?

A: All the cases that I did with regard to social justice, cases which concern social justice and which concern the environment, I think all of them were important. They gave me some satisfaction, some frustration also, in the sense of time, but I would certainly remember all these cases.

Q: Even though you were at the Supreme Court as a jurist, were there any learning experiences for you that may have surprised you?

A: There were learning experiences, yes. And plenty of them. Every case is a learning experience because you tend to look at the same case with two different perspectives. So every case is a great learning experience. You know how society functions, how the state functions, what is going on in the minds of the people, what is it that has prompted them to come the court. There is a great learning, not only in terms of people and institutions but also in terms of law.

Q: You are a Judge of the Supreme Court of Fiji, though a Non-Resident Judge. How different is it in comparison to being a Judge in India?