In CIVIL APPEAL No.5393 OF 2010-SC- Mere availability of alternative remedy of appeal or revision, which party invoking jurisdiction of HC under Article 226 has not pursued, would not oust HC’s jurisdiction & render petition not maintainable: SC

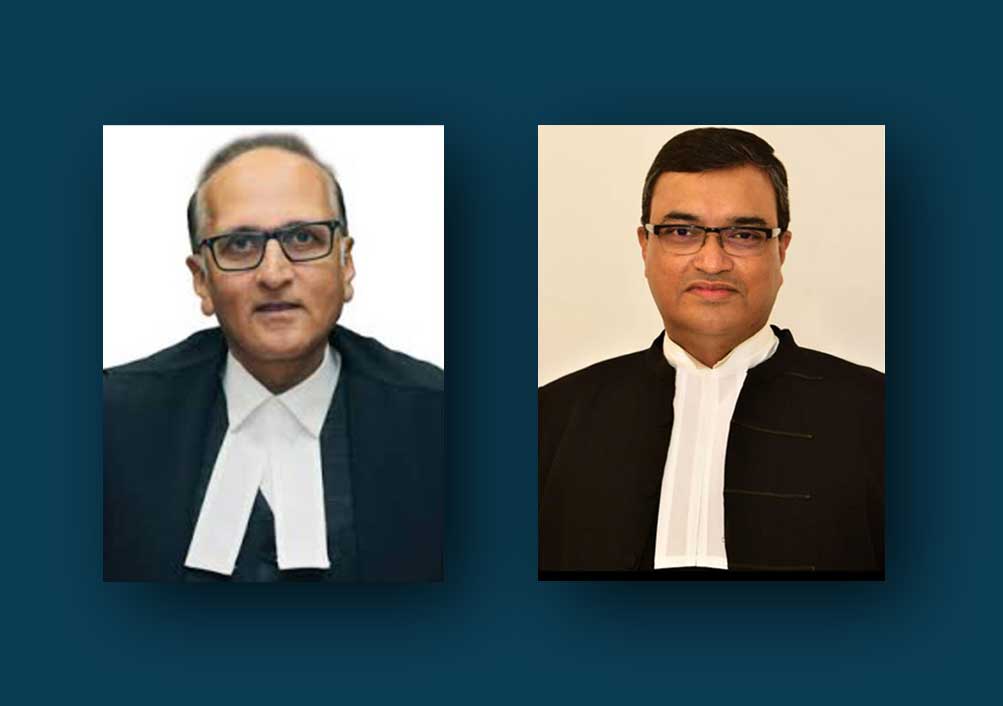

Justices S. Ravindra Bhat & Dipankar Datta [01-01-2023]

Read Order: M/S GODREJ SARA LEE LTD v. THE EXCISE AND TAXATION OFFICERCUM-ASSESSING AUTHORITY & ORS

Mansimran Kaur

New Delhi, February 3, 2023: The Supreme Court has observed that dismissal of a writ petition by a High Court on the ground that the petitioner has not availed the alternative remedy without, however, examining whether an exceptional case has been made out for such entertainment would not be proper.

While allowing an appeal by special leave challenging an order of the Punjab and Haryana High Court dismissing writ petition presented by the appellant and relegating it to the remedy of an appeal under section 33 of the Haryana Value Added Tax Act, 2003, the Division Bench of Justice S. Ravindra Bhat and Justice Dipankar Datta has opined that it was not the Assessing Authority’s orders but those passed by the Revisional Authority, which suffered from patent illegality.

Two questions that emerged in this appeal were, firstly, whether the High Court was justified in declining interference on the ground of availability of an alternative remedy of appeal to the appellant under section 33 of the Haryana Value Added Tax and secondly whether the writ petition was to be remitted to the High Court for hearing it on merits or to examine the correctness or otherwise of the orders impugned before the High Court.

It appeared on a perusal of the order under challenge in this appeal that the appellant had questioned the jurisdiction of the Deputy Excise and Taxation Commissioner (ST)-cum-Revisional Authority, to reopen proceedings, in exercise of suo motu revisional power conferred by section 34 of the VAT Act, and to pass final orders holding that the two assessment orders, both dated February 28, 2007 passed by the ETO-cum-Assessing Authority, for the assessment years 2003-04 and 2004-05 suffered from illegality and impropriety.

Keeping in view the objection raised by counsel for the respondents that without exhausting the remedy of appeal provided by section 33 of the VAT Act it would not be permissible to entertain this petition and upon consideration of the decision of this Court reported in Titagarh Paper Mills vs. Orissa State Electricity Board & Anr. based on which it was contended on their behalf that where any right or liberty arises under a particular Act then the remedy available under that Act has to be availed, the High Court was of the opinion that the appellate authority would not be able to grant relief sought in the writ petition.

Hence, the writ petition was dismissed and the appellants were relegated to the appellate remedy.

Before dealing with the questions, the Court deemed fit to comment upon the exercise of writ powers conferred by Article 226 of the Indian Constitution. In view of the same, the Court noted , “The power to issue prerogative writs under Article 226 is plenary in nature. Any limitation on the exercise of such power must be traceable in the Constitution itself”.

“A writ petition despite being maintainable may not be entertained by a high court for very many reasons or relief could even be refused to the petitioner, despite setting up a sound legal point, if grant of the claimed relief would not further public interest”,the Bench added. Reference was made to the judgments in Whirlpool Corporation vs. Registrar of TradeMarks, Mumbai and Others & State of Uttar Pradesh & ors. vs. Indian Hume Pipe Co. Ltd.

In the present case, the Court stated that the orders impugned were passed wholly without jurisdiction. Since a jurisdictional issue was raised by the appellant in the writ petition questioning the very competence of the Revisional Authority to exercise suo motu power, being a pure question of law, the Court was of the considered view that the plea raised in the writ petition did deserve a consideration on merits and the appellants’ writ petition ought not to have been thrown out at the threshold.

Hence, the Court observed that the High Court by dismissing the writ petition committed a manifest error of law for which the order under challenge is unsustainable. The same was accordingly, set aside.

Thereafter, the next issue was to be decided concerned with ordering a remand. In view of the same, the Court opined that the Revisional Authority might have been justified in exercising suo motu power to revise the order of the Assessing Authority had the decision of the Tribunal been set aside or its operation was stayed by a competent Court.

It was further noted that there was nothing on record to justify either illegality or (procedural/moral) impropriety in the proceedings before the Assessing Authority or the orders passed by him, as such. The Assessing Authority was bound by the order of the Tribunal and elected to follow it having no other option. Such a decision of the Tribunal was even binding on the Revisional Authority.

In such circumstances, to brand the orders of the Assessing Authority as suffering from illegality and impropriety appeared be not only unjustified but also demonstrated lack of understanding of the principle regulating exercise of suo motu revisional power by a quasi-judicial authority apart from being in breach of the principle of judicial discipline, while confronted with orders passed by a superior Tribunal/Court.

Thus, the Court stated that it was not the Assessing Authority’s orders but those passed by the Revisional Authority, which suffer from a patent illegality. Hence, in view of such observations, the appeal was allowed.

Sign up for our weekly newsletter to stay up to date on our product, events featured blog, special offer and all of the exciting things that take place here at Legitquest.

Add a Comment