In absence of express statutory authorization, delegated legislation in form of rules or regulations, can’t operate retrospectively, reiterates Apex Court

Read Judgment: Assistant Excise Commissioner, Kottayam & Ors. vs. Esthappan Cherian & Anr

Pankaj Bajpai

New Delhi, September 7, 2021: While upholding the judgment of the Kerala High Court quashing the demand from licensee pursuant to termination of its liquor license, the Supreme Court has ruled that that a rule or law cannot be construed as retrospective unless it expresses a clear or manifest intention, to the contrary.

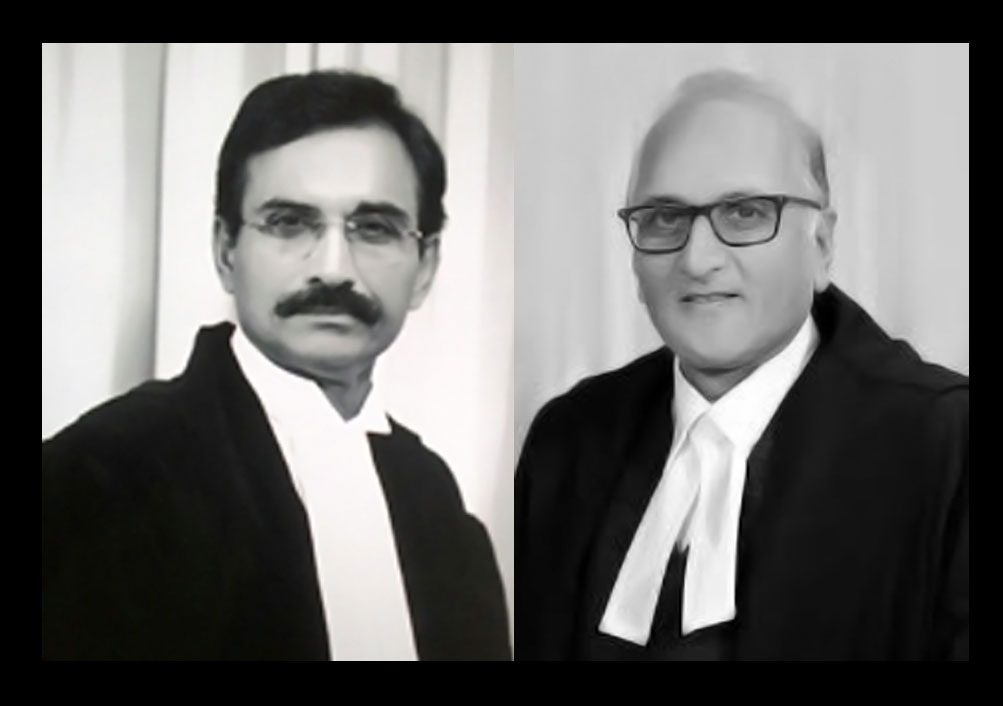

A Division Bench of Justice L. Nageswara Rao and Justice S. Ravindra Bhat observed that the respondent (licensee) had succeeded before the High Court and was thus entitled to claim adjustment of the departmental management fees, for the period after its contract for sale of country liquor was terminated.

The respondent was also entitled to claim relief under the Amnesty Scheme, which was denied to it despite having succeeded before the High Court, added the Bench.

The observation came pursuant to an appeal filed by the State of Kerala challenging the judgment of the Kerala High Court which allowed the licensee’s claim for an order quashing a demand in respect of certain amount towards the balance sought to be recovered after a country liquor license.

The background of the case was that the licensee, being the successful bidder for arrack shops in the state of Kerala, entered into an agreement with the State. However, alleging that the licensee had committed default in the payment of the bid amount, in not replenishing the security in a timely manner, the State issued a show cause notice.

Later, the license was cancelled and the licensed shops were put up for re-auction on seven different dates. However, the re-auction was unsuccessful as there were no bidders. As a consequence, the shops were managed by the Department of Excise in terms of the Abkari Shops Departmental Management Rules, 1972.

Now, the State argued that had the licensee continued operating the shop, it would have gained more revenues. It accordingly demanded dues, from the licensee. This was challenged by the licensee before the High Court as being illegal and void and that its liability with respect to arrack shops ended upon the cancellation of the licensee for sale of country liquor.

Since the challenge bears no fruit, the respondent approached the Division Bench which held that since the contracts were entered into before the amendment of Rule 13, the licensee was liable to pay only the actual loss suffered by the government, in realization of rentals and excise duty. The Bench therefore directed the government to issue fresh demands in accordance with the rules and agreements executed with the licensee covering only the actual loss.

After considering the arguments, the Top Court found that when the State initiated recovery proceedings it did not give credit of the amounts collected under the head of department management fee, as was required under pre-existing Rule 13.

Therefore, quoting the decision in Lucka v State of Kerala & Ors (OP 8271/1994), the Top Court highlighted that there cannot be any dispute that contracts entered into before amendment of Rule 13 as in the present case, were not to be treated as those transactions for which amounts were non-adjustable.

The Apex Court therefore concluded that upon payment of 50% of the amount, the respondent’s liabilities towards the arrears of dues for the liquor vend in issue which was cancelled by the State’s order, shall stand discharged.

Hence, the Court directed the State to release the respondent’s property attached and sought to be sold, towards satisfaction of the above liability, upon receiving the said balance 50% of the amount.

The Court also asked the State to refrain from initiating any proceedings for its recovery towards arrears for the said period the contract was to be in operation.

Sign up for our weekly newsletter to stay up to date on our product, events featured blog, special offer and all of the exciting things that take place here at Legitquest.

Add a Comment