Read Judgment: Ketan Kantilal Seth Vs State of Gujarat & Ors

Mansimran Kaur

New Delhi, September 10, 2022: If the Court is satisfied that it is imperative to transfer the cases in the interest of justice or to secure ends of justice, then it may do so, the Supreme Court has observed.

The Single Judge Bench of Justice J.K. Maheshwari allowed the instant transfer petitions by observing the common nature of allegations raised against the petitioner in all 14 FIRs and criminal proceedings emanating therefrom which were yet pending before respective Trial Courts in four States.

In a nutshell, the prosecution story in majority of the cases revolved around one accused company namely M/s Home Trade Limited, which was alleged to be engaged in the business Stock, Securities, Brokering and Trading. The allegations against the petitioner herein and one Sanjay Hariram Agarwal were that they were the authorized signatories of the accused company and while acting in the capacity of Directors of the said accused company, they entered into several transactions dealing with the government securities and further sold the said securities without any authorization.

Further, it was also alleged that the government securities were not delivered within time and the money raised thereby was misappropriated by the accused persons including the petitioner.

During the pendency of the instant petitions, applications for intervention were also filed on behalf of one applicant seeking permission to intervene on the grounds of being a ‘necessary’ and ‘proper’ party as stated in the application. Before adverting to merits of the transfer petitions, the application seeking intervention was taken up for disposal.

The intervenor claimed to be an agriculturist who was dependent on financial aid provided by Nagpur District Central Cooperative Bank Limited for his day today agricultural activities. It was said Chairman of NDCCB, who lodged an FIR in 2002 against the petitioner and other accused persons alleging nondelivery of the government securities worth Rs. 125 crores which NDCCB purchased through the accused company in which the petitioner and other accused persons were directors. The petitioner also sought transfer of concerned trial in the instant transfer petitions.

After hearing the contentions of the parties, the Court noted that the primary issue for consideration before this Court was whether the criminal cases pending before different Trial Courts in four States can be transferred to one Trial Court in one State and if transfer of case of one of the criminal cases which is at the final stage of trial before the concerned Court in Nagpur, can be directed to be transferred at such belated stage.

“Section 406 deals with the power of the Supreme Court to transfer the cases. The Court can exercise such power for fair trial and to secure the ends of justice. The language impliedly left the transfer of the cases on the discretion of the Court. If the Court is satisfied that it is imperative to transfer the cases in the interest of justice or to secure ends of justice, then it may do so”, the Court further noted.

In the instant case, it was not in dispute that since 2002, multiple FIRs across four States namely, Gujarat, Maharashtra, New Delhi and West Bengal were filed against petitioner and other accused persons containing broad and common allegations pertaining to act done in collusion by accused persons to defraud the complainants and misappropriate the money raised thereby while dealing/trading in government securities in the name of accused company M/s Home Trade Limited.

The State in its counter affidavit stated that during investigation, the accused Company was found not to be eligible to deal in transactions relating to government securities, whereas, petitioner and other accused persons namely Sanjay Hariram Agarwal were acting as Directors and authorized signatories of the accused Company. From a bare perusal of the facts and FIRs, it was seen that there was commonality of facts in each FIR and that most of the transactions were taken place in Mumbai. Further, the FIRs mainly had petitioner and Sanjay Hariram Agarwal as common accused persons.

Thus, considering the common nature of allegations and pendency of proceedings, the Court opined that to meet the ends of justice and fair trial, the transfer petitions deserved to be allowed.

Read Order: VIJAY BHUSHAN GUPTA v. UNION OF INDIA

Mansimran Kaur

New Delhi, September 7, 2022: Involvement of identically placed persons and judgment not being restricted to operate in personam by the Court, are the prerequisite conditions for the conferment of benefits of a judgment to non-parties, the Delhi High Court has reiterated.

The Division Bench of Justice Satish Chandra Sharma and Justice Subramonium Prasad disposed of the instant petition by observing that if the petitioner met the criteria for such regularization, then merely because he could not approach the Tribunal for seeking a direction to the department, cannot be a reason for the department to not have considered his representation.

The petitioner in this case had put forth a case that he had been superseded by three of his juniors who were promoted to the rank of Senior Investigator out of turn, owing to the relaxation of certain rules by the department, first on ad-hoc basis and then on regular posts. Consequently, the petitioner was also promoted. However, the respective dates of regularization of the petitioner and the three juniors had a gap of 4 years and aggrieved therewith, the petitioner called upon the Court to regularize his services from a prior date.

Factual matrix of the case was such that on June 5, 1979 , five Jr. Investigators, including the three colleagues in question, were promoted as Sr. Investigators on an ad-hoc basis w.e.f. June 1, 1979.

The petitioner gave representation to the department for consideration of his name as well for promotion. The department refused to accede to the representation. Thereafter, on January 31, 1981 the petitioner was appointed as Sr. Investigator on an ad-hoc basis.

After almost 8 years, in 1989, the three juniors of the petitioner approached the Tribunal, through O.A. 1631/1989 for regularization of their promotions from the date of their ad-hoc appointments. Thereafter, the petitioner also approached the Tribunal being aggrieved against the refusal of the department to entertain his representation for grant of promotion along with the three juniors in the same year i.e. 1979.

The Tribunal passed a common order on November 22, 1993 observing that there was no right to seek regularization from the date of ad-hoc appointment, and refused to entertain the cases on merits. However, noting that the vacancies in senior grade had arisen in 1986, it directed the department to conduct a review of DPC and consider the case of the applicants in light of the aforesaid vacancies.

In 1996, the three juniors of the petitioner preferred another application before the Tribunal seeking regularization w.e.f. the date of their ad-hoc appointment in the senior grade i.e. from 1979. The Tribunal identified that some regular vacancies existed from 1964 onwards, and the case of the applicants must be reviewed accordingly. Consequently, the department reconsidered the case of Sh. Suresh Kumar, Sh. R.S. Attri and Sh. K.L. Goyal, and regularized their appointment as Sr. Investigators w.e.f. June 14, 1979, September 16, 1979 and January 13, 1981 respectively.

The petitioner gave certain representations to the respondent for seeking the benefit of the Tribunals order the application, however, the same was denied.

The Tribunal dismissed the application holding that no discrimination has been meted out to the petitioner vis-à-vis the three juniors as they were promoted upon the completion of four years by offering a one-time relaxation as a class.

This petition emerged from the above order passed by the Central Administrative Tribunal. The principal argument addressed by the petitioner was that the three juniors of the petitioner were granted undue relaxation for promotion as they had merely completed 2.5 years of regular service (and not 4 years) when they were promoted in 1979. It was urged that the petitioner stood on the same footing with the three juniors at that point of time, and thus, discrimination was meted out to him by not granting the same relaxation.

After considering the submissions of the parties at length, the Court noted that the law regarding whether or not the benefit of a judgment could be extended to those who are not parties to the same is no more res integra.At this stage reliance was placed on the case of State of U.P. V. Arvind Kumar Srivastava.

In furtherance of the same, the Court noted that there was nothing on record which made the the case of the petitioner different in a manner that his request for regularization from the date of ad-hoc appointment cannot even be considered by the department, in accordance with the rules and as per the availability of vacancies.

If the petitioner met the criteria for such regularization, then merely because he could not approach the Tribunal for seeking a direction to the department, cannot be a reason for the department to not have considered his representation, the Court noted.

Particularly, keeping in view that the petitioner was an applicant in previous application relating to this subject matter, his case also warranted indulgence by the department, at least for the purpose of consideration when the cases of other identically placed employees were being considered. Therefore, for the purpose of consideration of regularization from the date of ad-hoc appointment, the petitioner was identically placed with the applicants.

Thus, the Court noted that there was no question for retrospective consideration of regularization of promotion in senior grade at a time when the employee was not even eligible for promotion.

“As the settled law states, the eligibility for promotion and existence of vacancy at the relevant point of time are two prerequisites for regularization of appointment from a prior date (wherever rules so permit)”, the Bench said. Thus, to maintain parity with the three juniors, whose services got regularized from the date of their ad-hoc appointment, the Court was inclined to give the petitioner a chance to get his case considered for similar regularization from the date of his ad-hoc appointment i.e. January 28, 1981, the Court observed.

Hence, it was noted that if the respondent department finds that the case of the petitioner meets the criteria for such regularization; all consequential benefits shall accordingly follow from the date of such regularization.

Thus, the petition was disposed of.

Read Order: Jangir Singh @ Jagir Singh v. State of Punjab

Monika Rahar

Chandigarh, September 3, 2022: After considering one-year-long incarceration of the petitioner in an NDPS Act matter involving commercial quantity and the stagnancy in the Trial, the Punjab and Haryana High Court has granted bail to the accused who was apprehended with his co-accused on a bike, carrying a polythene bag containing contraband.

The Bench of Justice Manoj Bajaj held, "Apart from it, the material witnesses are police officials and at present there does not seem to be any possibility of their being won over."

The petitioner in this case filed this petition under Section 439 Cr.P.C. for the grant of regular bail pending trial in an FIR registered under Section 22 Narcotic Drugs and Psychotropic Substances Act, 1985. The petitioner was in custody since his arrest on October 26, 2019.

The brief facts leading to this FIR are that the Police party, while being on patrolling duty apprehended the petitioner (pillion rider) and his co-accused (bike rider) for carrying a polythene bag in between them containing 100 strips of Tridol 50V.No.C11537 total 1000 capsules and intoxicant tablets Clovidol 100 SR B. NO.TVD 19294 i.e. 21 strips total

210 tablets.

It was the case of the Counsel for the petitioner that the petitioner was in custody for a long period and was not involved in any other case. The counsel submitted that the co-accused of the petitioner who was driving the motorcycle, was already granted the concession of regular bail by this Court.

According to him, the investigation of the case was complete and charges were framed, but no prosecution witness was examined so far, thus he prayed for bail.

On the contrary, the State counsel opposed the prayer on the ground that the alleged contraband recovered from the petitioner fell within the ambit of commercial quantity.

After hearing the parties and considering the above background, particularly the custodial period of the petitioner, the Court opined that his (petitioner's) further detention behind the bars was not necessary for any useful purpose, as the trial was not making any progress and its conclusion would consume considerable time.

"Apart from it, the material witnesses are police officials and at present there does not seem to be any possibility of their being won over", added the Bench.

Accordingly, the present petition was allowed.

1. Rajan Singh v. Roshan1

(High Court Of Delhi) | 12-02-2020

This court by citing the precedent held that no rights in immovable property are created, even on passing of decree for specific performance and till in execution thereof a Sale Deed is executed.

Relevant para is as follows:-

“16. Agreement purchasers do not have any right in the property/land agreed to be purchased. The Court, as far back as in Jiwan Das Vs. Narain Das, (1981) AIR Delhi 291 held that an Agreement to Sell does not create any right in the property to which it pertains and merely gives a right to the agreement purchaser to seek specific performance thereof. It was further held that no rights in immovable property are created, even on passing of decree for specific performance and till in execution thereof a Sale Deed is executed.”

1 https://www.legitquest.com/case/rajan-singh-v-roshan/1AD5A9

2. M.a. Keerthi Prasad And Others v. Bharuka Power Corporation Ltd. And Others2

(High Court Of Karnataka) | 22-07-2015

In this case court observed that though appellant got a decree for specific performance but he should have executed the decree for specific performance on or before 23.01.1986. He did not initiate any execution proceedings at all. Therefore whatever right was accrued to him in the decree for specific performance was lost.

Relevant Para is as follows:-

17. The understanding of the plaintiff that once a Civil Court declares the sale deed as void, the fifth defendant who lost the property under the sale deed the title reverted back to Smt. Rukminiyamma is erroneous. Fifth defendant was made a party to the suit for specific performance because, on the day the suit was filed, Smt. Rukminiyamma had no right or title vest with the fifth defendant. In pursuance of the decree for specific performance only the fifth defendant along with Smt. Rukminiyamma should have executed the sale deed. Fifth defendant would have lost the right if the sale deed had been executed. No such sale deed is executed, time prescribed in law for enforcement of decree for specific performance has lapsed. Notwithstanding the fact that sale deed in favour of the 5th defendant was declared to be void, fifth defendant continued to be the owner of the suit property. Therefore he has every right to make a gift and he has executed the sale deed in favour of the 3rd defendant. All these alienations are valid. The plaintiffs have no right or interest over the property. Therefore, we do not see any merit in this appeal. Accordingly, the appeal stands dismissed.”

2https://www.legitquest.com/case/ma-keerthi-prasad-and-others-v-bharuka-power-corporation-ltd-and- others/189DC2

3. Amol & Others v. Deorao & Others3

(In The High Court of Bombay at Nagpur) | 06-01-2011

In this High court of Bombay stated that a decree for specific performance passed on the basis of an agreement to sale or a contract for sale, merely recognizes a claim for specific performance of contract, which is capable of being specifically enforced at the instance of a decree-holder. It does not elevate the status of a decree-holder, subsisting prior to passing of such a decree, to that of the owner of the property in question. It does not create any right, title, interest in or charge on the immovable property in favour of a decree-holder. Even in respect of such a decree, the sale would be complete only upon the execution of the sale-deed in favour of the decree-holder either by the vendor/judgment-debtor or through the process of the Court. It is only upon the registration of such sale-deed upon payment of stamp duty under Item 20 of Schedule I of the Stamp Act, that any right, title and interest in such property shall validly pass on to the decree-holder, who is the purchaser of the suit property. Hence, mere passing a decree for specific performance of contract does not result in the transfer of property.

Another relevant para is as follows:-

“The decision is on clause (vi) of Section 17(2) of the Registration Act, which deals with any decree or order of a Court, which is exempted from registration under clauses (b) and (c) of Section 17(1) of the said Act. It has been held that the exception engrafted therein is meant to cover that decree or order expressed to be made on compromise, which declares the pre- existing right and does not by itself create new right, title or interest in praesenti in immovable property of the value exceeding one hundred rupees. The Executing Court has recorded the finding that Hifzul Kabir was one of the plaintiffs and was having preexisting right in the decree. Assuming this finding to be correct, the exemption under clause (vi) of Section 17(2) of the said Act would apply. Be that as it may, a decree for specific performance of contract, as has already been held, neither extinguishes right, title or interest in the immovable property, nor creates right, title or interest in immovable property and hence it is not compulsorily registrable under clauses (b) and (c) of Section 17(1) of the said Act.”

3 https://www.legitquest.com/case/amol–others-v-deorao–others/D51DA

4. Kumaran v. Kumaran & Another4

(High Court of Kerala) | 30-11-2010

In this case, High court of Kerala by citing the precedents stated that the law, with no doubt, is that a decree for specific performance of an agreement for sale would not, by itself, be effective as a transfer of title and so long as the sale deed is not executed in favour of the successful vendee, either by the vendor himself or by the court, the title continues where it was before the passing of the decree. To the same effect is the decision of the Division Bench of this Court in Chrisentia Chacko v. Choyikutty [1987(1) KLT 60 Case No.83]. A Full Bench of the Allahabad High Court in Mahendra Nath and another v. Smt.Baikunthi Devi and Others [AIR 1976 All. 150] stated that a person who has got only a contract for sale or has got a decree for the specific performance of the contract, has got no interest in the land. He can only enforce the contract compelling the other side to execute the sale deed failing which the Court might execute a sale deed for the defendant, but the rights and liabilities under the contract do not attach to the land. In Hiralal Agarwala v. Bhagirathi Gore and others [1975 Cal.445], it was stated that a decree for specific performance passed on the basis of a contract for sale of immovable property does not create any interest in the property in favour of the decree holder. It only super-adds the sanction of the court to enforce it through the medium of court.

Another Relevant Para is as follows:-

7. Even if the appellants version that he was put in possession by the vendor (the judgment debtor herein) in part performance of that contract for sale, the claim that the appellant may have could be only under S.53A of the Transfer of Property Act as against his vendor. That claim does not contain or recognise any element of title in the vendee, the appellant, who is merely a promisee qua the vendor. Title to that immovable property does not pass even by a direction that is issued by a court in a suit for specific performance requiring a vendor to perform the contract, as already noted. Such a direction, as is contained in Exts.A1 and A2, the judgment and decree, has necessarily to be followed by the transfer of property by a document either on the defendant voluntarily executing it following the direction of the court or by such a document being executed with the intervention of court on the failure of the defendant to abide by the direction of court. The transfer of title occurs only with the execution and registration of the document of transfer of title, wherever registration is required. This is the law.”

4 https://www.legitquest.com/case/kumaran-v-kumaran–another/D2023

1. M/s Rashmi Hospitality Services Private Limited (GST AAR Karnataka)

20-09-2019

In this case the issue involved was whether the subsidy received from the state government would form part of consideration under section 2(31) of the CGST Act.

Herein, the applicant had entered into agreements with Deputy Commissioners of the districts to provide hotel/ restaurant services for the Indira Canteen through tender. He had been providing the restaurant services by serving the food to beneficiaries and collecting a specified amount from beneficiaries,which was notified.At the end of the month, the applicant was submitting a consolidated bill by showing the amount collected from beneficiaries and subsidy available from the Government.

While referring to clause (31) of section 2 of the Central Goods and Services Tax Act, the Authority of Advance Ruling, Karnataka, observed that the amount of subsidy given by the Central Government or a State Government is not a part of the consideration as per the section 2(31) of the CGST Act.

It was also observed that as per provisions of the 2(31) of SGST/CGST consideration received in the form of subsidy given by the State Government or Central Government for the supply of service of food and drinks to the end-user is excluded from the definition of consideration and hence would not form the part of the consideration and in consequence does not form the part of the turnover.

But the amount collected for the supply from the beneficiaries, which is inclusive of tax, would form the consideration on which the turnover is to be calculated after deducting the proportionate tax as the collected consideration is inclusive of tax.

Hence,it was held that the subsidy amount received from the Government of Karnataka for the supply of service of food to the ultimate beneficiaries (consumers) in Indira Canteens by the applicant is excluded from the definition of consideration and would not form the part of the turnover on which tax is liable. The consideration collected from the beneficiaries is liable to tax after deducting the tax fraction as the price collected is inclusive of tax.

https://gst.kar.nic.in/Documents/General/AAR61RashmiHospitality.pdf

2. M/s Megha Agrotech Private Limited (GST AAR Karnataka)

23-03-2020

Two main issues involved in this case were–

1. Whether under section 15(2)(e) of CGST Act, for calculating “value if taxable supply”, the subsidy amount granted to the farmer by Horticulture / Agriculture / Sericulture Department of Government of Karnataka under PMKSY scheme or any other Central / State Government approved schemes but disbursed to the supplier to be treated as “subsidy” in the hands of the supplier and to be excluded while ascertaining the “transaction value”?

2. Whether the question of inclusion or exclusion of subsidy amount in the value of taxable supply would arise under Section 15(2) of the CGST Act, when such subsidy is not impacting the transaction value, which is price actually paid or payable for the supply of goods by the customer i.e., farmers and when the subsidy is disbursed by Horticulture / Agriculture / Sericulture Department to the supplier on behalf of recipient of the supply (farmers)?

The Authority of Advance Ruling, Karnataka, observed herein that –

Coming to the issue of subsidy, it is very clear that the value of supply shall include the subsidies directly linked to the price, excluding subsidies provided by the Government. The financial assistance provided by the Government is–to–the farmer to enable him to afford the facility and Government is not making payment to, the applicant vendor nor the amount receivable by the farmer has any bearing on the price of the supply.

If the subsidies provided by the Government is directly linked to the price, then the same would be excluded from the value of taxable supply.

In the instant case, the amount receivable or received from the Government is received by the farmer and this amount may be received by him directly in option 1 or by the Bank in case of option 2 or by the applicant in option 3. The farmer has a choice of either opting option 1 or option 2 or option 3 and choice of any one of the option has no impact on the price of the supply of goods and /or services.

Further, the liability of the farmer with the applicant for the supply received by him will get extinguished only when the applicant receives the consideration and it is immaterial from whom he actually receives the amount and the amount received in only credited against the liability of the farmer with him.

Hence the method of receipt of payment has no bearing on the price of the supply and also the receipt of payment by the applicant from the Bank or the Government Department (on the authorization of the farmer concerned) is on the account of the farmer only. Hence the price is independent of the assistance amount and hence would not be covered under clause (e) of sub-section (2) of section 15 of the CGST Act.

The Authority held that the amount of assistance received by the farmer or on account of the farmer from the Government Department has no bearing on the price and hence on the value of supply made by the applicant to the farmer and is not covered under section 15(2)(e) of the CGST Act, 2017.There is no question of excluding the amount of assistance or subsidy received from the transaction value or value of taxable supply.

3. Commissioner of Income-Tax, West Bengal-II, Kolkata v. Rasoi Limited

High Court Of Judicature At Calcutta | 19-05-2011

One of the questions involved in this case was whether the Income Tax Appellate Tribunal was justified in law in allowing the Appeal of the assessee by holding that the assistance received by the assessee from the Government of West Bengal amounting to Rs.5,34,18,887/- is of the nature of capital receipt and hence non-taxable.

The Court while referring to various judgments like Saheney Steel and Press Works Ltd and CIT Vs. Ponni Sugars and Chemicals Ltd., reported in (2008) 306 ITR 392 (SC), opined that it is the object for which the subsidy/assistance is given which determines the nature of the incentive subsidy. The form of the mechanism through which the subsidy is given is irrelevant.

In this case, the object of the subsidy is for expansion of their capacities, modernization, and improving their marketing capabilities and thus, those are for the assistance on capital account. Similarly, merely because the amount of subsidy was equivalent to 90% of the sales tax paid by the beneficiary does not imply that the same was in the form of refund of sale tax paid.

As pointed out by the Supreme Court in the case of Senairam Doongarmall Vs. Commissioner of Income-tax, Assam, reported in AIR 1961 SC 1579, it is the quality of the payment that is decisive of the character of the payment and not the method of the payment or its measure, and makes it fall within capital or revenue.

Thus, in this case,the amount paid as subsidy was really capital in nature.

While answering the question in the affirmative and against the Revenue, the Court observed that in the case of CIT-1, Ludhiana Vs. Adarsh Kumar Goel, reported in (2006) 156 Taxman 257 (Punjab), a Division Bench of the Punjab and Haryana High Court was dealing with a case of subsidy granted in the form of sale tax exemption and thus, the Division Bench held that in the absence of any document or policy of the State Government to show the kind of subsidy it had granted it should be treated as a revenue receipt. In this case, having regard to the objects and reasons behind the grant of the subsidy the Court found that it is a case of capital receipt and thus, the said decision does not help the Revenue in any way.

1. Sudhakar Dinkar Malekar v. Hemu Prabhudas Thakur1

(High Court Of Judicature At Bombay) | 24-07-1981

In this case, question before the court was whether noncompliance with the provisions of Section 173(5)(a) and (b) and Section 207 of the Criminal Procedure Code affects the legality of the proceedings. By denying the application of the applicant, Court made the following observation:

“In the present case therefore, the mere fact that copies of the statements were not supplied to the accused persons before the case was committed to Sessions by the learned Magistrate as required by Section 207 of the Criminal Procedure Code, would not by itself, be sufficient to quash the proceedings. It is after all a question of prejudice and in the present case it is an admitted fact that the copies of the statements have been furnished to the accused. This case stands on the same footing as Narayan Raos case (supra) where the notes were destroyed by the police. After all the statements of witnesses under Section 161 of the Criminal Procedure Code are required to be recorded by the police, and the signature of such witnessses are not obtained on those: statements. They stand on the same, footing as the notes recorded by the police officers in Narayan Raos case (supra). Therefore, it is difficult for me to hold that merely because the original statements are to-day, not available, that prejudice has been caused to the accused.

16. In regard to the F.I.R. recorded under Section 154 of the Code, it is no doubt true that the original F.I.R. is not available, but its copy is available and it is furnished to the accused. It will be for the trial court to decide as to what would be the consequence of the original F.I.R. not being available, and whether secondary evidence could be led on that score, but the fact that the original F.I.R. is not available is not sufficient to quash the proceedings.”

1 https://www.legitquest.com/case/sudhakar-dinkar-malekar-v-hemu-prabhudas-thakur/17A3F6

2. Suresh Kumr Pathrella v. State through CBI2

(High Court of Delhi) | 13-09-2010

2 https://www.legitquest.com/case/suresh-kumr-pathrella-v-state-through-cbi/145DDA

In this case, petitioner contended that the prosecution-CBI has not filed original documents and therefore cognizance should not have been taken is also without merit and cannot be accepted. The High court of Delhi, on dismissing the petition observed as follows:-

“The court had taken cognizance and issued summons after filing of statements of witnesses and perusing the said statements. Photocopy of the documents were filed. It is not alleged that the charge sheet did not comply with Section 173(2) of the Code. Cognizance is taken on the basis of the police report and material submitted therewith. Section 190(1)(b) of the Code provides that the magistrate has power to take cognizance upon a police report of such facts as provided therein on being satisfied that it is a fit case for taking cognizance of the offence.”

3. SHIVHARI LOKHANDE v. PRABHA SINGH3

(High Court Of Madhya Pradesh) | 05-10-2016

In this case, it was vehemently argued by the petitioner that photocopies cannot be admitted as secondary evidence and there were manipulation in the cheque. To this, High court of Madhya Pradesh held as follows:-

“10. In the case of Aher Rama Gova v. State of Gujarat reported as AIR 1979 SC 1567, the Apex Court has held that “in a criminal proceeding, on proof of loss of original dying declaration, secondary evidence can be given by the prosecution”. This indicates that in criminal trial, when the original papers and the documents were missing, it was not a ground to quash the proceedings and the question whether the secondary evidence could be admitted was for the trial Court to decide with reference to the documents.

11. In case of State of Kerala v. Raju 1982 Cri.L.J. 304 (Kerala), it is held that even if the originals have not been produced as provided by Section 173(5) (b) of the Criminal Procedure Code, 1973 Section 65 of the Evidence Act is wide enough to enable the accused to use the copy delivered to him as secondary evidence for the purpose of contradicting the witnesses. It would be appropriate to clear it that under Section 65 of the Evidence Act, secondary evidence is admissible only of the existence of the contents of documents which is lost but the execution of the document must be proved by primary evidence as required by Section 67 read with Section 47 of the Evidence Act.

12. It is established that the original document was lost or that the party is not in a position to produce and it has been satisfactorily proved by the complainant/respondent, therefore, the provision of Section 65 (C) of the Evidence Act can be invoked. Hence, the order dated 09/09/2014 passed by the learned Fourth ASJ, Jabalpur calls for no interference.”

3 https://www.legitquest.com/case/shivhari-lokhande-v-prabha-singh/18F9A0

(In The High Court of Bombay At Nagpur) | 02-02-2018

In this case, Bombay High court stated that the power to grant maintenance under Section 20(1)(d) of the D.V. Act conferred upon the Magistrate is in the nature of monetary relief and is directly related to suffering of the losses by the aggrieved person and any child of the aggrieved person as a result of domestic violence. Therefore, unless it is shown that the aggrieved person and/or her child has suffered such a loss, no order of maintenance can be passed under Section 20(1)(d) of the D.V. Act. In a given case, the aggrieved person has in her hand an order of maintenance granted in her favour under Section 125 of Cr.P.C. or any other law for the time being in force, still, maintenance can be granted to the aggrieved person or a child or both by invoking power under Section 20(1)(d) of the D.V. Act. But, in such a case, the order of maintenance to be granted would be in addition to the maintenance already granted to the aggrieved person or a child under the other law and that in order to be entitled to receive such additional maintenance, the aggrieved person or a child would have to establish that subsequent to the order of maintenance passed under the other law, there were fresh circumstances amounting to domestic violence leading to suffering of loss by her or her child. If no such circumstances are pleaded and proved, the power of granting maintenance under Section 20(1)(d) of the D.V. Act cannot be exercised by the Magistrate in such a case.

This court referred the case of B. Prakash vs. Deepa & Anr., reported in 2016 ALLMR (CRI)168, in which learned Single Judge of Madras High Court taking the same view, has held that the maintenance which could be granted under Section 20(1)(d) of the D.V. Act is in the nature of mandatory relief and such mandatory relief cannot be granted unless two conditions are fulfilled i.e. sufferance of domestic violence by the aggrieved person at the hands of her husband as contemplated under Section 3 of the D.V. Act and incurring of expenses and/or suffering of losses by the aggrieved person or her child as a result of such domestic violence.

1 https://www.legitquest.com/case/mamta-gautam-wankhede-v-gautam-sukhdev-wankhede/FD9B4

The court further observed as follows:-

“8. The learned Magistrate has gone on record saying that filing of divorce petition by the respondent against the petitioner after 23 years of marriage itself amounted to domestic violence. The remark is outlandish and, if I may say so, is alien to the known jurisprudential concepts. If this is the way how the applications filed under Section 12 of the D.V. Act are decided, as has been done in the present case by the learned Magistrate, as rightly submitted by the learned Counsel for the respondents, all the provisions of law, be they be from Hindu Code Bill or Family Courts Act or D.V. Act, creating rights and obligations of parties while maintaining a fine balance between the competing interests of both sides, would be rendered nugatory and a party would dither to initiate a proceeding for assertion of his right, for the fear of being labelled as merchant of domestic violence. The learned Magistrate shall do well to avoid making such remarks without giving any thought to rights and obligations of parties under the law.”

(High Court Of Gujarat At Ahmedabad) | 09-01-2018

In this case grievance of the applicant was that both the courts below have failed to consider that there was mental cruelty against him by his wife and that there was no proof regarding Domestic Violence Act, and that wife has not prayed protection against domestic violence, so there cannot be a straitjacket order of maintenance in absence of domestic violence.

The High Court of Gujarat remanded the matter to the trial court to decide the matter afresh by observing as follows:

“It is quite clear and obvious that though trial Court is empowered to award maintenance for the aggrieved person as well as the children, if any, including an order under or in addition to an order of maintenance u/s.125 of the Code of Criminal Procedure, 1973 or any other law for time being in force, while disposing an application u/s.12(1) of the Domestic Violence Act, such reliefs is to be granted to meet with the expenses incurred and losses suffered by the aggrieved person as a result of domestic violence and not otherwise. Therefore, there is material difference so far as right to claim maintenance is concerned in all different provisions viz. u/s.125 of the Cr.P.C. – wherein maintenance is payable when husband neglects to maintain the wife and minor child, who are unable to maintain themselves; u/s.24

2 https://www.legitquest.com/case/amardip-jagdip-raval-v-state-of-gujarat–others/10069E

of the Hindu Marriage Act – maintenance during pendency of litigation; u/s.26 of the Hindu Marriage Act – maintenance is granted in case of divorce between the parties; and Section 18 of the Hindu Adoption and Maintenance Act – wherein maintenance is payable when wife has been deserted and when husband is having sufficient properties. Thereby, it is a maintenance based upon the civil dispute between the parties; whereas, under the Domestic Violence Act, Section 20 makes it clear that monetary relief to meet the expenses incurred and losses suffered, may be directed to be paid when aggrieved person suffers such loss as a result of domestic violence. Therefore, if there is no need of protection against domestic violence because the parties are residing separately and thereby, when there is no proper proof of domestic violence at the time of filing such application, which seems to be filed at a belated stage i.e. after 18 years of marriage, it would be appropriate for the trial Court to re- examine the evidence and to decide the matter afresh so as to avoid any injustice to either side.”

(High Court of Judicature at Bombay) | 04-05-2018

In this case Bombay High court stated that though the Act of Domestic Violence would be established after rendering evidence before the Court, at least the Court prima facie must be satisfied that the person approaching is as an “aggrieved person”. It is not every person who can invoke the jurisdiction of the Court under the 2005 Act, simply for claiming maintenance, as the purpose of the enactment is to protect rights of women who are victims of violence of any kind occurring within the family.

The Matter was remanded to Family Court to decide the entitlement of maintenance of the wife under Section 20 of the D.V. Act and following observation was made by the court:-

“However, at the same time it is to be noted that the reliefs mentioned under Section 12 are available to “Aggrieved person” and the reliefs which may be availed by invoking Section 17, 18, 19, 20, 21 and 22 are dependent on one important aspect namely the said relief is available to an “aggrieved person” who alleges to have been subjected to any act of domestic violence by the respondent. The object of D.V. Act 2005, being to protect the rights of women who are offended by the act of domestic violence committed by the respondent which

3 https://www.legitquest.com/case/prakash-kumar-singhee–another-v-amrapali-singhee–another/101B10

may include any adult male person or with whom the aggrieved person is in domestic relationship. The term Domestic Violence has been given a specific connotation under Section 3 of the Act and any act, omission and commission or conduct of the respondent shall constitute domestic violence in case it :

(a) harms or injuries or endangers the health, safety, life, limp or wellbeing, whether mental or physical, of the aggrieved person or tends to do so and includes causing physical abuse, sexual abuse, verbal and emotional abuse and economic abuse; or

(b) harasses, harms, injures or endangers the aggrieved person with a view to coerce her or any other person related to her to meet any lawful demand for any dowry or other property or valuable security; or

(c) has the effect of threatening the aggrieved person or any person related to her by any conduct mentioned in clause (a) or clause (b); or

(d) otherwise injuries or causes harm, whether physical or mental, to the aggrieved person.

12. Thus, in order to claim relief under Section-12 of the Act which permits an “aggrieved person” to present an application to the magistrate seeking one or more reliefs under the Act, levelling the allegations of Domestic Violence. Thus, the reliefs contemplated under the Act are thus available to an aggrieved person who alleges that she is or has been in domestic relationship with the respondent and was subjected to any Act of Domestic Violence by the respondent. Allegation about the commission of a Domestic Violence Act is prerequisite for the magistrate or Court of competent jurisdiction to exercise the powers under the Protection from Women from Domestic Violence Act, 2005, and grant of any reliefs contemplated under the Act.

13. Perusal of the application filed by the wife claiming maintenance would reveal that apart from making the allegations that the husband is well off and earning a huge amount and the wife is left with no source of livelihood, not a single averment has been made as to any act of domestic violence which would have brought the applicant wife under the category of “aggrieved person” who would have been entitled for the benefits flowing under Section-12 including to the benefits under Section-20 of the D.V. Act 2005. The applicant in the

application preferred on 16th February 2013 do not give a single instance of domestic violence and the application has been simply preferred under the caption as an application under Section20 of the D.V. Act 2005 praying for following reliefs.”

(Before The Madurai Bench of Madras High Court) | 15-10-2015

In this case Madras High court upheld the decision of the lower court of denial of Maintenance as allegation of domestic violence was not proved and highlighted that mere registration of a complaint will not amount to proof of cruelty, as registration of the First Information Report is towards the first step to investigate and to find out whether the allegation stated in the complaint is true or not. Further court held as follows:

“35. From the provisions of Section 20(1)(d) of the P.W.D.V. Act, it is clear that the grant of maintenance under this Act is in addition to the amount awarded under any other enactment providing for maintenance. Therefore, even though the revision petitioners is not granted any maintenance, it is open to her to work out her remedy before any other law if found eligible.”

The following are the case laws on this query:

1.SHRI C.K. BALJEE v. STATE OF RAJASTHAN THROUGH P.P.1

(High Court Of Rajasthan, Jaipur Bench) | 09-02-2017

In this case, Petitioner filed this petition under Section 482 Code of Criminal Procedure, 1973 challenging the order dated 15.03.2016 whereby the complaint filed by respondent No. 2 under Section 138 of the Negotiable Instruments Act, 1881 was ordered to be restored.

Learned counsel for petitioner opposed the lower court decision by citing two case laws as follows:-

“3. Learned counsel has placed reliance on the decision of Honble Supreme Court in Maj. Genl. A.S. Gauraya and another v. S.N. Thakur and another, wherein it was held as under:-

“We would like to point out that this approach is wrong. What the Court has to see is not whether the Code of Criminal procedure contains any provision prohibiting a Magistrate from entertaining an application to restore a dismissed complaint, but the task should be to find out whether the said Code contains any provision enabling a Magistrate to exercise an inherent jurisdiction which he otherwise does not have. It was relying upon this decision that the Delhi High Court in this case directed the Magistrate to re-call the order of dismissal of the complaint. The Delhi High Court referred to various decisions dealing with section 367 (old code) of the Criminal Procedure Code as to what should be the contents of a Judgment. In our view, the entire discussion is misplaced. So far as the accused is concerned, dismissal of a complaint for non-appearance of the complainant or his discharge or acquittal on the same ground is a final order and in the absence of any specific provision in the Code, a Magistrate cannot exercise any inherent jurisdiction.”

4. Learned counsel has next placed reliance 2009 SCC Online P & H 4894, Krishan Lal v. Sangeeta Aggarwal, wherein it was held as under.

1 https://www.legitquest.com/case/shri-ck-baljee-v-state-of-rajasthan-through-pp/19E50F

“I have heard learned counsel for the parties and perused the order dated 23.10.2006, whereby the Chief Judicial Magistrate recalled his order dated 16.12.2005 and restored the complaint to its original stage. The Code of Criminal Procedure does not confer any power to review/recall an order. The only situation, in which a court may legitimately alter its order is, where it proposes to correct clerical and/or arithmetical errors. A complaint, once dismissed for failure of the complainant to put in appearance, therefore, cannot be restored. The question, whether the Magistrate was empowered to dismiss the complaint in default for non- appearance, is a matter apart and can be legitimately agitated in appropriate proceedings. It is, therefore, apparent that the learned Chief Judicial Magistrate had no jurisdiction to pass the order dated 23.10.2006.”

Court made the following observations:-

“8. In the present case, complaint was filed by respondent No. 2 against the petitioner and others under Section 138 of the Act. On 04.03.2015 the complaint filed by the petitioner was dismissed for want of prosecution. A perusal of the order reveals that for the last three dates complainant had not been appearing, nor the counsel for the complainant had appeared. Necessary fee for summoning the respondent had also not been deposited. In these circumstances, left with no option learned trial Court dismissed the complaint for want of prosecution. It is settled law that the Magistrate has no power to restore the complaint. In the absence of any specific provision in the code, a Magistrate can not exercise any inherent jurisdiction. The judgments relied upon by the learned counsel for the respondent No. 2 fail to advance the case of the complainant as they were based on their own facts. In the decision given by the Honble Apex Court in Mohd. Azeem case supra, Honble Apex Court was dealing with an order passed by the High Court in an appeal.”

2. Martin v. Khileshwar Prasad2

(High Court Of Chhattisgarh)| 06-12-2013

In this case, learned counsel for the applicant submitted that the Court below ought not to have dismissed the complaint in absence of the complainant and by dismissing the complaint

2 https://www.legitquest.com/case/martin-v-khileshwar-prasad/F5860

instead of adjourning the same, the trial Court has committed illegality. Reliance was placed on the matter of Smt. R. Rajeshwari v. H.N. Jagdish II (2002) BC 89 in which the High Court of Karnataka has held that complaint dismissed for want of prosecution may be restored in exercise of inherent jurisdiction under Section 482 of Cr.P.C.

To which High court of Chhattisgarh observed as follows:- “5. Section 256 of Cr.P.C. reads thus;- —

“256. Non-appearance or death of complainant. –

(1) If the summons has been issued on complaint, and on the day appointed for the appearance of the accused, or any day subsequent thereto to which the hearing may be adjourned, the complainant does not appear, the Magistrate shall, notwithstanding anything hereinbefore contained, acquit the accused, unless for some reason he thinks it proper to adjourn the hearing of the case to some other day:

Provided that where the complainant is represented by a pleader or by the officer conducting the prosecution or where the Magistrate is of opinion that the personal attendance of the complainant is not necessary, the Magistrate may dispense with his attendance and proceed with the case.

(2) The provisions of sub-section (1) shall, so far as may be, apply also to cases where the non-appearance of the complainant is due to his death.”

6. Effect of dismissal of any summon trial in terms of Section 256 of Cr.P.C. would be of acquittal. In the matter of Maj. Genl. A.S. Gauraya & another v. S.N. Thakur & another the Supreme Court while dealing with the question of restoration of dismissed complaint and acquittal of the accused on the ground of non-appearance of the complainant has held that” the Magistrate has no jurisdiction to restore or revive the dismissed complaint on a subsequent application of the complainant. The Code does not permit a Magistrate to exercise an inherent jurisdiction which he otherwise does not have

7. In the light of effect of dismissal of complaint in summon trial cases the remedy to file leave to appeal and appeal under Section 378 (4) of Cr.P.C. is available to the complainant. This is not the case where the applicant is remediless.

8. In these circumstances, in the light of dictum of the Supreme Court in Maj. Gen I. A.S. Gauraya (1986) 2 SCC 709 and availability of remedy under the law, I am unable to accept the view taken by the High Court of Karnataka in Smt. R. Rajeshwari1.”

3. SANTOSH KUMAR KEYAL v. DURGA DUTTA BISWANATH (M/S.) AND OTHERS3

(High Court Of Gauhati) | 20-07-2013

In this case, Mr. P.K. Sharma, learned Counsel, appearing for the respondents, referring to the decision, held in the case of Mohd. Azeem (supra), submitted that in view of the judgment and order, passed by the Supreme Court, in the said case, the learned SDJM committed no error by setting aside the order of dismissal of the complaint and restoring the same to file. It is also submitted that, as there is no provision of filing of second complaint, the respondent i.e. the complainant, had no other alternative but to approach the trial Court for restoration of the complaint to file and as such, the learned SDJM rightly restored the complaint to file.

However court refuted the same by stating that Supreme Court, while observing that the learned Magistrate committed error in acquitting the accused for absence of the complainant only on one day, indicated that the learned Magistrate committed error by dismissing the complaint for absence of the complainant on one day only and that High Court committed error by refusing to restore the complaint. As revealed from the facts, indicated in the said case, no petition for restoration of the complaint was preferred before the learned Magistrate. The complainant, against the order of dismissal of the complaint and the acquittal of the accused, preferred an appeal before the High Court. As no application for restoration was filed before the Magistrate, there was no question of restoration of the complaint by the learned Magistrate.

Further observations of the court are as follows:-

3 https://www.legitquest.com/case/santosh-kumar-keyal-v-durga-dutta-biswanath-ms-and-others/1B6FFC

“5. Law is well settled that a Judicial Magistrate, who passes an order u/s 256 Cr.P.C., resulting the acquittal of the accused person, has no jurisdiction to review his own order, inasmuch as after passing the order of dismissal, he ceases to have jurisdiction over the matter.

6. In the case of Maj. Genl. A.S. Gauraya (supra), the Supreme Court, referring to the observation, made in the case of Bindeshwari Prasad Singh Vs. Kali Singh, recorded the following observation made in the said case.

Even if the magistrate had any jurisdiction to recall this order, it could have been done by another judicial order after giving reasons that he was satisfied that a case was made out for recalling the order. We, however, need not dilate on this point because there is absolutely no provision in the Code of Criminal Procedure of 1898 (which applies to this case) empowering a magistrate to review or recall an order passed by him. Code of Criminal Procedure does not contain a provision for inherent powers, namely, Section 561-A which, however, confers these powers on the High Court and the High Court alone. Unlike Section 151 of Civil Procedure Code, the subordinate criminal courts have no inherent powers. In these circumstances, therefore, the learned magistrate had absolutely no jurisdiction to recall the order dismissing the complaint. The remedy of the respondent was to move the Sessions Judge or the High court in revision. In fact, after having passed the order dated November 23, 1968, the Sub-divisional Magistrate became functus officio and had no power to review or recall that order on any ground whatsoever. In these circumstances, therefore, the order even if there be one, recalling order dismissing the complaint, was entirely without jurisdiction. This being the position, all subsequent proceedings following upon recalling the said order, would fall to the ground including order dated May 3, 1972, summoning the accused which must also be treated to be a nullity and destitute of any legal effect. The High Court has not at all considered this important aspect of the matter which alone was sufficient to put an end to these proceedings. It was suggested by Mr. D. Goburdhan that the application given by him for recalling the order of dismissal of the complaint would amount to a fresh complaint. We are, however, unable to agree with this contention because mere was no fresh complaint and it is now well settled that a second complaint can lie only on fresh facts or even on the previous facts only if a special case is made out. This has been held by this Court in Pramatha Nath Taluqdar V. Saroj Ranjan Sarkar. For these reasons, therefore, the appeal is allowed.

The order of the High court maintaining the order of the magistrate dated May 3, 1972 is set aside and the order of the magistrate dated May 3, 1972 summoning the appellant is hereby quashed.

7. As held by the Supreme Court, so far as the accused is concerned, dismissal of a complaint for non-appearance of the complainant or his discharge or acquittal on the same ground is a final order and in absence of any specific provision in the code, the Magistrate can not exercise any inherent jurisdiction. The inherent jurisdiction, provided by Section 482 Cr.P.C., can be exercised by the High Court to prevent abuse of the process of any Court or to secure ends of justice. The revisional power is vested with the Sessions Judge or the High Court and the code i.e. the statute has not provided any inherent jurisdiction or power on the Magistrate to review his own order.”

The following are the Case Laws answering these questions:

1. Standard Chartered Bank v. Dharminder Bhohi (Supreme Court of India) | 13-09-2013

In this case Supreme Court observed as follows:-

“27. The aforesaid provision makes it quite clear that the tribunal has been given power under the statute to pass such other orders and give such directions to give effect to its orders or to prevent abuse of its process or to secure the ends of justice. Thus, the tribunal is required to function within the statutory parameters. The tribunal does not have any inherent powers and it is limpid that Section 19(25) confers limited powers. In this context, we may refer to a three- Judge Bench decision in Upper Doab Sugar Mills Ltd. v. Shahdara (Delhi) Saharanpur Light Rly. Co. Ltd. wherein it has been held that when the tribunal has not been conferred with the jurisdiction to direct for refund, it cannot do so. The said principle has been followed in Union of India v. Orient Paper and Industries Limited.”

2. M/s. Satnam Agri Products Ltd. & Others v. Union of India & Others (High Court Of Delhi) | 10-12-2014

In this case, a direction was sought by petitioner before DRT in Section 17 to issue any direction to the creditor bank to consider the rehabilitation or settlement proposal, if any submitted by the borrower, On which High court of Delhi observed as follows:-

“20. Though we entertain doubt as to the correctness of the view of the two Division Benches of this Court, being of the opinion that expanding the scope of a proceeding under Section 17 of the Securitization Act to the same extent as a proceeding under the DRT Act would to a large extent nullify the very purpose of enactment of the Securitization Act, we do not feel the need to refer the said aspect for consideration by the Full Bench inasmuch as we are of the view that even if DRT in a Section 17 proceeding under the Securitization Act were to have the jurisdiction to adjudicate the debt, still it would not have the jurisdiction to issue a direction as sought by the petitioners, to the creditor bank to consider a proposal for rehabilitation / settlement.

21. It may also be added that DRT being a statutory Tribunal can perform only such functions as the Statute provides. From a reading of the Securitization Act, we are unable to find any provision empowering DRT, in a proceeding under Section 17, to issue any such direction to the creditor Bank/Financial Institution to consider the proposal for rehabilitation.”

3. Messrs Eminent Agencies & Another v. Bank of Baroda & Others (High Court of Judicature At Bombay) | 17-10-2015

In this case, Petitioners on 24th May, 2010 filed Miscellaneous Application No.101 of 2010 under Section 19(25) of the Recovery of Debts Due to Banks and Financial Institutions Act, 1993 (for short, “the RDDB Act, 1993”) before the DRT inter alia praying that the Respondent Bank be ordered and directed to accept the balance OTS amount of Rs 64.50 lakh together with interest at the rate of 10% p. a. from 16th February, 2009 or such other rate as the DRT deems fit. The Bombay High court after observing that O.A. was already decided observed as follows:-

“17. Before parting, we must mention here that we seriously doubt whether the DRT had jurisdiction to entertain the prayer sought for by the Petitioners in Miscellaneous Application No.101 of 2010. In the said Application, the Petitioners, in effect sought enforcement of the settlement proposal dated 19th December, 2008. In view of the fact that the DRT had already decreed the Original Application filed by the Respondent Bank, it had become functus officio and therefore we seriously doubt that at the instance of the debtor such a Misc Application seeking enforcement of the settlement proposal dated 19th December, 2008 could have been entertained by the DRT under section 19(25) of the RDDB Act, 1993. However, since this issue was neither argued nor raised by the parties, we leave this point open to be considered in an appropriate case.”

4. State Bank of India v. Mcleod and Co. Ltd. and Ors (Debts Recovery Tribunal At Kolkata)| 03-08-2005

In this case, applicant bank refused to accept the settlement proposal as it was not covered by RBI guidelines, Debt recovery tribunal observed that it would not be equitable and just to accept the proposal of compromise under Section 19(25) of the RDDBFI Act and held as follows:

“17. It is obvious from the above quoted submission of the certificate holder Bank that the proposed compromise is not covered by the R.B.I, guidelines. Furthermore, the learned Recovery Officer has clarified in his reference vide order No. 34 dated 28th February, 2005 that the proposed compromise settlement has been approved at an amount less than the amount of certificate. Keeping in view the above circumstances where the certificate holder Bank has expressed its inability to accept the compromise proposal being contrary to the guidelines and keeping in view the ratio decidendi of the Civil Appeal No. 4929/2004 (arising out of SLP(C) No. 17147/03) as quoted above, it would not be equitable and just to accept the proposal of compromise under Section 19(25) of the RDDBFI Act. In case the compromise proposal is granted beyond what has been declined to be granted by the Bank it would not be an equitable settlement of claims. The requirement settlement of claim is the settlement between the parties by any lawful agreement of compromise. In case the settlement is against the policy of the

R.B.I. which is not acceptable to the certificate holder Bank it would be imposition of the settlement and not an equitable and agreeable settlement between the parties which cannot be accepted in the interest of justice.”

5. Neeraj Syal and Ors v. State Bank of India (High Court of Delhi)| 4-11-2019

By Highlighting the erroneous act of DRT on not accepting the settlement reached by the parties, even if both continued to stand by the settlement which they considered binding on themselves, High court of Delhi observed as follows:-

“18. This Court has heard the submissions of learned counsel for the parties. The failure to take on record the settlement arrived at between the parties by the DRT or the DRAT was the subject matter of Satish Chander Gupta (supra) where this Court inter alia observed as under:

“The DRAT is no one to decide as to at what value the bank should settle its dues with the borrower especially when the bank has Managers who have acted in pursuance to authorization in their favour and after due consideration of the proposal of the petitioners.”

19. Later in Harpreet Kaur v. M/s. Fullerton India Credit Company Limited (supra), again in the context of the failure of the DRT to take on record a settlement, it was again held:

“Even otherwise, as observed by a Division Bench of this Court in the said order dated 19.4.2010, extracted hereinabove, the parties to a proceedings are at liberty; at any stage thereof, to arrive at an amicable settlement in relation to the subject matter of the dispute, and it does not lie in the mouth of the judicial authority to obstruct or impede the amicable settlement on a ground which is not sustainable in law. The learned DRAT, as observed in the said order dated 19.4.2010, is not some kind of Ombudsman/Auditor of the Bank; to scrutinise the settlement arrived at between the bank and the borrower, as it is not within the scope and ambit of its jurisdiction or function. It is reiterated that the learned DRAT cannot arrogate to itself the power to determine the value at which the Bank should settle its dues with the borrower, especially when it does not any involve public money.”

****

Order VII Rule 14(1) Code of Civil Procedure provides for production of documents, on which the plaintiff places reliance in his suit, which reads as under :

14: Production of document on which plaintiff sues or relies.– (1) Where a plaintiff sues upon a document or relies upon document in his possession or power in support of his claim, he shall enter such documents in a list, and shall produce it in Court when the plaint is presented by him and shall, at the same time deliver the document and a copy thereof, to be filed with the plaint.

(2) Where any such document is not in the possession or power of the plaintiff, he shall, wherever possible, state in whose possession or power it is.

(3) A document which ought to be produced in Court by the plaintiff when the plaint is presented, or to be entered in the list to be added or annexed to the plaint but is not produced or entered accordingly, shall not, without the leave of the Court, be received in evidence on his behalf at the hearing of the suit.

(4) Nothing in this rule shall apply to document produced for the cross examination of the plaintiff’s witnesses, or, handed over to a witness merely to refresh his memory.”

I. Maria Margadia Sequeria Fernandes v. Erasmo Jack De Sequeria (D) Tr.Lrs

Supreme Court of India | 21-03-2012

In the said case, the Supreme Court highlighted that suspicious pleadings, incomplete pleadings and pleadings not supported by documents would not even warrant issues to be settled by making following observation:-

71. Apart from these pleadings, the Court must insist on documentary proof in support of the pleadings. All those documents would be relevant which come into existence after the transfer of title or possession or the encumbrance as is claimed. While dealing with the civil suits, at the threshold, the Court must carefully and critically examine pleadings and documents.

72. The Court will examine the pleadings for specificity as also the supporting material for sufficiency and then pass appropriate orders.

73. Discovery and production of documents and answers to interrogatories, together with an approach of considering what in ordinary course of human affairs is more likely to have been the probability, will prevent many a false claims or defences from sailing beyond the stage for issues.

74. If the pleadings do not give sufficient details, they will not raise an issue, and the Court can reject the claim or pass a decree on admission.

75. On vague pleadings, no issue arises. Only when he so establishes, does the question of framing an issue arise. Framing of issues is an extremely important stage in a civil trial. Judges are expected to carefully examine the pleadings and documents before framing of issues in a given case.

II. Sagar Gambhir v. Sukhdev Singh Gambhir (Since Deceased) Thr His Legal Heirs & Another

(High Court Of Delhi) | 06-03-2017

In the said case, the Delhi High court highlighted the vague assertion of the appellant in the pleadings and by referring P.K. Gupta vs Ess Aar Universal (P) Ltd in which it has been stated “11. We need to highlight that the fundamental principles, essential to the purpose of a pleading is to place before a Court the case of a party with a warranty of truth to bind the party and inform the other party of the case it has to meet. It means that the necessary facts to support a particular cause of action or a defence should be clearly delineated with a clear articulation of the relief sought. It is the duty of a party presenting a pleading to place all material facts and make reference to the material documents, relevant for purposes of fair adjudication, to enable the Court to conveniently adjudicate the matter. The duty of candour approximates uberrima fides when a pleading, duly verified, is presented to a Court. In this context it may be highlighted that deception may arise equally from silence as to a material fact, akin to a direct lies. Placing all relevant facts in a civil litigation cannot be reduced to a game of hide and seek.” held that in the plaint the lack of pleadings to said effect cannot be overlooked. There is thus a bald assertion without any material particulars regarding the firm M/s Gian Singh Sukhdev Singh being set up by the great grandfather of the appellant on which present appellant claims his share.

III. Victor Fernandes & Others v. Raghav Bahl of Noida & Others

(High Court Of Judicature At Bombay) | 21-09-2011

In this case Bombay High court made the following observation:-

“4. We have gone through the pleadings and the documents on record and heard the respective submissions of the learned Senior Counsel appearing for the parties. Mere allegations of fraud or conspiracy or misrepresentation are not sufficient. Apart from above prayer clauses, the basic averments with regard to the allegations though made in paragraph 11 but there are no particulars/ materials /details provided. Mere allegations and/or averments are not sufficient to grant any interim or ad-interim relief, as sought, in the present case, by the Plaintiffs. The alleged defaults, misrepresentations and/or loss or damages caused to the company if any, need to be stated in a clear terms with supporting documents and the particulars. The vague allegations or averments made in the Petition, therefore, in our view, cannot be a basis to grant interim relief as sought in the present matter at this stage.”

https://www.legitquest.com/case/victor-fernandes–others-v-raghav-bahl-of-noida–others/7534B

IV. Wallace Pharmaceuticals Pvt. Ltd v. m.v. Bunga Bidara & Others

(High Court Of Judicature At Bombay) | 27-09-2013

In this case Bombay High court stated that In the matter of an admiralty action to arrest a ship, it cannot be mere averments that would support the action. It must be supported by documentary evidence to show that the goods were in fact shipped to maintain action against the vessel and made the following observation-

“24 When a ship is arrested the owners are put to immense pressure and loss. It is not only the owners but even those whose cargo are on board the vessel suffer. Any attempt of parties to cleverly draft the plaint and create an illusion of the cause of action and obtain orders of arrest of vessel to pressurize owners to settle the matter should be nipped in the bud. Some owners may succumb to the pressure, particularly in view of the fact that cost of litigation is very high today. It will save lot of time of the Courts if fraudulent and frivolous litigations are not entertained. A meaningful reading of the Plaint shows that the basis of the Plaintiffs allegation against Defendant Nos.1 and 2 are based on documents. But no document has been produced or presented or entered in any list to show there was a contract between the plaintiff and Defendant no.2 or that the consignment was loaded on defendant no.1-vessel or carried by defendant no.2. The single Judge and the Division Bench has conclusively held that the plaintiff has failed to so establish. This is not a case where admittedly the vessel has carried the cargo but the Plaintiff has not been able to establish his prima-facie title to sue or establish the value of his claim and the security is ordered to be reduced or returned. The Single Judge and the Division Bench have in no uncertain terms held that the Plaintiff has failed to establish any link with Defendant Nos.1 and 2. In such circumstances, just because the plaintiff has alleged that they have a cause of action by narrating facts without any basis, and which has so been held by the single Judge and the Division Bench, it will be unfair to make the defendant nos.1 & 2 to go through the entire trial by incurring costs. It would also save valuable time of this Court.”

https://www.legitquest.com/case/wallace-pharmaceuticals-pvt-ltd-v-mv-bunga-bidara–others/8025C

CONCLUSION

From the above discussions and decisions the following points emerge:

The pleadings must contain something more than a statement of facts that merely creates a suspicion of a legally cognizable right of action and recitals of the elements of a cause of action, supported by mere conclusory statements, do not suffice. Same can be inferred from Order VII Rule 14(1) as well that when a plaintiff sues upon a document or relies upon document in his possession or power in support of his claim, he shall enter such documents in a list, and shall produce it in Court.

1. Saquib Abdul Hamid Nachan v. The State of Maharashtra

(High Court Of Judicature At Bombay) | 31-07-2014

In the said case, the Bombay High court highlighted that the prohibition in regard to Section 437 of the Code of Criminal Procedure which treats a person who has been previously convicted of an offence punishable with death, imprisonment for life or iImprisonment for 7 years or more, differently from others, and provides that such person shall not be released on bail, is not absolute and observed as follows:-

“23. I have carefully considered this aspect of the matter, and I have heard the learned counsel for the applicant in this regard. Indeed, section 437 of the Code treats a person who has been previously convicted of an offence punishable with death, Imprisonment for Life or Imprisonment for 7 years or more, differently from others, and provides that such person shall not be released on bail. However, the prohibition in that regard is not absolute, and the second proviso to subsection (1) of section 437 of the Code retains the power of the Court to direct such a person to be released on bail if it is satisfied that it is just and proper, so to do for any special reason. In my opinion, that there is no prima facie case, would by itself be a special and sufficient reason for releasing an accused who has been previously convicted, on bail. Any other interpretation would mean that a previous convict of a category mentioned in section 437 of the Code can be booked for any and every offence, and would have to remain in custody till the conclusion of the trial irrespective of whether or not, there is substance in the accusation. In the instant case, coupled with the weaknesses on a number of aspects of the prosecution case, as observed in my orders granting bail to the co-accused Shamil Nachan and Akif Nachan, the applicant has managed to bring out further weaknesses in the prosecution case on the basis of the information procured by him under the Right to Information Act. It is not as if for releasing the applicant on bail, a positive finding that he is not guilty of the alleged offences, is required to be reached or recorded. What would be required is satisfaction about existence of reasonable grounds for believing him to be not guilty. The phrase reasonable grounds imports lesser degree of satisfaction than sufficient grounds. It is not that it is only if there would be no case for proceeding against an accused, that he can be released on bail. This has been specifically made clear by their Lordships of the Supreme Court of India of Ranjitsingh Brahmajeetsing Sharma Vs. State of Maharashtra & Anr (supra).”

https://www.legitquest.com/case/saquib-abdul-hamid-nachan-v-the-state-of-maharashtra/89B7F

2. TEJINDER PAL KAUR AND OTHERS v. STATE OF NCT OF DELHI AND OTHERS

(High Court of Delhi) | 27-03-2015

In this case Delhi High court released the petitioner on bail by stating the previous undergone imprisonment was not under any cognizable offence and observed as follows:-

“17. As already stated by the learned counsel for the petitioners that the petitioner Tejinder Pal Kaur is prepared to deposit the alleged embezzlement amount of Rs. 6,48,443/- and even she is agreeable for the attachment of the balance GPF amount of Rs. 12,70,813/- till the final decision of the case. She has already given the undertaking about joining further investigation and shall provide full cooperation in the matter. Having considered the entire facts and circumstances of this case coupled with the fact that since the co-accused have already got the bail from the trial court in the matter pertaining to the present FIR after having undergone to judicial custody for about 2 months (although the learned APP for the State submits that the co-accused were released after getting the regular bail under Section 439 Cr.P.C.), similar is the case of Sunil Kumar I think that no useful purpose will be served if she is arrested when she is ready to deposit the alleged embezzled amount as well as attachment of her GPF account in which she is having more than Rs. 12 lacs, and she is also ready to join the investigation in future if so required. They do not have any prior antecedents and have not previously undergone in respect of cognizable offences. The possibility of the petitioners to flee from justice is almost not possible in view of the statement made by them that they would appear on each and every date before the trial court.”

________________________________________

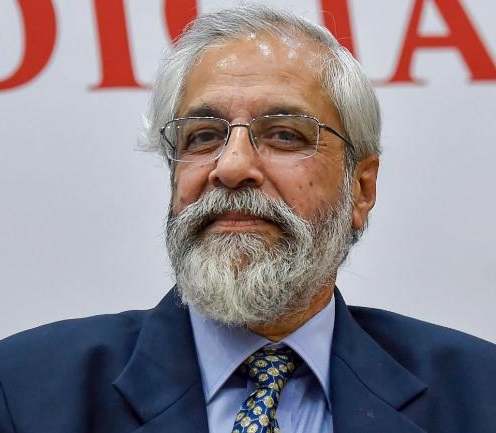

Time for judiciary to introspect and see what can be done to restore people’s faith – Justice Lokur

Justice Madan B Lokur, was a Supreme Court judge from June 2012 to December 2018. He is now a judge of the non-resident panel of the Supreme Court of Fiji. He spoke to LegitQuest on January 25, 2020.

Q: You were a Supreme Court judge for more than 6 years. Do SC judges have their own ups and downs, in the sense that do you have any frustrations about cases, things not working out, the kind of issues that come to you?

A: There are no ups and downs in that sense but sometimes you do get a little upset at the pace of justice delivery. I felt that there were occasions when justice could have been delivered much faster, a case could have been decided much faster than it actually was. (When there is) resistance in that regard normally from the state, from the establishment, then you kind of feel what’s happening, what can I do about it.

Q: So you have had the feeling that the establishment is trying to interfere in the matters?

A: No, not interfering in matters but not giving the necessary importance to some cases. So if something has to be done in four weeks, for example if reply has to be filed within four weeks and they don’t file it in four weeks just because they feel that it doesn’t matter, and it’s ok if we file it within six weeks how does it make a difference. But it does make a difference.

Q: Do you think this attitude is merely a lax attitude or is it an infrastructure related problem?